Insight Focus

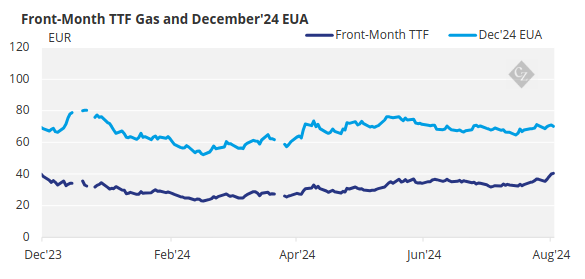

EUA futures have shrugged off recent volatility in the equity market. Could this be a sign that the European carbon and gas prices are beginning to diverge?

Carbon Shrugs Off Equity Market Woes

European carbon prices were relatively immune to the wild swings seen in global equity markets last week, with front-year EUA futures ending the week just 0.6% down even as natural gas futures jumped more than 10%, reflecting the EU ETS’ relatively stable outlook in the short to medium term.

Source: ICE

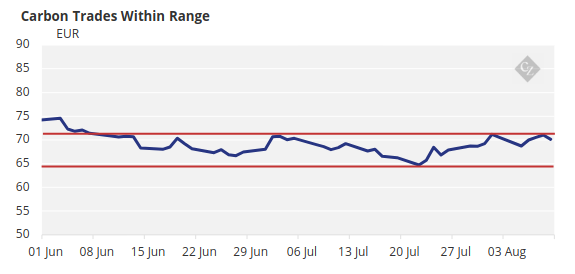

Carbon has traded resolutely in a narrow EUR 65-71 range since the start of June, with the upper half of this channel now supported by the 200-day moving average, as well as the 100-day and 50-day averages.

Source: ICE

In the most recent nine weeks, EUAs have moved in a range averaging EUR 4.16 each week, representing roughly 6% of the average closing price over the period.

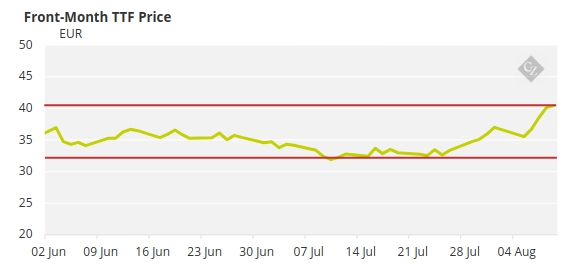

For comparison, the TTF front-month gas has moved in an EUR 8.50 range over the same period, between EUR 32.50/MWh and EUR 40.50/MWh, and its daily high-low range represents around 3.7% of the average closing price.

Source: ICE

Carbon-Gas Correlation Could Break

To be sure, EUAs are still closely linked to the fortunes of natural gas. For a period in June and July this correlation appeared to be breaking down, but lately the two markets move in the same direction, not only on a daily basis, but within-day as well.

Certainly, natural gas responds far more violently to geopolitical and supply-based news, with production outages and conflicts driving occasional price spikes in the benchmark TTF gas market, but EUAs have been fairly quick to follow the direction of these moves, and it suggests to some participants that speculative investors who are active in gas are also, to some extent, hedging those positions in carbon.

Carbon however is about to reach one of its key fundamental calendar events, and even though this year will be different, it could mark a changing of the guard in terms of price dynamics.

Compliance for 2023 is fast approaching, when industrial installations across the EU must surrender EUAs equivalent to their verified emissions for last year. The deadline falls on September 30, and with much of the market taking a summer break, trading sources don’t expect much of a rush to fill last-minute shortfalls.

Industrials May Wait It Out

Indeed, the shift in the compliance deadline from the end of April to the end of September may mean that the days of frantic last-minute buying are in the past. Industrials may decide that waiting until July or August to top up their operator accounts may be too complex a task to be undertaking during the leak holiday season, and so may simply complete their buying in a more leisurely fashion during the second quarter, some people think.

Furthermore, the annual issuance of EUAs has also been shifted from February to June, and this means that for those companies that prefer to borrow from their current year’s handout to pay for last year’s emissions, it might just be easier to wait till the latest quota of EUAs drop into their account.

But with free issuance beginning to tighten as the EU turns the screw on CO2, this may be a luxury that industrials can ill afford. With EUA prices forecast to resume climbing from 2026 or 2027, borrowing current-year EUAs to pay for previous-year compliance may just be storing up expensive trouble.

CBAM Adds New Element

This is all the more relevant as the EU’s Carbon Border Adjustment Mechanism takes shape and approaches its active phase in 2026. As imported materials start to face a cost on their embedded emissions, so will EU producers of those same materials start to lose their free EUA allocations.