Insight Focus

- EU proposes to delay annual compliance deadline by 5 months.

- This comes as member states struggle to reach Feb 28th deadline.

- New rules could come into effect in 2024.

The European Commission has proposed to shift the annual compliance deadline for the EU Emissions Trading System by five months as member states struggle to calculate changes to the allocation of free EUAs for industrial plants.

In leaked documents published last week the European Commission proposed to change the timetable for the issuance and surrender of EU emissions allowances in order to relieve the administrative burden on member states, a move that is likely to change the present pattern of trading.

Since 2021 governments have been required to adjust free allocations if an installation’s output changes by an average of more than 15% over the two preceding years.

Last year, EU governments struggled to complete their analysis of 2021 data in time to issue EUAs by the February 28 deadline. In fact, as of December 1 last year, France had issued just 52% of its 2022 allocation, while Ireland had only handed out 70,000 EUAs from a total of 3.8 million.

(Traders confirmed last week that some French installations are still waiting to receive their free allocation for 2022.)

The delayed issuance will prevent many companies from “borrowing” from their 2023 handout to pay for 2022 compliance, and this could force more companies into the market to secure the EUAs they need.

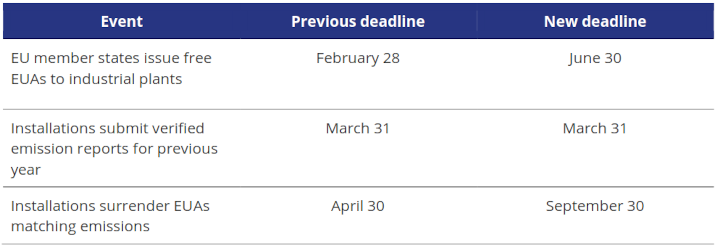

According to a leaked text of the political agreement reached in December, EU regulators will push back the deadline for member states to hand out free EUAs to industrial installations from February 28 to June 30 each year. The new rules will likely take effect from 2024.

Companies covered by the EU ETS will still be required to submit verified emissions reports and output reports by the end of March each year.

This change to the timetable will give member states more time to calculate production levels at each installation, and make any adjustments required to their free allocation.

Current EU rules also set a deadline of April 30 for companies to surrender EUAs covering their previous year’s emissions, but this deadline will also be pushed back to September 30, giving companies an additional five months to assemble the EUAs they need to comply.

The change means that the peak of compliance season will now fall during the summer holiday period, and in the month of August when auctions of EUAs are cut by 50%.

It will also change the schedule for the annual Total Number of Allowances in Circulation (TNAC), the measure which the market stability reserve uses to calculate how many EUAs will be withheld from the market.

The TNAC has hitherto been released in May, shortly after the verified emissions data is published, and the MSR begins to pull allowance from the auction reserve the following September.

But the decision to push back the compliance cycle means that the TNAC may not be available until October each year. This in turn means that the MSR may apply its reductions over the course of a calendar year rather than the current September-to-August cycle.

The overall market impact of this is most likely neutral, though there are likely to be periods of volatility as participants grow accustomed to the new schedule.

For example, the compliance season falling within the summer holiday season may mean industrials choose to carry out buying between May and July rather than March and April.

The traditional 50% reduction in auction volumes in August is likely to be changed, since throttling supply at the height of the industrial demand season could be counter-productive.

European traders have also been warned that this year’s issuance of free EUAs, which is being carried out under existing rules, is likely to be delayed.