Insight Focus

The European Commission has published proposals to delay CBAM’s financial costs by a year. The threshold for coverage will change to target size of imports rather than value. EU also delays introduction of sustainability reporting.

EU Commission Delays CBAM Financial Obligation

Last week, the European Commission published proposed changes to its Carbon Border Adjustment Mechanism that would exempt thousands of small and medium sized enterprises from the CO2 levy, while delaying the start of the financial element of the mechanism for a year.

The changes were tabled as part of “omnibus” legislation that is intended to simplify sustainability reporting regulations such as the Corporate Sustainability Reporting Directive.

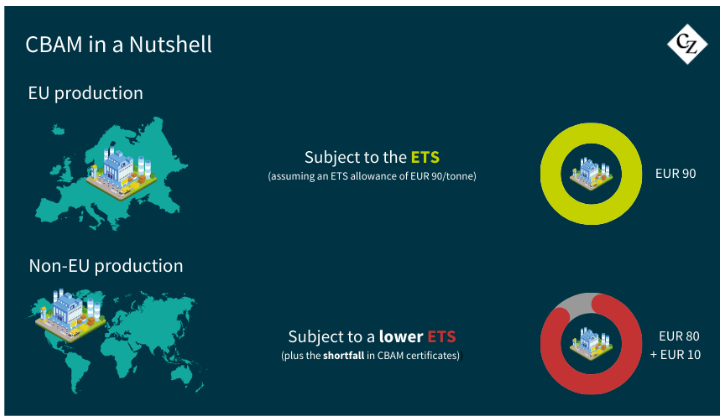

CBAM’s mandatory application starts in 2026, when it will levy tariffs based on the carbon content of imports of iron and steel, cement, fertilisers, aluminium, electricity and hydrogen. Companies have been required to report their imports and the carbon content since 2025.

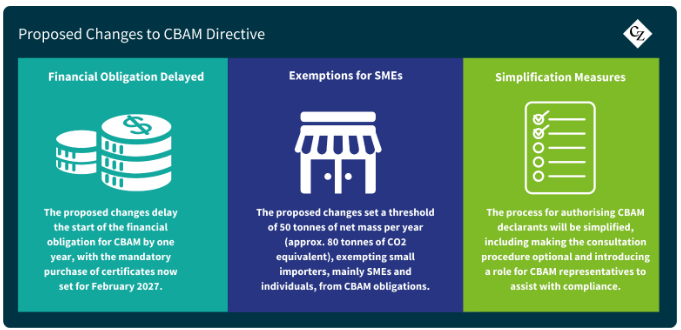

The legislation proposes to delay the start of the obligatory purchase of CBAM Certificates by one year, to February 2027. However, covered entities will still need to buy CBAM certificates equivalent to the embedded CO2 in products imported in 2026. Analysts have suggested that this one-year delay in the start of CBAM certificate purchases is unlikely to impact the market price.

The certificates are not fungible in the EU ETS, nor are EUAs eligible for use in CBAM, but the cost of CBAM certificates is set by EUA auction prices, and numerous experts have suggested that larger importers may buy EUA futures to hedge their CBAM exposure.

The Commission’s legislation also proposed to change the threshold for inclusion in CBAM. The initial directive set the bar for coverage at EUR 150 value of imported goods but is now proposed to change to 50 tonnes of covered goods.

The Commission said this amendment would exempt more than 180,000 European companies from the levy, yet will still cover around 99% of the emissions originally targeted.

EU Delays CSRD and CSDDD Implementation

The other elements of the omnibus legislation include a two-year delay to the introduction of Corporate sustainability reporting regulations (CSRD) to 2028. The rules will impose reporting requirements on companies’ impacts on the environment, human rights and social standards and sustainability-related risk.

The directive took effect in 2024, requiring public-interest companies with over 500 employees to report, with the first reports being issued in 2025. The rules were scheduled to be broadened in 2026 to companies with more than 250 employees or more than EUR 50 million in revenues but will now be limited to entities with more than 1,000 staff and either revenue of more than EUR 50 million, or a balance sheet of more than EUR 25 million.

Meanwhile the Corporate Sustainability Due Diligence Directive (CSDDD) requires companies to identify, prevent, address and remedy impacts from their entire supply chain on people and the planet. The metrics range from child labour and slavery to pollution and emissions, deforestation and damage to ecosystems. The CSDDD was adopted in May 2024, but its application will be delayed to July 2028.

EUA and Natural Gas Futures Fall

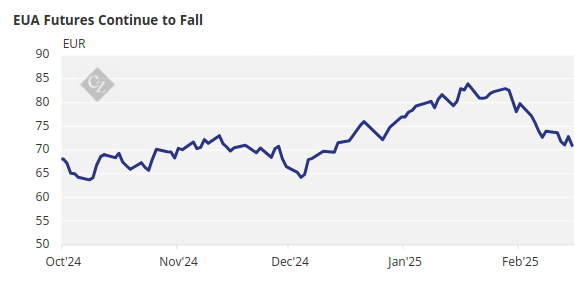

Energy and carbon prices in Europe continued to drop last week as the market priced in what it perceived as an increasing likelihood of a peace deal in Ukraine, with investment funds reducing their length as the gas market nears the “shoulder season” between the high-demand winter and the impending summer months.

EU carbon allowance futures for December 2025 delivery ended last week at EUR 71/tonne, a drop of 3.9% from the week before and the lowest level of the year to date. At the same time, front-month TTF natural gas prices dropped 6.5%.

The declines capped a month in which the EUA and TTF markets shed 15% and 17% respectively. For carbon this represented the biggest drop for a February since 2016.