Insight Focus

The 2023 compliance cycle in Europe’s emissions trading system introduced extended deadlines and removed the August auction volume reduction. These changes have shifted market behaviour, increasing interest in shorter-dated futures contracts and contributing to subdued EUA demand.

New Compliance Deadlines and Allocation

The 2023 compliance cycle in Europe’s emissions trading system closed on September 30, with analysts reporting that more than 98% of last year’s greenhouse gas emissions in the 27-country bloc had been covered by the surrender of EU Allowances (EUAs).

The September 30 deadline marked the first alteration to the compliance calendar since the market began in 2005, reflecting a more complex process for calculating the number of free allowances distributed to industrial companies each year.

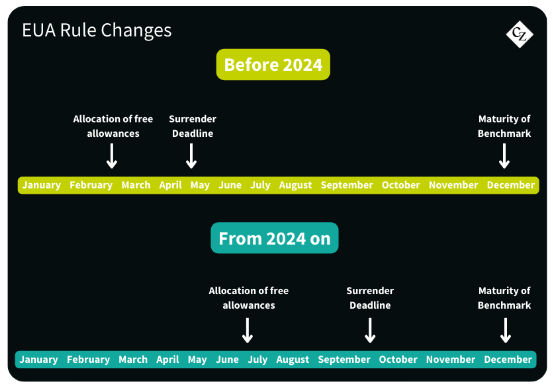

Previously, installations were required to surrender EUAs matching their previous year’s emissions by April 30, while governments were required to issue free EUAs for the current year by February 28.

However, since a rule change in 2021, allocations of free EUAs must be adjusted according to the actual output of each plant. If an installation’s production changes by more than 15% on average over the previous two years, the relevant national authority is required to adjust its free allocation either up or down.

The process of gathering activity reports from more than 11,000 plants across the EU each year has extended the time required for calculating free allocations. As a result, the original deadline of February 28 for the distribution of free allowances could not be met.

In response, the European Commission proposed shifting both the issuance of free EUAs and the compliance deadline to the end of July and September, respectively, starting in 2024.

Changes in Auction Volumes

Another significant change is the end of the annual 50% reduction in auction volumes during August. Previously, the supply of EUAs was reduced each August in anticipation of lower demand during the peak holiday season.

Source: European Commission

With the new September compliance deadline, it is expected that companies will be more likely to enter the market during this period to top up their compliance accounts. Consequently, the yearly auction reduction has been discontinued.

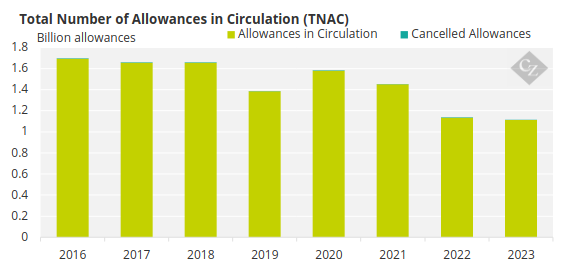

The shift in the deadline this year meant that compliance companies had a total of 17 months to buy EU allowances covering their 2023 emissions, rather than the usual 12 months. This extended period may have contributed to a subdued industrial demand for EUAs in 2023.

Market Reactions

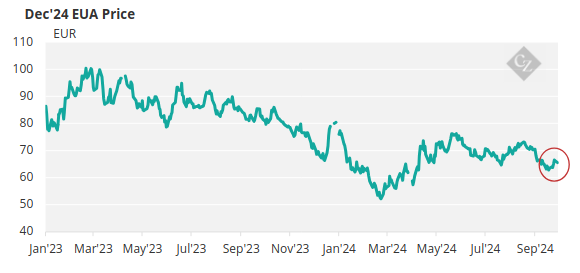

Trading sources noted a near absence of late demand for EUAs for 2023 compliance. Buyers have taken a more opportunistic approach, purchasing permits for future use whenever prices dip. For instance, when December futures prices briefly fell below EUR 63 ten days ago, buyers entered the market.

The adjustment in the compliance schedule has also spurred changes in market behaviour, with growing interest in futures contracts expiring close to the compliance deadline.

Previously, the March contract was the most popular delivery date ahead of the annual surrender deadline. However, ICE Endex, the leading futures exchange for the EU ETS, now offers August delivery futures contracts up to three years in advance, with open positions already established for 2025, 2026, and 2027.

Open interest in August 2024 futures peaked at more than 64 million tonnes—over six times the previous record—as compliance buyers shifted their long positions to the nearest delivery ahead of the new deadline.

This shift also mirrors a broader increase in liquidity for non-December contracts for EUAs. Higher interest rates over the last two years have made holding longer-dated positions more expensive. As a result, traders are increasingly buying shorter-dated futures and rolling those positions rather than holding long-dated futures.