Insight Focus

- ASF spreading to new region of Italy poses risk of further outbreaks in Europe

- EU pig numbers, feed grain demand seen falling in 2022 on ASF, less demand

- Farmers sending pigs to slaughter at minimum weight to cap feed costs

The spread of African Swine Fever (ASF) cases in Europe is set to cut the number of farmed pigs and feed grain demand this year.

ASF is a highly contagious disease that is fatal to pigs but poses no danger to humans. The disease has been endemic in Sardinia, Italy for several decades and there were frequent outbreaks in several countries since 2007, according to the European Food Safety Authority (EFSA).

ASF Spreads to Mainland Italy

A new ASF case in a wild boar was confirmed in the Lazio region near Rome in Italy on 4 May, according to the World Organisation for Animal Health (OIE). This was the first report of ASF in mainland Italy, which indicated the disease has spread further in Europe. Hungary, Italy, Latvia and Romania have also reported new outbreaks as of 18th May, OIE said

“The detection of ASF in new territories poses a risk of spreading to neighbouring areas,” said OIE on 18th May.

The number of reported ASF cases in domestic pigs was 175 and 3,622 in wild boars between 1st January and 20th May this year, EFSA data shows. Domestic ASF cases in Romania accounted for 89% of the total diseased pigs. A third of the wild boar ASF cases were in Poland with 1,104 diseased animals, followed by 807 in Germany.

In 2021, the number of confirmed ASF cases in domestic pigs and wild boars was 1,874, and 12,150 respectively.

Threat to Feed Demand

The spread of ASF could devastate pig farming in Europe, as the disease could wipe out a substantial part the pig population and slashed feed grain demand. At the height of the ASF pandemic in China in 2018, it was estimated that the country’s pig population halved because of the disease.

As a result, the EU has implemented measures to prevent the spread of the disease, including a ban on the importation of live pigs or porcine-origin products from infected region. As a result, farmers in the affected region are reducing the number of farmed pigs to limit their financial losses.

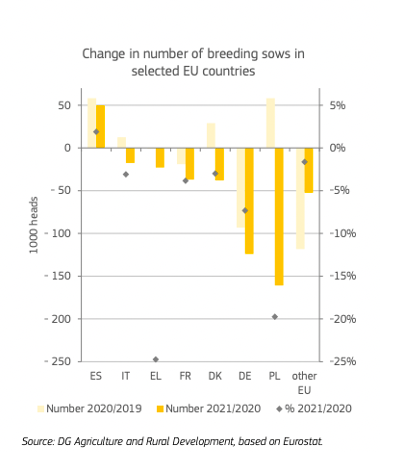

“In Italy, Poland and Germany, farmers have reduced their [pig] numbers significantly by hundreds of thousands of sows,” one major meat supplier in Europe said in mid-May.

The number of farmed pigs in the EU have been falling over the past year because of lower meat consumption and environmental restrictions. Data from EU statistics agency Eurostat shows there were 142m pigs in the EU as of December 2021, a drop of 0.7% from 2021.

The number is expected to fall further this year, with the sharpest decrease expected in Germany, Poland, and Romania because of ASF, according to the Spring Short-Term Outlook report published by the European Commission.

In 2021, Spain accounted for 24% of the EU pig herd, followed by Germany on 17% and France on 9%.

EU Pork Demand, Production Fall on Export Market Loss

To prevent the spread of ASF, some Asian countries have banned imports from European countries with confirmed cases.

Europe’s second largest pig farming country, Germany, was particularly hard hit by ASF, and the country lost its access to the Chinese and Japanese export market in late 2020.

The outbreaks in Italy and Poland have also led to some export contracts to Asia being cancelled, the major meat supplier said.

“They cannot export with swine fever; agreements are [cancelled] with Japan and South Korea, it left Spain holding the baby,” the meat supplier said.

In addition, meat exports to Russia and Belarus were mostly halted after sanctions were imposed on the two countries following Russia’s invasion of Ukraine on 24th February. Shipments to Ukraine was expected to fall significantly due to the war.

The EU produced 23.43m tonnes of pork in 2021, and this is expected to fall by 3% in 2022, according to EC’s forecast in its Spring Short-Term Outlook. Export is also projected to drop by 2.2% this year, down from the 5.31m tonnes of carcass weight in 2021.

EU Feed Grain Consumption to Fall on Lower Pork Output in 2022

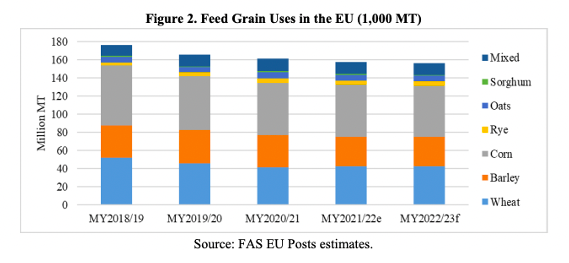

Lower EU pork demand and output this year has also cut feed grain consumption

The US Department of Agriculture (USDA) forecast, a 1% year-on-year fall in EU feed grain consumption to 156.1m tonnes in the 2022/23 marketing year. The USDA projection is lower the EC’s forecast of 159.1m tonnes in 2022/23.

The volume of wheat and barley in EU feed grain consumption is expected to remain stable, while corn and minor grains could account for the biggest drop, the USDA said.

Farmed pigs are fed a mixture of farm origin roughage and compound feeds. The bulk of compound feeds consist of feed-grade cereals (barley, wheat, rye, triticale, corn), crude protein in the form of oilcakes or meals (soybean or rapeseed meal), and a small quantity of feed additives such as amino acids and vitamins. Soybeans and rapeseeds are crushed to extract oil and the meal is the by-product of the process.

Pig Carcass Weights Fall as Farmers Cut Feed Costs

Wheat, corn and soybean prices are at multi-year highs, which has led to a sharp increase in feed grain costs.

To reduce the feed cost for pigs, farmers are sending younger and lighter animals to slaughter than usual. Feed conversion efficiency tends to fall as animals grow, so many farmers are capping their input costs by sending animals to slaughter at the minimum weight range set by the abattoir.

The average carcass weight at slaughter was 94 kg in 2021, so this is likely to fall.