526 words / 2.5 minute reading time

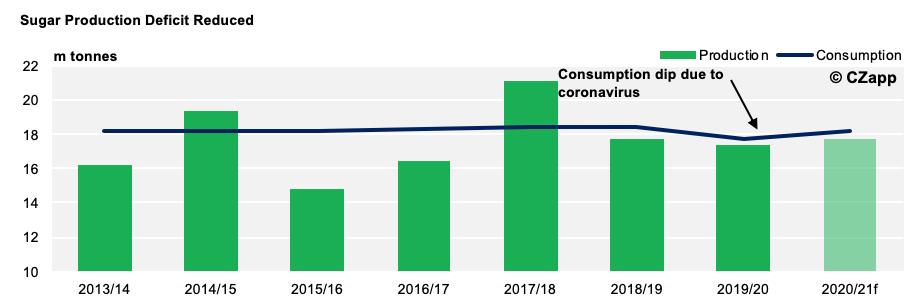

- The EU’s sugar consumption will fall this year due to the coronavirus.

- Sugar stocks within the EU will increase.

- The EU premium to the world market is likely to narrow.

Less Pressure On Stocks

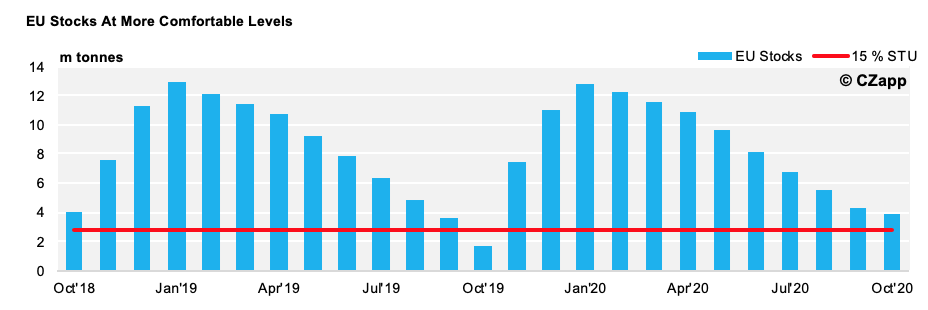

- Sugar stocks in the EU (including the UK) now look less tight towards the end of the 19/20 season.

- Stocks at the low point of the cycle (October 2020) will be above what we consider a ‘comfortable’ level (15% stocks-to-use).

- This is because we have reduced our EU consumption estimate by 700k tonnes (4%) for the rest of the 19/20 season due to the coronavirus outbreak.

- This reduces the production deficit within the EU to 400k tonnes.

- Lockdown restrictions across much of Europe mean out-of-home sugar consumption will decrease.

- Food and drink in bars, restaurants and at events tends to be high in sugar.

- Coca-Cola has already reported a decline in sales due to the closure of restaurants, postponement of sports and large entertainment events and a slump in global travel.

EU Premium To Weaken

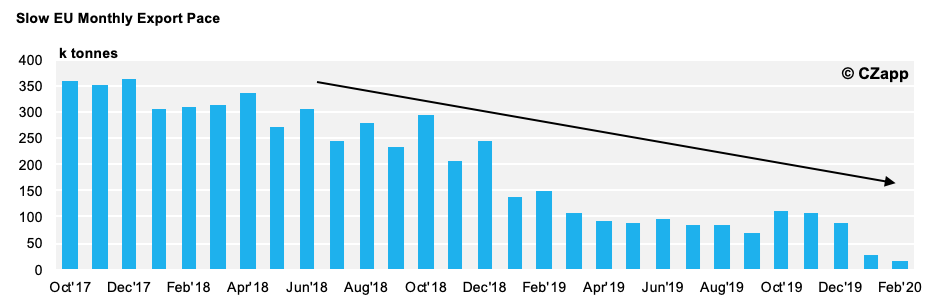

- With less pressure on stocks, we expect the EU premium to the world market to gradually reduce.

- EU prices have been trading at a large premium to the world market for most of the season.

- This has meant comparative returns for world market exports have been poor.

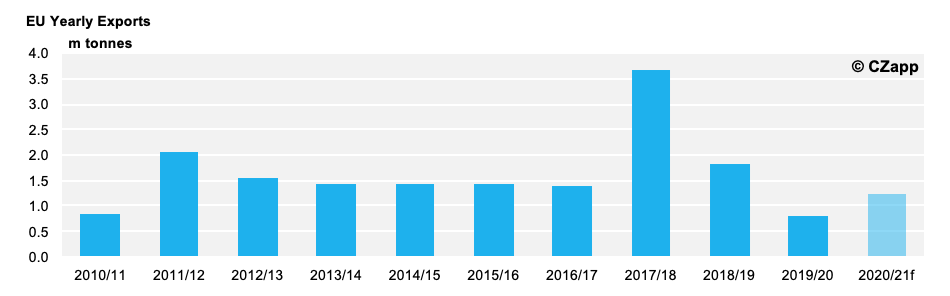

- The pace of exports has slowed considerably to below 25k tonnes per month as a result.

- If the EU premium narrows, exports are likely to become more attractive in the 20/21 season.

- We currently forecast 1.2m tonnes of exports next season, 400k tonnes more than this season.

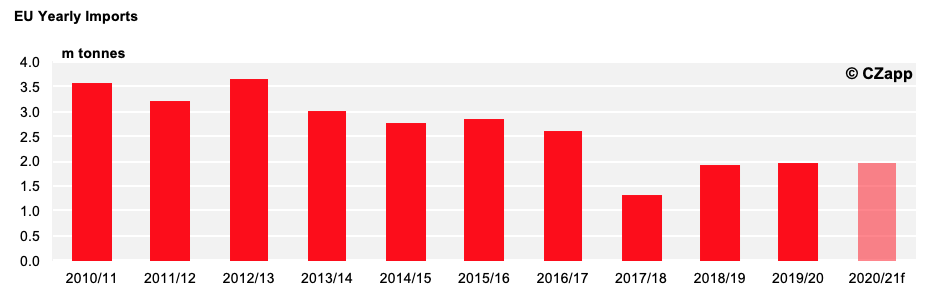

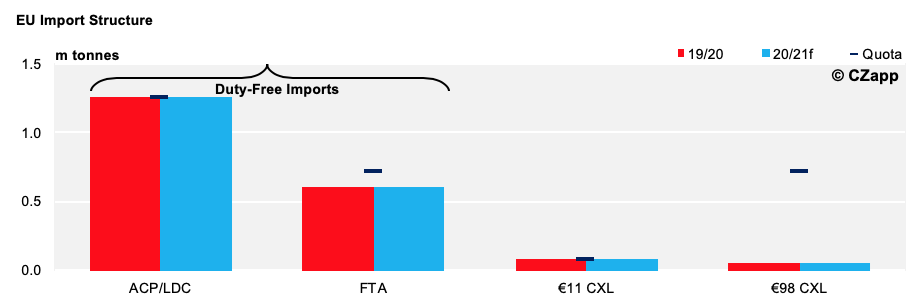

- Unless there is a large decrease in the EU premium, sugar imports into the EU will not reduce.

- We expect imports of just under 2m tonnes in 20/21 season, the same as in 19/20.

- This is because of duty-free sugar imports, which allow the exporting country to take advantage of any EU premium to the world market.

- African, Caribbean, Pacific/Less Developed (ACP/LDC) countries have duty-free imports up to 1.25m tonnes.

- There is also a Free Trade Agreement (FTA) with several other countries such as South Africa and Central America of up to 700k tonnes.

20/21 Production Update: Sowing Into Wet Fields

- Farmers across the EU are now starting to plant their sugar beet.

- A wet winter across North-West Europe left some fields submerged in water.

- We think planting may be delayed in some regions, but this should have a minimal impact on sugar output.

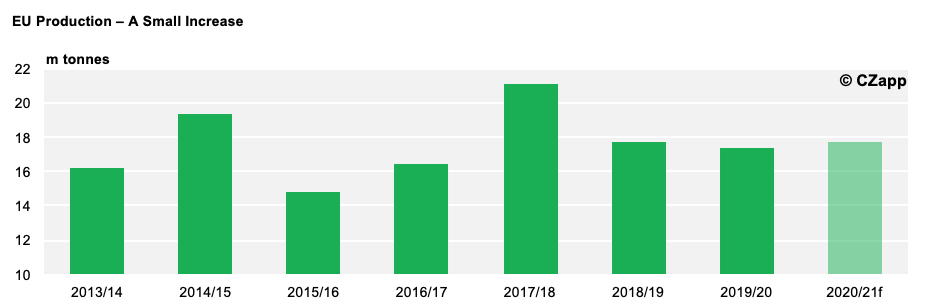

- We forecast 17.8m tonnes of sugar to be produced in 20/21.

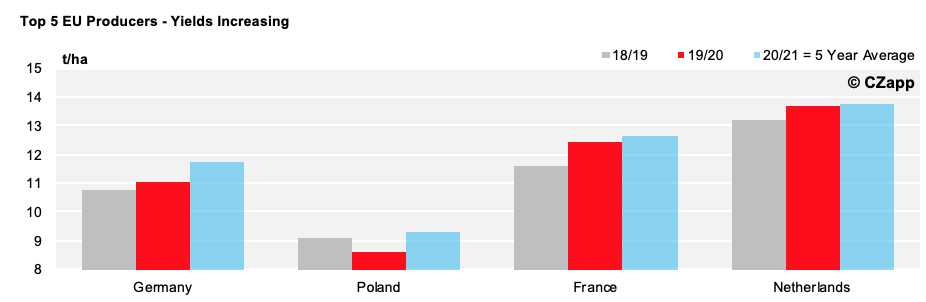

- We expect yields in most countries to increase in 20/21 as they have been below average for the past two seasons.

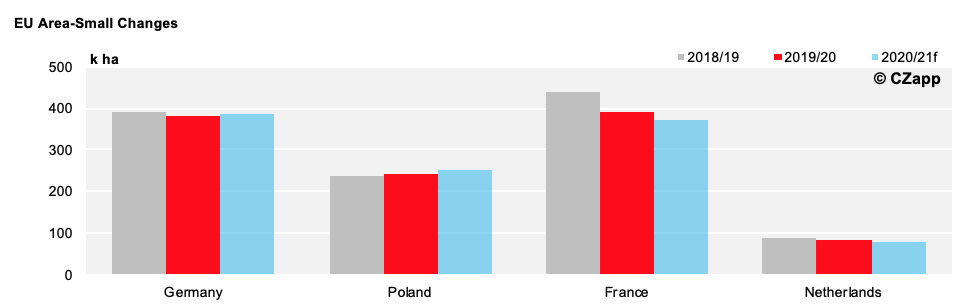

- Planted area will remain almost unchanged, with small increases in area in Poland and Germany being offset by reduced acreage in the Netherlands and France.