It was confirmed this week that the EU is going to place a 25% tariff on cane molasses imports from the USA. With the tariff now in place, how will this affect the molasses market?

The US’ cane molasses are exclusively centred around Florida and the Port of West Palm Beach. Over the last five years, exports have been fairly stable with an average of 100-125k tonnes mt of cane molasses exported each month. All this tonnage is shipped to Europe and we were a similar quantity to be imported from December 2020 and beyond, once the new cane crush had started.

The background to the tariff story centres around the 16-year battle between the US and the EU on subsidies for Boeing and Airbus, which has gone back and forth through the World Trade Organisation with multiple tariffs and counter-tariffs. Cane molasses was added to a broad range of products attracting a 25% tariff, from rum, to bike frames, to tractors. It also confirms a tariff of 15% on aircraft, which is the main target of this action.

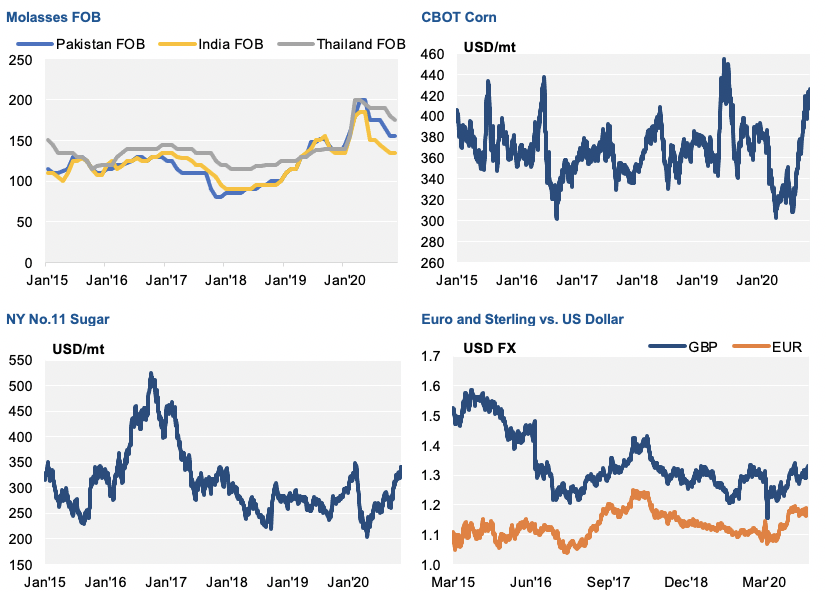

Europe imports around 1m tonnes of cane molasses each year, so the likely reduction in Floridian cane molasses imports represents 12% of the total. The potential shortfall can likely be covered from a combination of Indian and Central American imports. It is an overall small increase in demand in both areas, so the impact on pricing may be limited. India and Central America will export a minimum of 1.4m tonnes of cane molasses between them in 2021.

The main beneficiaries of the tariffs may be the US molasses feed market if exports are curtailed, although the tariffs could be paid to facilitate exports to the EU if required.

In other developments, the Thai cane crop looks to be as disappointing as expected and could even fall below 70m tonnes of cane crushed. The Thai market will need to look to imports in 2021 to make up for the shortfall in domestic production. Ethanol producers may be caught between the shortage of molasses and higher cassava prices on the back of increased Chinese demand.

Other Opinions You Might Be Interested In…

- India is a Pivotal Molasses Supplier Once Again

- United Molasses Commentary: Quiet Molasses Market Continues

- How Will the EU’s Poor Crops Impact the Molasses Market?

- Thai Molasses Exports to Reduce with Poor Cane Crop

- Cane Molasses Regains Some Competitiveness