Insight Focus

The UK carbon market continues to face an oversupply of permits. Benchmark UKA futures have averaged £40 since mid-2023. The October budget statement presents the first opportunity for the government to signal potential changes.

Budget Generates Optimism

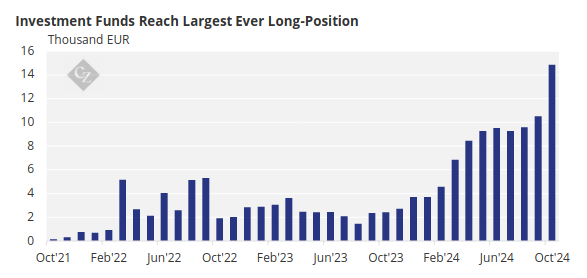

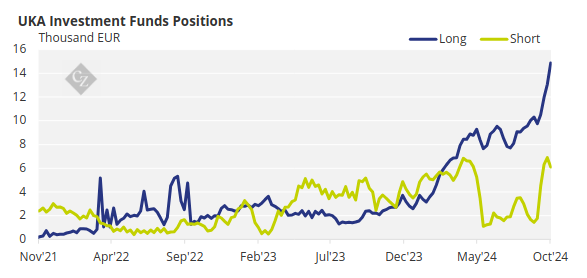

Optimism has been building lately as the market eyes the October 30 Autumn budget. Some traders built long positions in anticipation that the Chancellor’s statement may include references to changes in the UK carbon market. Data from ICE Futures Europe showed that investment funds amassed their largest-ever long position, totalling nearly 15 million tonnes, in the week ending October 18.

Source: ICE

Sources have suggested various ways the government may propose to bolster the market. An adjustment to the auction reserve price—currently GBP 22/tonne—was mentioned by some, as well as changes to the Carbon Price Support, a GBP 18/tonne levy paid by power generators above and beyond the cost of UKAs.

Market participants are also focusing on ways to adjust the UK carbon market to generate more government revenue, which is the overriding priority of the government at this point.

It is clear to most stakeholders that the primary way to boost Treasury coffers would be to increase the UKA price, leading to optimism that ambitious reforms will be proposed before the end of this year, if not in next week’s budget.

Room for UK-EU Collaboration?

For many, the most effective way to increase UK ETS revenues would be to link the UK and EU carbon markets. However, this approach presents several challenges. Firstly, since the UK ETS market is only 10% the size of its EU counterpart, it is evident that the UK would need to tailor its market to align with EU ETS parameters.

The longer the two markets operate separately, the greater the potential for regulatory divergence. Already, there are significant differences in auction operations, price-calming measures, supply adjustment systems and compliance schedules.

Despite these challenges, there are significant advantages to linked markets, particularly for the UK. Given the substantial cross-border trade in power, linked markets would simplify the complex application of CBAM levies on the UK’s electricity exports to the EU.

Increasing the scale of linked carbon markets would also reduce costs across the board, boosting liquidity and providing lower-cost abatement options for UK emitters. However, substantial political obstacles to linking remain unaddressed, frustrating advocates for market integration.

UK Carbon Market Faces Surplus

UK carbon allowance prices have been trading at an average of around GBP 40/tonne (USD 52/tonne) for the last 16 months, reflecting a market that is gradually building up a surplus while compliance demand is declining.

Source: ICE

The market’s main challenge is a structural over-supply of allowances compared to actual demand. Data from the UK ETS regulator show that for the first three years of the market’s operation, each year has seen verified emissions lower than total supply.

For example, 2023 emissions from installations covered by the UK ETS totalled 87.96 million tonnes, down from 99.74 million a year earlier, representing an 11.8% year-on-year drop.

At the same time, the supply of UK Allowances to the market fell by 15.7% to 99.87 million tonnes in 2023, resulting in a surplus of 11.9 million tonnes.

Government Seeks Feedback on Carbon

Currently, there is no mechanism to adjust supply in a transparent manner. In contrast, the EU ETS has its Market Stability Reserve, which removes 24% of the calculated market surplus each year by withholding an equivalent volume of allowances from the auction programme.

The previous UK government conducted a consultation on whether to introduce a similar mechanism in the UK market. This consultation ended in March this year, but since then there has been no response from Westminster.

Additionally, the last government held consultations on expanding the scope of the UK market to include the waste sector, upstream oil and gas venting and maritime shipping, as well as on integrating CO2 removal into the market, among other issues.

Most recently, the government has called for feedback on whether to extend the current trading phase (2021-2025) by one year, allowing fundamental reforms to take effect simultaneously with the introduction of a CBAM in 2027.

This consultation triggered a drop in UKA prices into the mid-GBP 30s (approximately USD 45) as traders reacted to bearish supply implications. However, prices soon rallied as investors and some compliance buyers entered the market.