Insight Focus

EUAs have dropped back into mid-EUR 60s after brief rally. Speculators still hold significant short positions, and the European Commission is soon set to reveal September-December auction volumes.

Carbon Finds a Floor

After a twelve-month decline that saw prices drop almost 50% by February this year, European carbon appears to have found a floor in the low- to mid-EUR 60s, but not everyone in the market is convinced that a recovery will come imminently.

Data show that demand for EU carbon allowances (EUAs) is declining. Calendar 2023 verified emissions were down by 15% year-on-year, the biggest annual drop on record. Emissions from the power sector were 24% lower in 2023, while industrial emissions fell 7%, EU data showed.

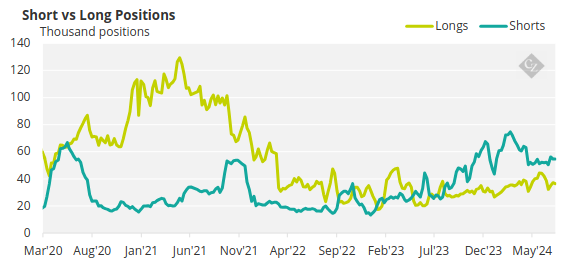

Investment funds were quick to spot the downtrend in EU emissions. Since August 2023 they have held a net short position in EUAs, according to data from the two main futures exchanges. This net bearish positioning reached its peak at 39 million EUAs in February and has since shrunk to as little as 6 million EUAs.

Source: ICE, European Energy Exchange

But the weekly commitment of traders (COT) data show that even while the net position has fluctuated over time, that has been a consequence of an ebb and flow in long positions. Funds have held a minimum of around 50 million EUAs in total short positions since last October. This suggests there is a bedrock of shorts that isn’t easily swayed.

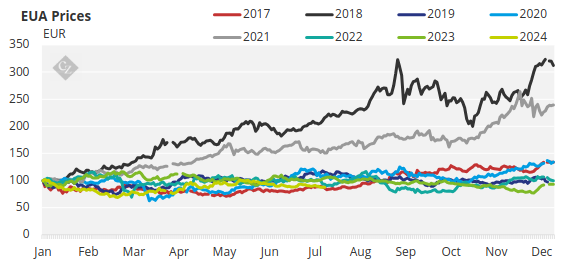

Price data confirms this bearish outlook. The annual EUA price index shows that 2024’s performance has been the worst since 2017.

Source: ICE

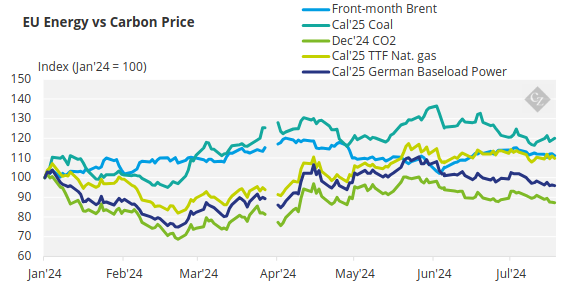

Compared to other energy markets, carbon has also underperformed. Coal has risen the most this year, making the fuel less competitive for power generation compared to natural gas and therefore damping demand for EUAs.

Source: ICE, European Energy Exchange

And the European Union’s economic performance over the last six months suggests there has been little improvement on 2023. Purchasing Managers Indexes from the EU’s two bellwether economies – France and Germany – have remained below 50 for two straight years, while power generation from fossil fuel sources fell 20% in the first six months. Renewables output in January-June grew 14% year-on-year.

Change Afoot for the Market

The next two months will usher in some key changes to the market. The first is that the issuance of free EUAs to industrials is now underway. The formal deadline for member states to hand out permits to covered installations is the end of June, and as of the first week of July the allocation was 76% complete.

The second major date is September 30, which is the deadline for compliance. All covered entities are required to hand in EUAs matching their 2023 verified emissions by that date or risk financial penalties of more than EUR 108/tonne.

This year marks the shift in compliance from April to September, and also explains why the EU will not make its traditional 50% reduction in auction volumes in August, in order to cater for any last-minute demand.

But anecdotal information from the market suggests that demand is weak. The shift in deadline means industrials have had 17 months instead of 12 to do their buying, and because the run-up to compliance now falls in the summer holiday season, most companies are likely to have finished their buying early rather than spend the holiday at work.

The resetting of August auction volumes means that this year the EU will sell 53.9 million permits compared to 26.8 million in 2023 and 24.1 million in 2022.

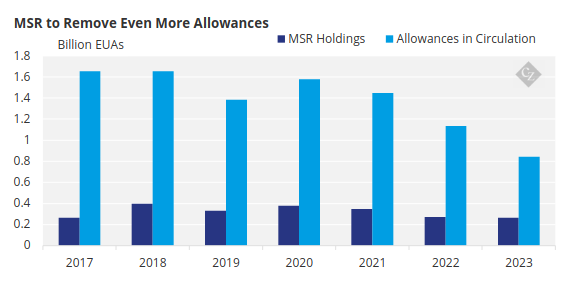

The Commission is also set to change the auction supply for the final four months of the year to reflect the annual Market Stability Reserve adjustment. The MSR will take 266 million EUAs out of the auction supply, which is estimated to maintain the daily auction volume at just over 3 million EUAs, as it has been since the start of the year.

Source: European Commission

But at the same time, the Commission is expected to make an upward adjustment to auction supply under its REPowerEU initiative, which is selling additional EUAs to fund the bloc’s energy transition.

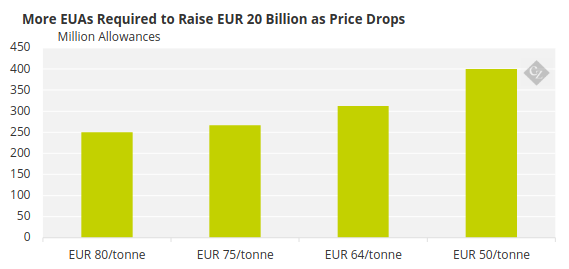

REPowerEU was introduced in July 2023 with the goal of raising EUR 20 billion from the sale of EUAs taken from member states auction reserves for the 2027-2030 period. The initial plan was to sell 250 million EUAs over three years to raise these funds, but lower EUA prices have meant that the sales are not raising as much money as planned.

Current calculations show that the Commission may need to sell a further 50 million EUAs to reach EUR 20 billion, and some of this additional volume could be added to the auction process in September.