Insight Focus

Gas prices are falling despite higher consumption and lower stocks, with EUAs continuing to be highly correlated to natural gas. Modest changes to the EU ETS in 2025 offer little potential for a rally.

Carbon Prices Drop Amid Weak Fundamentals

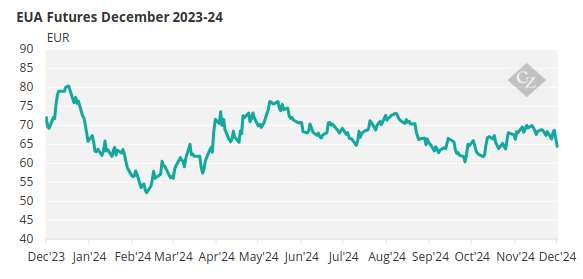

Front-December futures for European carbon have fallen into the low-to-mid EUR 60s/tonne as the year draws to a close. With speculative trading around the December options contract ending, traders are focused on weak fundamentals and the expiry of the December 2024 futures contract.

EUA prices briefly topped EUR 70/tonne towards the end of November as traders hedged call options exposure at the EUR 65/tonne and EUR 70/tonne strike prices, but steady weakness in TTF natural gas prices has pulled the benchmark carbon contract lower over the last three weeks.

Source: ICE

January TTF futures have dropped 21% since November 22, while December carbon futures have fallen nearly 11% over the same period.

Gas Market Volatility Drives Carbon Prices

The gas market has once again been the main driver of carbon price sentiment. The market has been roiled by reports that some EU member states are in talks to secure supplies of Russian natural gas via Ukraine, even after the current transshipment contract with Kyiv ends on December 31.

At the same time, media reports have also suggested that Azerbaijan may step in as an alternative source of gas for the EU, though it’s not clear whether this too may be a transshipment agreement for Russian fuel.

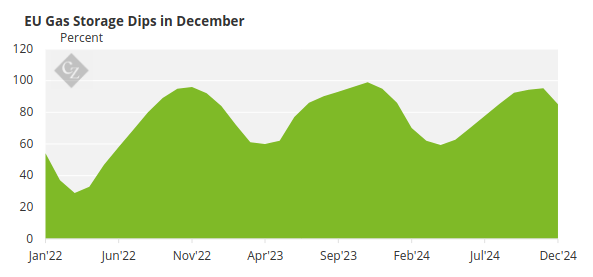

The impact of these and other reports has been to outweigh data showing that European gas stocks were at just 85% on December 1, compared to nearly 95% on the same date in 2023, and 92% in 2022. Recent cold weather and a drop in wind generation has increased the call on natural gas for power generation, reducing gas stocks that had reached 95% a month earlier.

Source: AGSI

This unexpected draw on gas reserves has boosted the price of gas for delivery next summer, when storages are typically refilled during a time of lower demand. This lack of a summer discount could slow the pace at which gas reserves are replenished.

A surge in gas demand for power this winter could also be expected to translate into an increased call on EUAs but with Europe’s industrial sectors continuing to struggle, most sources agree that the EU has an annual surplus of EUAs in 2024.

Stable EUA Prices in 2025 Forecast

Analysts are starting to look ahead to 2025 and predicting that EUA prices are unlikely to move much from their current channel in the mid EUR 60s to low EUR 70s/tonne next year.

Part of this reflects the ongoing economic slump across the region, which is in turn being exacerbated by high energy costs. The European Commission is targeting energy security as a central mission in 2025 but has said it will not negotiate any new supply contracts from Russia. The carbon market may therefore have to look elsewhere for signs of improved demand.

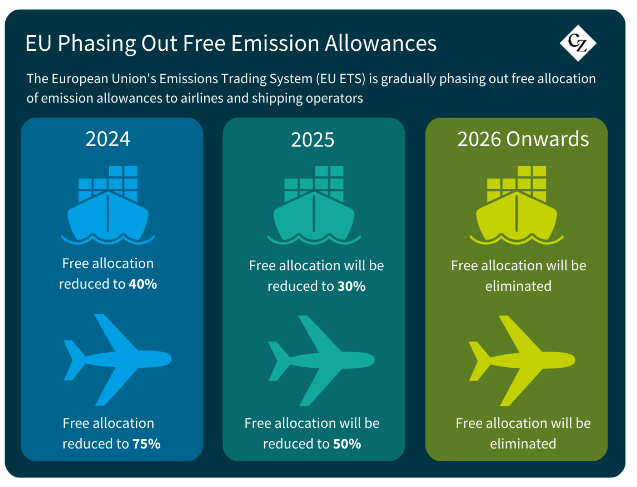

The first may come from the shipping sector. In 2025, maritime shipping operators will be required to surrender EUAs covering 70% of their voyage emissions, up from the current 40%. However, so far there have been relatively few clear signs of shipping demand.

At the same time, the aviation sector is likely to be more active. In 2024 airlines saw their allocation of free EUAs drop to 75%, and next year this quota will fall to 50%, likely prompting additional demand in the secondary market.

Beyond these changes, there is likely to be relatively little to boost prices until 2026, when a host of adjustments alter the market outlook more significantly. Firstly, the free allocation of EUAs to industrial plants will be slashed as benchmarks used to calculate the annual cut in free EUAs are tightened from 2026, from 1.6% a year to 2.5% a year.

Both maritime and aviation operators will have to cover 100% of their emissions from 2026. Aviation accounted for 165 million tonnes in 2023, while shipping emitted 124 million tonnes.

In 2026, the REPowerEU program for additional EUA sales will conclude. EU member states are selling EUR 20 billion worth of allowances to finance the energy transition from 2023 to 2026. These extra permits were brought forward from the 2026-2030 supply, meaning the market will likely tighten significantly once the programme comes to an end.

But in the shorter term, all eyes remain on the natural gas market, and how Europe continues to replace Russian flows.