Insight Focus

The upcoming EUDR may create a two-tier market. Structural issues in major producers Ivory Coast and Ghana mean farmgate prices are lower than the global market. This will be compounded by lack of compliance with EUDR due to reporting challenges.

When the EU Deforestation Legislation (EUDR) comes into effect as scheduled by the end of 2024, there is potential for a two-tier market, with non-compliant cocoa trading at a discount. Farmers in supply chains that cannot prove compliance to EUDR will achieve discounted farmgate prices.

It is likely that a “EUDR premium” will emerge due to the percentage of the world crop that will need to be compliant versus the volume that will be ready — especially in third party supply chains.

In particular, Ivory Coast and Ghana, which collectively are responsible for about 65% of global production, will have difficulties in establishing a farmgate price that will match those paid in other origins. This is primarily because these two origins are government-regulated markets, whereby the system requires the sales to happen a year in advance so that the farmgate price can be fixed by the regulator at the beginning of the prevailing season.

Prices Regulated in Ivory Coast, Ghana

Cocoa is a tropical crop with around 75% of global production coming from West Africa. Both Ivory Coast and Ghana are government-run systems with farmgate prices set by the authorities at the beginning of each season. The prices are established by selling the crop forward during the year prior to the harvest period. The remaining origins are free markets.

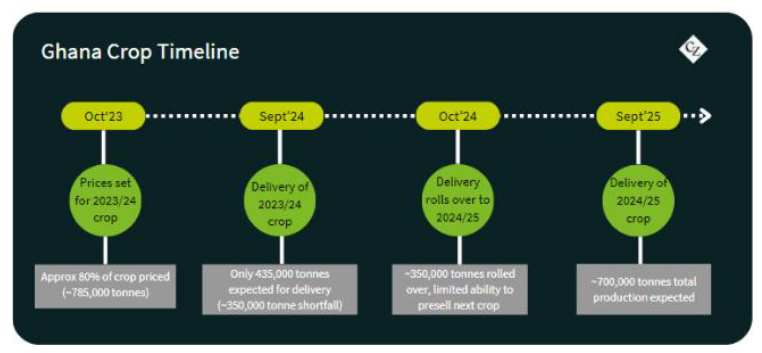

The Ghanaian system uses licensed buying companies (LBCs) and the regulated Cocoa Marketing Company (CMC), while in Ivory Coast, sales are made through co-ops or middlemen called traitants. The farmgate prices in Ivory Coast and Ghana during the 2023/24 main crop were based upon sales made a year forward due to these structures.

Therefore, whilst the free-market origin farmers like Nigeria, Ecuador and Cameroon were seeing the highest ever farmgate prices in history with some quotes of between USD 8,000/tonne and USD 9,000/tonne at farmgate level compared to Ivory Coast and Ghana farmers getting around USD 1,550/tonne.

Farmers Locked In

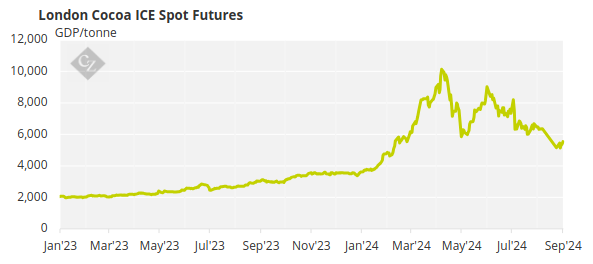

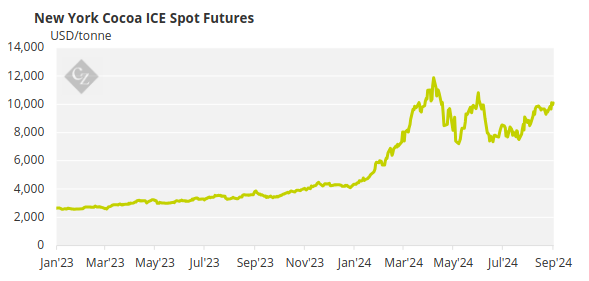

Going forward, the freely traded origins will see farmgate prices at levels in line with the prevailing market, both in relation to the futures market and the physical differential. The ICE Cocoa London spot July’24 contract hit highs of GDP 9,980 in late April, while cocoa spot prices reached USD 11,722 in New York.

The market has settled back further with London December 2024, closing at GDP 5,362 and New York at USD 7,695 with significantly reduced volatility on September 13. Physical differentials have been equally volatile with physical demand pushing differential prices to record highs.

Meanwhile, Ivory Coast has sold volumes over the last twelve months a year forward into heavily backward markets. During the April highs, the spot month was at a USD 4,000/tonne premium to 12 months forward.

There is greater room to sell more 2024/25 crop, so the price should exceed the recently announced Ghana farm gate price of around USD 3,050/tonne. The crop is expected to recover but there are still concerns about selling too much volume after defaults last season, thus creating a restriction on taking advantage of current spot market levels.

Ghana has announced its price and has increased it by 45% over the 2023/24 main crop price which was a lower increase than expected. Having said that, even achieving the announced level will be a challenge because of the previous sales at much lower levels followed by a 250,000-tonne roll from defaults from previous crops.

Cocobod recently revised its crop forecast to 650,000 tonnes, meaning it will have had very little wriggle room to make sales at current levels to meet the farmgate level that it has committed to.

The port arrivals (particularly in Ivory Coast and Ghana) and the global grind figures will be monitored very closely, particularly over the next few months to try and establish whether the crop forecasts are in line with the reality. Any divergence creating a surplus or deficit will influence the direction of the market.

But in any case, the Ivorian and Ghanaian farmers will be locked into a price for the 2024/25 main crop.

EUDR Creates More Challenges

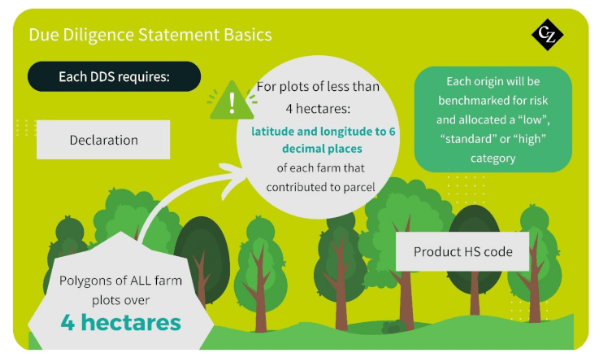

More volatility will be created by the EUDR, which is set to apply on December 30 of this year (barring any delays). This will require any cocoa crossing the EU customs border to be traceable to farm plot and compliant to the criteria of the regulation. This includes no risk of deforestation or being grown illegally according to the land of production. For more about this, read our article What EUDR Means for Cocoa.

It is questionable whether the supply chain will be able to prove compliance with EUDR for the entire volume required for Europe – which accounts for about 60% of the global crop. Over 95% of the cocoa is grown on smallholder farms by farmers who are significantly challenged by high poverty levels, human rights issues such as child labour and major levels of deforestation.

The due diligence needs to have been completed by the 2024/25 main crop in October 2024 so it would be very risky to assume that there will be a delay in the implementation of EUDR.