Insight Focus

CBAM edges towards implementation despite some countries’ call for delay. The levy tackles the carbon content of imported materials but ignores European exporters’ costs. The European Commission has been sent to suggest ways to compensate exporters in Q2 study.

EU CBAM Set to Come into Force

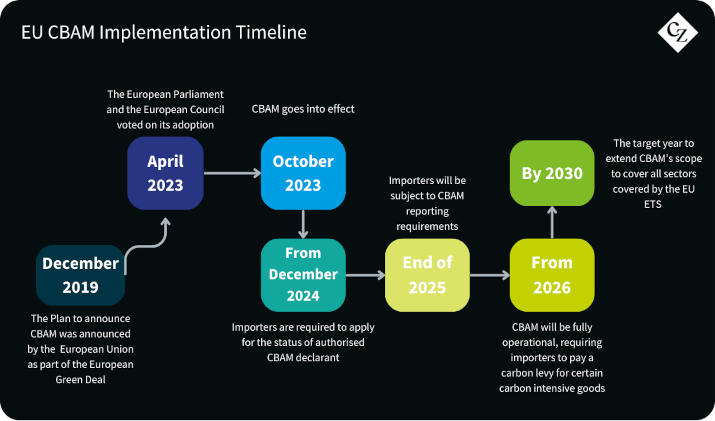

Europe’s Carbon Border Adjustment Mechanism (CBAM) will start to impose charges on the carbon content of selected imports from next year, aiming to level the playing field between EU producers who are required to pay the cost of carbon emissions, and non-EU manufacturers that are not subject to any carbon levy.

CBAM will charge imports a levy according to the greenhouse gases emitted in their manufacture. The cost of CBAM certificates will be payable at the same price as EU carbon allowances are sold at daily auctions under the EU ETS.

Importers have already been submitting data on the carbon in their imports since October 2023, as part of the system’s transitional phase.

However, the mechanism has so far failed to address the competitiveness of European exporters, who must pay for emissions generated by their production, but who are not compensated for this additional cost when selling to countries that do not put a price on greenhouse gases.

This imbalance has been highlighted for some time but has taken on additional importance in recent months as the trade measures such as US tariffs have increased the pressure on European exporters.

EU Faces Rising Manufacturing Costs

Europe’s leadership on climate issues, which includes the EU Emissions Trading System, has meant that the region faces “massive near-term investment needs for EU companies that their competitors do not face,” according to the 2024 Draghi report on European competitiveness.

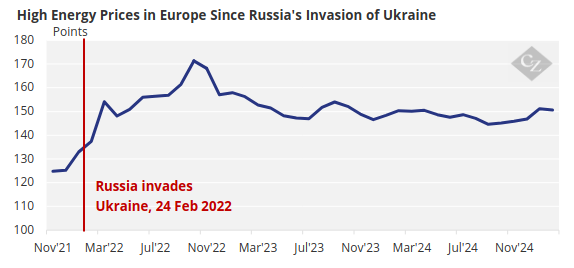

This, combined with the impact of high energy prices in the wake of the loss of Russian natural gas supplies, means that EU manufacturing costs are on the rise, the same time as the threat of tariffs in the US looms large.

Source: Eurostat

A number of EU member states have flagged the problem that CBAM does not protect exports from the EU and indeed, it positively disadvantages them, since production within the bloc is subject to the EU ETS, which currently prices carbon allowances at just under EUR 70/tonne.

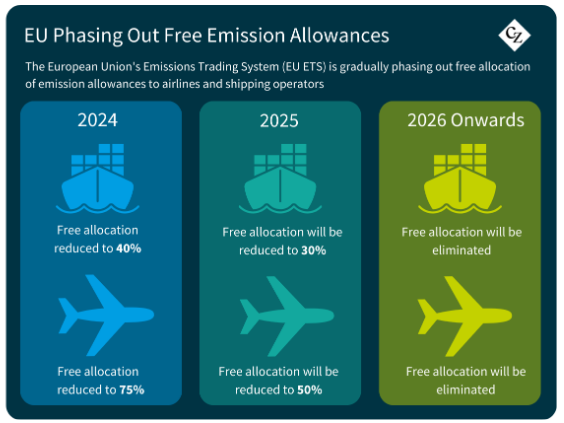

Since the EU ETS still hands out a large portion of industrial companies’ EUA needs free of charge as a support to avoid what is called “carbon leakage” – the relocation of EU production capacity abroad to jurisdictions where there is no carbon price – the risk to exports has so far been minimal.

But as the cost of CBAM begins to be paid by importers, the amount of EUAs given out to EU industrials free of charge will decline, and that free allocation is set to reach zero in 2034. For some sectors, having to pay the full cost of their emissions will hit their export competitiveness hard.

The European Roundtable on Climate Change and Sustainable Transition points out that the sectors covered by CBAM in the first phase are particularly significant exporters. In a study published earlier this year, ECRST noted that “in 2018, iron and steel exports accounted for 22% of EU27 production value, aluminium 18%, and fertilisers 14%, with absolute values reaching billions of euros annually.”

Additionally, the European Commission’s own estimates suggest CBAM-covered industries could see their market share drop by 6.8% unless ways are found to mitigate the cost of carbon.

Commission Explores Solutions to Address Export Leakage

However, the Commission is now looking into ways to address this so-called “export leakage”. Officials in Brussels have said the Commission will issue a report during the second quarter, outlining various options to mitigate the cost of carbon in exports.

One suggestion that has already been floated involves allowing free allocation to continue for that share of EU production that is exported, though this risks falling foul of World Trade Organisation rules on subsidies.

Instead, ERCST suggest creating export adjustment certificates, which could be issued to exporters and in turn exchanged for EU Allowances. These certificates could be issued using the same emissions benchmarking methods that are used to calculate the issuance of free EUAs at present, thereby tying the compensation closely to actual emissions.