Insight Focus

- European PET sales boosted by import delays and a switch over from rPET.

- Prices raced higher in April, averaging 1,735 EUR/tonne.

- High prices look set to be sustained through Q2 on tight supply-demand balance.

Demand Heating Up with Bullish Outlook

Demand for PET is heating up in preparation for the peak summer months, and with low stocks across the supply chain, this sellers’ market has buyers under increased pressure.

Most multinational brands are reporting adequate coverage, but small and mid-sized converters needing to secure additional volume are faced with eye-wateringly high prices to secure short-term supply.

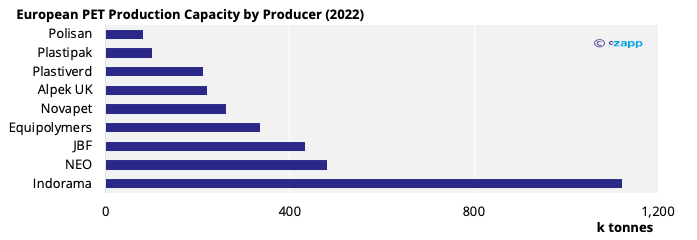

With European PET resin producers heavily contracted this year, many are reporting strong sales with full April books, improving upon the previous month.

Availability should remain constrained through the first half of summer, with buyers unable to build stock.

Domestic Producer Benefitting from Import Delays

Demand is being supported by a bullish outlook for summer consumption voiced by major brands and pre-formers across Europe.

With the most severe COVID restrictions now lifted, bottlers are preparing for strong sales growth this summer, with bottled-water brands reporting high production, close to capacity.

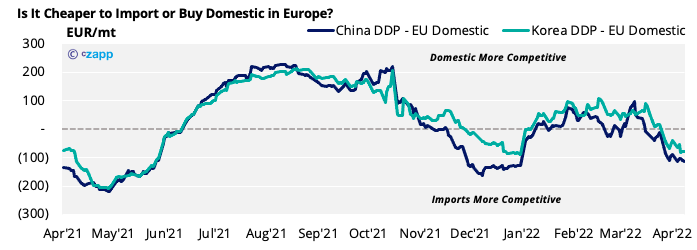

However, with import delays and disruption caused by COVID controls within China (see recent article), buyers are increasingly having to turn to domestic supply.

With Chinese producers offering June shipment at the earliest, the window to arrive in Europe in peaks season is also closing fast.

Buyers in Southern European countries, including Spain, Italy, and Greece, that would have taken a larger proportion of imports, are purchasing additional domestic volumes, and driving up prices in the process.

Sustainability a Casualty of Higher rPET Prices

Virgin PET producers are also benefitting from converters increasingly switching over from rPET to virgin resin.

April prices for recycled material are now at record highs of, 2,300-2,500 EUR/tonne for food-grade rPET pellet, and 1,800-2,000 EUR/mt for hot washed colourless rPET flake.

Whilst thermoformers have typically been quick to respond to price difference in materials, switching back and forth between virgin and rPET over the last 2-3 years, bottlers have generally held firm on recycled content.

Private brand owners, as well as some multinational brands, are now reducing their use of rPET.

Sellers noted that clients that had previously used 50% rPET content, or higher, are now dropping down to 10-25% rPET. As one producer put it,” there are no legal requirements for rPET yet, so buyers are questioning, why the rat race?”.

With the EU’s Single-Use Plastic directive requiring 25% recycle content by 2025 and 30% by 2029, brands and products with less media exposure are silently stepping back from higher rPET content.

Intertwined with record prices, the market lacks ample rPET supply; buyers struggle to secure reliable, high-quality sources of material.

Adding salt to the wound, the introduction of the UK Plastic Packaging Tax on the 1st April (see recent Explainer) means UK buyers are hoovering up greater rPET volumes.

Other multinational beverage brands are maintaining a strong commitment to recycle targets, though, instead looking to optimise the use of rPET across product portfolios and improve access to higher quality feedstock.

PET Resin Prices Reach Record Highs in April

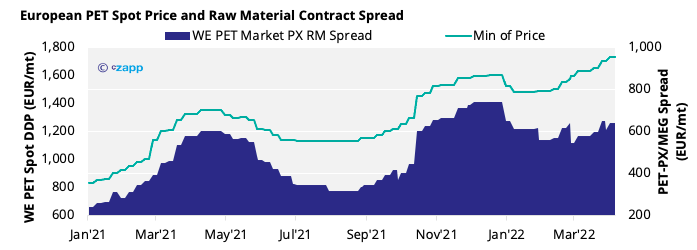

European PET resin spot prices have leapt in April, averaging around 1,735 EUR/mt, up 105 EUR/mt from March.

Lower spot prices of around 1,700 EUR/mt were heard for local delivery in Northwest Europe, whilst other producers reported prices as high as 1,770 EUR/mt for smaller, irregular buyers.

Import prices based on offers from Chinese producers are currently in the range of 1,490-1515 EUR/mt CIF, offering a substantial discount to domestic European prices on a delivered basis.

March’s PX European Contract Price (ECP) eventually settled late in the month at 1,735 EUR/mt, an increase of 105 EUR/mt on the previous month.

Based on raw materials’ March settlements the spread between the PET spot price has narrowed over the last month.

Given crude’s retreat in recent weeks and Chinese lockdowns adding bearish sentiment to the upstream markets, expectations are for flat to modest upside for April’s ECP.

Surcharges have been discussed with customers (300 EUR/mt on IPA from Indorama; 200 EUR/mt on PTA from INEOS). At least one producer has been heard contemplating surcharges on PET raw-material-based contracts in late March, and another reneging on volumes, due to the surge in energy costs.

With most contracts now linked to price indices in a move away from traditional raw material formulas, expectations remain that, unlike last October, additional surcharges on PET resin contracts shouldn’t become commonplace in 2022.

European Production Highest for Nearly Two Years

Despite the challenging business environment, it’s also important to note that European PET production is running relatively smoothly and at high operating rates for first time in nearly two years.

Whilst energy prices remain highly volatile and added costs continue to plague the market, PTA supply and subsequent PET production planning has improved.

Delivery times for PTA imports, particularly from South Korea, whilst longer than pre-COVID, have stabilised over the last few months allowing for adequate planning.

Other producers that had previously lost production due to a lack of feedstock, have improved PTA supply security by making the switch to breakbulk vessels.

Producers are nervously eyeing INEOS, hoping for a successful restart on PTA planned this week, given the plant’s history of difficult restarts following scheduled maintenance.

Market Outlook & Concluding Thoughts

- Although crude oil and energy prices have retreated over the last month, underlying costs for the PET market should remain highly volatile.

- Potential escalation of sanctions on Russia’s energy markets and further lockdowns within China, could see prices pressed higher still.

- For Q2, historically low inventories, coupled with high demand and import disruption, should lead to sustained high prices and spreads over raw material costs.

- Even with a softening of seasonal demand in Q3, production costs look set to remain high, supporting high prices through much of the next six months.

Other Insights That May Be of Interest…

Chinese PET Industry Faces Biggest COVID Outbreak Since 2020

PET Resin Trade Flows: China’s COVID Response Slows Exports

What the Ukraine Crisis Means for PET

European Port Delays and Heavy Snow Tighten PET Supply

Europe’s PET Supply Worries Ease as Omicron Hits Consumer Demand