Insight Focus

Carbon prices hit a six-month low after compliance season. This decline was followed by a rally when investment funds raised their short positions. As winter approaches, the market is expected to track natural gas prices.

Volatile Movement in European Carbon Prices

European carbon prices have recently experienced significant fluctuations, plunging over 10% before bouncing back, underscoring the technical dynamics of carbon trading this year.

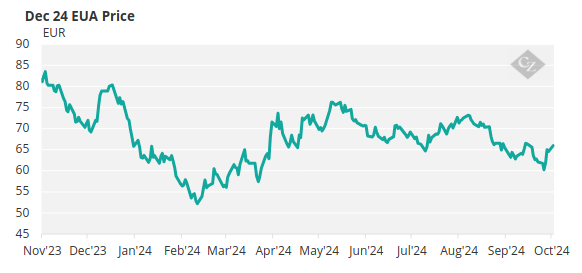

December 2024 EUA futures dropped from EUR 66.97 to a six-month low of EUR 59.95 between September 30 and October 9, before recovering to EUR 66.18 on October 14. Despite this volatility, traders emphasize that there has been no substantial shift in the demand outlook for EU carbon allowances or the profitability of gas and coal power during this period.

Source: ICE

This price volatility largely reflects the increasing influence of speculative and algorithmic traders rather than fundamental demand changes. Recent data from the Commitment of Traders (COT) report indicates that investment funds have established their largest net short position in EUAs since March. Historically, such bearish positions have prompted price increases as traders seek to test the conviction of those short positions through price squeezes.

EUA prices reached their six-month low just before the release of the latest COT report. Following its publication on October 9, prices reversed direction and have been on the rise since. Carbon traders widely cite the COT data as the main catalyst for this rally, noting that at prices of EUR 60 and below, compliance buyers have shown fundamental demand for future use.

Correlation with Natural Gas Prices

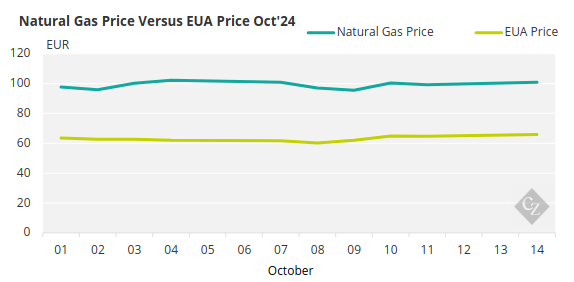

Additionally, a renewed correlation between natural gas and carbon prices has emerged. During the steep decline of carbon prices in early October, natural gas prices remained stable, suggesting that carbon was reflecting bearish sentiment following the annual compliance period.

However, the correlation has resumed, with carbon prices moving in tandem with month-ahead TTF gas prices. Market sources indicate that this correlation has been a defining feature of 2024, with little expectation for other influences to emerge soon.

EUA prices have maintained a range of EUR 60 to EUR 67 over the past month, and market participants do not anticipate a significant breakout from this range in the short term. EU carbon emissions are continuing to decline, with ENTSO-E reporting that fossil-fired power plants produced 16% less electricity in September 2024 compared to the previous year, while gas-fired power’s share fell by 13%.

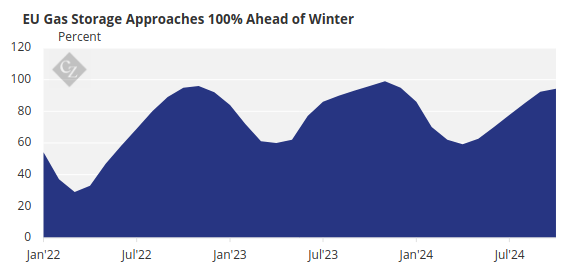

According to analysts at Commerzbank, natural gas prices are influenced by a balance of ample supply and geopolitical concerns. They note, “The fact that gas prices are rising despite weak demand in Europe and nearly full gas storage facilities is due to supply risks.” These risks are expected to continue to support gas prices in the coming months.

Source: AGSI

This suggests that carbon prices will likely continue to track the fluctuations of TTF gas. Without major regulatory changes or a significant economic recovery, EUAs are expected to remain price takers rather than price makers.