Insight Focus

EUA prices have stabilised in the low-EUR 80s. Natural gas is also at long-term highs. Funds, speculators with record long positions seen as “stretched”. The European Commission is likely to water down CBAM rules to help industry, which may depress EUA demand.

Carbon Prices Stabilise

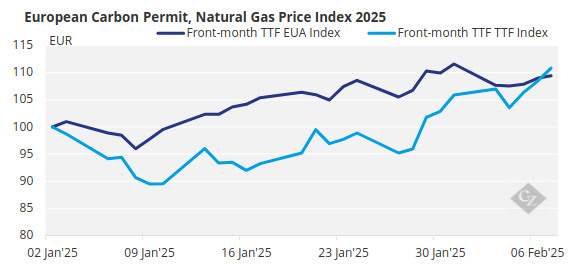

European carbon prices have stabilised in the low EUR 80s/tonne for the last 10 days after a six-week rally took the market from EUR 62.00 to EUR 84.50, a gain of 35%.

Source: ICE

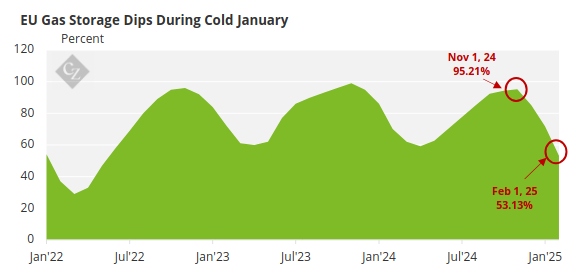

The main driver for the gain in EUA prices has been natural gas. The benchmark TTF futures contract has climbed by 25% over the same period, bolstered by colder-than-predicted weather that has drained EU gas storages faster than expected, and uncertainty over how the region will replenish these stocks before next winter.

Source: AGSI

Carbon’s bullish trend has been accentuated by soaring speculative positioning by investment funds. The latest weekly Commitment of Traders data showed funds held their largest net long position in nearly three and a half years.

Coincidentally, investment funds’ total open interest of 143 million EUAs is their largest-ever share of total open interest.

Funds have also amassed their largest ever net long position in TTF natural gas contracts, speculating that Europe’s harsh winter and rapidly swindling stockpiles will force the region to continue buying at high prices over the coming summer, to ensure that storages are once again 90% full by the November 1 mandated deadline.

This upward pressure on gas prices has dragged EUA levels higher as investors bet that rising gas prices will force the EU to maximise its coal burn in the short term.

Coal Rebalances Market

And indeed, utilities have turned back to comparatively cheaper coal to generate power. Data from the EU’s grid agency show that in January, hard coal use was marginally higher than at the same time in 2024, while lignite-fuelled generation rose 8% year-on-year. Increased use of more carbon-intensive coal and lignite is supportive for EUA prices, since their use requires operators to surrender at least twice as many EUAs as for natural gas.

But is this trend coming to an end? With Europe seemingly now burning as much coal as it can, where is the further upside for carbon prices? Over the last week the price of EUAs has stalled in the low-to-mid EUR 80s, as traders battle it out over the market’s direction.

Technically minded participants have commented that the bulls are stretched and don’t have the resources to push prices significantly higher, but the influence of record-high TTF gas is helping stabilise EUA prices and there is no strong sense that a shake-out is imminent.

Instead, voices have begun to emerge suggesting that carbon prices in the EUR 80s, while front-month TTF gas is in the EUR 50s/MWh, are too painful for European industry.

Two Year CBAM Delay Proposed

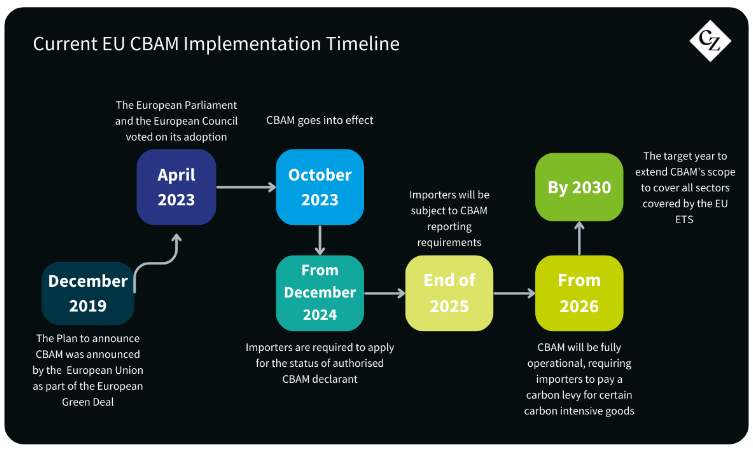

Coincidentally, some segments of the European political sphere are now calling for a delay to the introduction of the compliance phase of the bloc’s Carbon Border Adjustment Mechanism.

In January, the centre-right European People’s Party Proposed delaying CBAM for two years to help halt what it called the “deindustrialisation” of Europe and allow the region to recover from the current economic downturn.

This brought a robust response from industry groups such as cement lobby Cembureau and steel group Eurofer, which said any delay to border carbon levies would harm EU industry.

But more recently, EU climate commissioner Woepke Hoekstra announced he was considering scaling back the scope of CBAM to cover just 20% of the companies initially targeted by the system. He pointed out that 97% of the emissions covered by CBAM are produced just 20% of companies in the scheme.

An exemption of 80% of the companies nominally covered by CBAM would require some adjustments to the plan to gradually remove their free allocation of EUAs. These companies would likely continue to get support against so-called “carbon leakage” – the risk of offshoring production to jurisdictions without a price on carbon emissions.

Any delay to CBAM would mean that expected “hedging” of CBAM costs by buying EUAs might also be delayed, cutting projected market demand, some observers have suggested.

Any changes to CBAM will be tabled by the European Commission at the end of the month, as part of an “omnibus” regulatory proposal to simplify sustainability policies, according to media sources.