Insight Focus

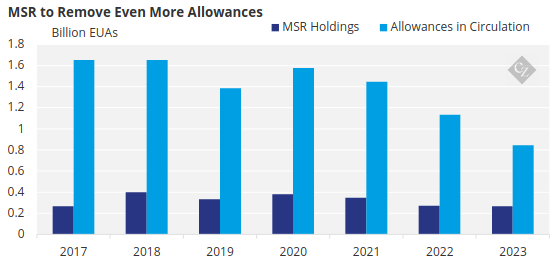

The annual Market Stability Reserve reduction is at its smallest level yet. Total EUA supply is now falling closer to the targeted level of 833 million per year. The EU has also invalidated more than 2.5 billion EUAs to date.

MSR Removes EUA Supply The European Commission announced over the weekend that it will remove 266 million EU Emission Allowances from the market over the period from September 1, 2024 to August 31, 2025.

The withholdings represent an adjustment to supply based on data covering total supply and demand at the end of 2023.

The annual adjustment to market supply is carried out by the Market Stability Reserve (MSR), an automatic mechanism that removes 24% of total market supply based on data from each calendar year.

Source: European Commission

The MSR removes surplus EUAs when the Total Number of Allowances in Circulation (TNAC) exceeds 833 million tonnes and injects additional EUAs if the TNAC falls below 400 million tonnes.

The principle behind maintaining a steady “float” of supply is to ensure that companies that wish to hedge the future exposure to carbon prices can do so in a market with sufficient supply.

The MSR was introduced in 2018 after a glut of EUAs had grown to in excess of 2 billion allowances – more than a full year’s demand from the entire market – after compliance entities had opted to buy and surrender UN carbon credits rather than more expensive EUAs.

MSR May Be Suspended Soon

The European Commission also announced that it had invalidated more than 380 million EUAs from the MSR in order to maintain the reserve’s holdings at 400 million, as mandated by EU ETS regulation. In total, more than 2.5 billion EUAs have been invalidated to date.

The MSR adjustment for 2023 represents the smallest annual cut in EU ETS supply since the mechanism was introduced. In 2022 the MSR took 272 million EUAs from the market supply, compared to nearly 379 million in 2020.

This leaves total market supply at the start of 2024 at 845 million tonnes – still above the 833 million threshold that would trigger the MSR again in 2025. But under the rules governing the MSR, if the TNAC falls below 1.096 billion tonnes, any cut to supply under the MSR can only withdraw as many EUAs as needed to bring the resulting supply to 833 million.

This means that the market is approaching a point where the MSR may be suspended, as supply drops below the threshold for activation.

However, more than 34 million extra EUAs have been added to supply so far in 2024 under the REPowerEU initiative that is aimed at raising funds to support the transition away from Russian energy sources. Another 30-40 million are likely to be sold over the rest of the year.

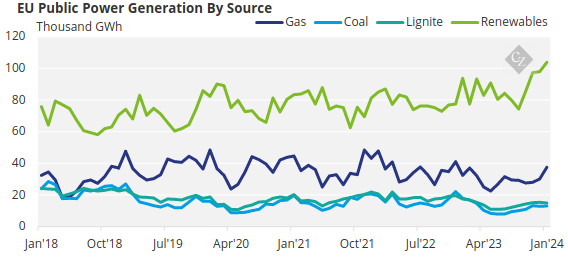

Equally, demand for EUAs is slipping as power generators continue to cut output at coal- and gas-fired plants across the EU, and this could also help increase the market supply as utilities buy fewer permits.

Both these factors raise the prospect that the MSR may operate again next year.