Insight Focus

The urea slide subsided this week but China could change price direction. Processed phosphate prices were up but new production coming online could weigh on sentiment. The outlook for ammonia is gloomy, particularly in Europe where another producer curtailed production amid high gas prices.

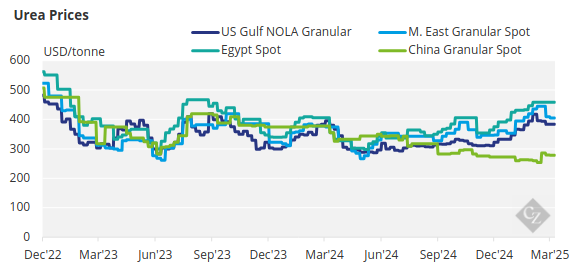

Urea Price Slide Subsides

The slide in urea prices has come to an end — at least temporarily — with IPL of India announcing a 1.5-million-tonne urea tender to close on April 8 with validity to April 15 and shipments through June 12. The reaction on prices was swift with the paper market in the Middle East April futures up USD 9/tonne from the last settlement and May up USD 13/tonne.

Oman apparently sold a cargo to Australia at USD 363/tonne FOB for May shipment. MOPCO of Egypt sold a small cargo for the second half of April at USD 370/tonne, which is up between USD 1/tonne and USD 5/tonne. However, for comparison, a mid-February urea cargo changed hands in Egypt at USD 459/tonne FOB, meaning the market has lots of recovery to do.

However, the big issue will be China and when it will resume international shipments. With the long shipment period until June 12 on the India tender, China may come into play. However, everything suggests that this could still be too soon since the domestic market in China will still experience demand. In the event Chinese products come into the market, it could put enormous pressure on prices yet again.

In summary, it is too early to make a definitive call on urea prices since Middle East producers and others in North Africa have yet to place March and April production.

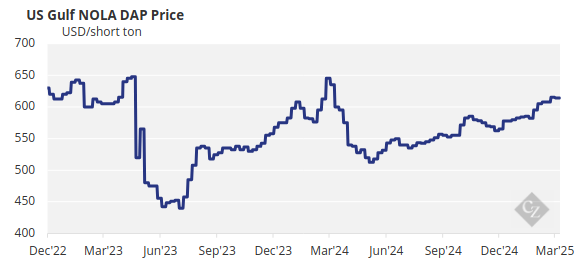

Processed Phosphate Awaits China Return

Production cost of processed phosphate went up exponentially with Qatar Energy increasing sulphur prices by USD 73/tonne for April shipment to USD 275/tonne FOB vs USD 166/tonne in January 2025. For comparison the February 2022 sulphur price was USD 428/tonne FOB.

In addition, JPMC of Jordan and Coromandel of India have confirmed a new phosphoric acid 100% P2O5 price of USD 1,153/tonne CFR which is up USD 98/tonne from last done. Obviously, this price is a reflection of sulphur prices with sulphur being an important input to make phosphoric acid.

Further, DAP prices in India are going up with the latest sale reported at USD 650/tonne CFR, up USD 17/tonne since the start of the year. Latest offers in India are said to be around USD 660-680/tonne CFR.

On the back of Chinese producers not taking part in international business, other producers are now taking advantage of this supported by higher production costs. China is expected to come back into the market sometime in April or May.

The long awaited OCP and India arrangement of a 1.5-1.6 million tonne DAP and TSP supply agreement is still not concluded, yet the parties have been in discussion since December 2024. Apparently, the disagreement is around the pricing of the TSP, which will make up around 800,000 tonnes of the arrangement. Shipments were expected between February and December 2025.

Moroccan phosphates fertilizer producer OCP’s subsidiary OCP Nutricrops plans to increase fertiliser production capacity by 9 million tonnes/year by 2028, with 4.5 million tonnes/year operational as early as 2026, it said on 26 March.

In other news, OCP Nutricrops will build two new mining and industrial facilities, Mzinda and Meslaka. The two hubs will focus on TSP and TSP+, which refers to TSP with micronutrients. The company’s current phosphates production capacity is around 15 million tonnes/year.

The two sites are designed to operate entirely on renewable energy sources, with the use of advanced technologies, artificial intelligence and automated production processes, according to OCP Nutricrops.

Brazilian MAP prices are also going up, with the latest conclusion at around the USD 660/tonne CFR mark, up USD 5/tonne week-on-week. Last week’s prices went up USD 15/tonne CFR. Now producers are offering USD 670/tonne CFR.

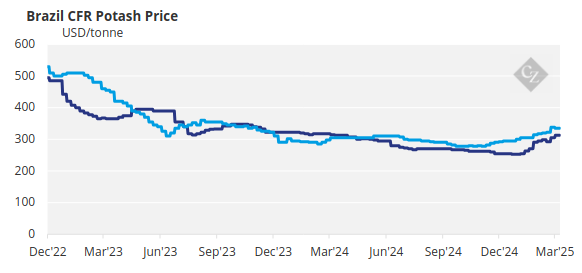

Potash Up Ahead of Q2 Price Rises

Potash prices increased in Southeast Asia, the US and Northwest Europe ahead of Q2, as supply outside the US begins to tighten slightly with limited prompt offers. Southeast Asian standard potash prices rose to USD 315-330/tonne CFR this week, driven by increased demand from palm oil plantation tenders.

April offers remained limited, with expectations that they may range from USD 340-350/tonne CFR. Prices are expected to continue rising in the coming weeks due to tightness in the Q2 market and favourable palm oil prices, which could further boost demand.

Potash prices in Northwest Europe increased this week due to higher second-quarter contract prices. Standard MOP prices rose to EUR 327.5/tonne CIF, while granular MOP reached EUR 350/tonne CIF, the highest levels since May 2024. Sales surged last week as buyers secured product before the higher Q2 prices.

In the Northwest European SOP market, standard prices remained stable this month at EUR 570- 590/tonne FCA. Prices are expected to rise modestly in Q2 due to increasing costs, particularly higher MOP prices, though producers may proceed cautiously given the already high price levels.

The Brazilian MOP market saw little change this week as the slow inland market limited CFR business. Prices stayed at an average of USD 337.5/tonne, the highest since 4 April 2024. Offers for May range between USD 340-355/tonne CFR, though no deals above USD 340/tonne CFR have been reported yet.

In the US market, demand remains positive across the board, with ample supply. Nutrien raised its price to USD 370/short ton (USD 407/tonne) FOB for all terminals in the Midwest on 24 March, driven by strong spring demand. The NOLA potash market saw a price increase this week, reaching USD 315- 320/short ton FOB.

The outlook for potash prices in Southeast Asia is bullish with palm plantations coming back into the market from Eid celebrations.

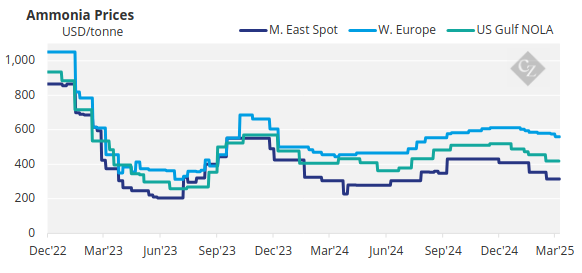

European Ammonia Outlook Gloomy

The ammonia market remains largely oriented to the downside, with supply more than enough to cover the small pockets of demand seen globally. Bearish sentiment was further amplified by news this week from Tampa, where Yara and Mosaic settled April’s contract at yet another decline, although one not as substantial as some may have been expecting.

Whilst most had suspected the USD 460/tonne CFR number for March would indeed decline, the USD 25/tonne downward correction to USD 435/tonne CFR – the lowest figure since July 2024 – appears relatively modest considering latest news from elsewhere in the US Gulf.

After years of delays, the 1.3 million tonne/year Gulf Coast Ammonia (GCA) facility in Texas finally looks set to commence exports, with Yara’s Dancing Brave scheduled to depart Texas City late March with the plant’s maiden export shipment. However, it remains unclear under which basis Yara has procured the tonnes from GCA/offtake partner Mabanaft, with clarity tentatively awaited.

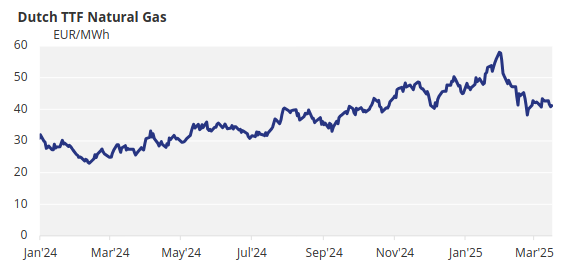

Production of ammonia in Europe is facing a gloomy future. Yet another producer, Achema of Lithuania has decided to curtail its ammonia production until further notice claiming that it is unable to compete with third-party ammonia coming in from Africa and Russia.

The company says that European producers are at a massive disadvantage relying on the European TTF gas index plus CO2 emission costs, which imported ammonia currently does not have to pay. The company says that the fertilizer industry in Europe, as well as the food industry, will suffer significantly in the future as more closures of ammonia production facilities take place.

Prices should remain positioned towards the downside, with little upside support forecast moving into Q2.