Insight Focus

- Argentina is the world’s largest peanut kernel exporter, but weather is limiting yields this harvest.

- Brazil and the US are both contending with potential aflatoxin, which means products would not meet EU spec.

- Due to quality considerations, the EU is running out of sources for peanut kernels and prices continue to rise.

Global peanut supply is modestly constrained, particularly in the European market. A severe shortfall in Argentinian 2022/2023 production has driven prices higher in the European peanut markets in recent months, up 22% from the start of the year and the highest price since August 2012. Argentina and Brazil, the two primary exporters of high oleic peanuts to Europe, are showing signs that they may be unable to meet demand from December onwards.

Americas Production Suffers from Weather, Pest

The European market requires high-quality peanuts, meaning it cannot just buy from anywhere. It mainly procures its peanuts from Argentina, Brazil and the US, although India is also emerging as a source of high-quality peanuts.

Harvest has already started in the Northern Hemisphere, delayed by late rains in many production areas so stocks are already low. But European peanut kernel imports are also constrained due to lower yields and production quantities in Argentina. In 2021, Argentina exported 24% of its production to Europe and the UK.

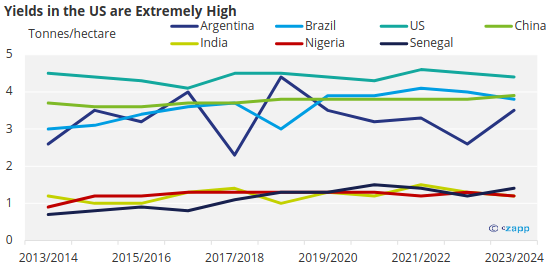

Rain is critical for planting but the usual seasonal rains in Argentina are late. El Niño projections raised hopes, but cold weather persisted, further postponing showers. As a result, Argentina’s peanut crop faces low yields, with exports anticipated to fall dramatically. According to the Argentine Peanut Chamber, the country’s production fell by 40% this year and average yield was just 2.6 tonnes/hectare. This is resulting in a lack of high-quality peanuts on worldwide markets and increased costs.

Source: USDA Foreign Agricultural Service

At the same time, Brazil is struggling to find EU-spec peanuts to send due to pesticides and aflatoxin. Even though planting was delayed due to high temperatures and a lack of rain, the planted area increased by roughly 10%. And as a result of increased export demand, primarily from Russia, Brazil has seen a 10% price spike.

A few weeks ago, the forecast of a potentially poorer crop outcome and serious risk of aflatoxin issues in the US drastically altered expectations for that crop too. The US crop looks like it will be substantial, although it is unclear whether the quality will be adequate for the European market.

Argentina Key Peanut Kernel Source

Groundnuts are native to South America (Bolivia, Peru, and Brazil), but today they are grown in nearly 100 countries in tropical and subtropical regions. In the Northern Hemisphere, harvesting is commonly performed between September and November and in the Southern Hemisphere between February and May.

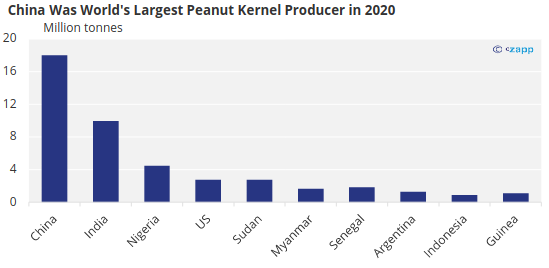

According to FAOSTAT, worldwide peanut production was almost 54 million tons in 2021, with Asia accounting for the largest production (59.6%), followed by Africa (30.3%), and the Americas (10%).

Source: Tridge

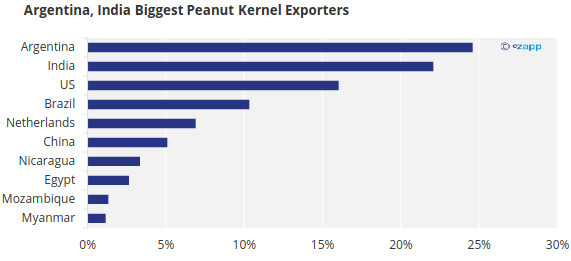

China tends not to export its production, though. The main exporters of peanut kernel in 2022 were Argentina, India and the US. Argentinian export levels have grown considerably between 2018 and 2020. Despite a slight drop between 2020 and 2021, it has maintained its position as the largest exporter.

Source: Tridge

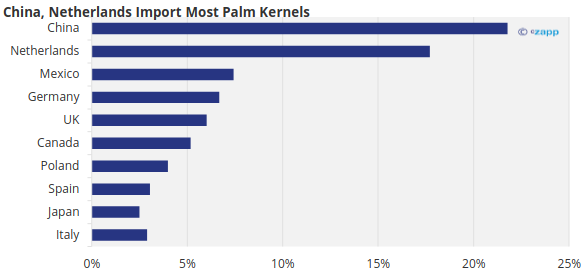

European countries Germany, Poland, Spain and Italy – alongside the UK – are significant peanut kernel importers. Combined, they account for 22.7% of global peanut kernel imports.

Source: Tridge

Prices Likely to Keep Rising

With prices already high and supply limited, China could further complicate matters. Despite being a major producer, China is still recovering from the lost volume on the previous crop. In 2022, the planting area was 4.6% lower than 2021 but this year, it will increase by 2.8%. Due to severe rains during harvest and increased demand, there was a 16% price increase in China – although this may be temporary due to anticipated post-holiday market dynamics and the current harvest.

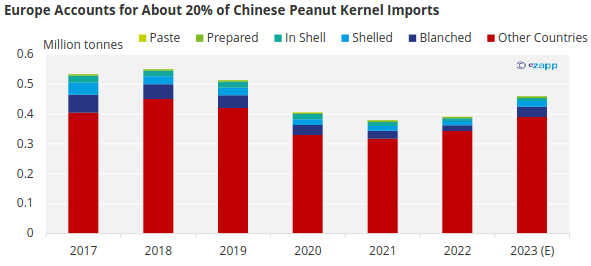

According to China’s import statistics, the country still has a significant demand for peanuts. But if Europe faces peanut shortages, China will need to find a new source. Already, China’s has slowed imports of European peanut products.

Source: HT Nuts

China’s peanut imports will remain at between 600,000 tonnes and 1 million tonnes per year, while peanut oil imports will remain at between 240,000 tonnes and 300,000 tonnes. This could monopolise a large chunk of Indian exports and cause headaches for Europe.

Planting in the Southern Hemisphere is approaching, albeit hampered by weather and pest. But the good news is that high prices are causing Argentina and Brazil to expand their planting areas, which might improve supply from June onwards if the weather cooperates.

Nonetheless, Q1 2024 will be challenging for Europe, with Argentine stockpiles depleting quickly and the idea of filling this gap from other sources at best speculative. There will be enough supply; the question is whether high-quality product will be available until the next crop from the Southern Hemisphere.

Concluding Thoughts

- Argentinian production constraints are pushing up prices across the global peanut market.

- This is compounded by issues in the Brazilian and US markets.

- This could present opportunities for India, which is capable of producing EU-spec peanuts.

- But a shortfall in China could create competition for Indian peanuts, which will likely increase prices.

- Over the last five years, Nicaragua and Egypt gained the most market share in the European market as relatively new, emerging suppliers.

- There could be opportunity for smaller suppliers to enter the European market as long as they are capable of producing EU-spec products.