Insight Focus

- PET resin demand slowed in May as buyers became more cautious.

- Despite a hike in PX contract prices, PET resin prices fell by an average of 75 EUR/tonne.

- European prices expected to track import parity closely in Q3, producers to defend market share.

Following a somewhat frantic March and early April, demand eased going into May as buyers pushed back against high prices and some producers found themselves with stock to sell.

Additional inventory acquired by converters following the invasion of Ukraine enabled buyers to pause for thought, taking the heat out of the market.

However, major European buyers also noted traditional buying patterns where sales are higher in April than in May.

Unlike at other points over the last two years, European PET production is also running at relatively high rates, meaning supply is far from constrained.

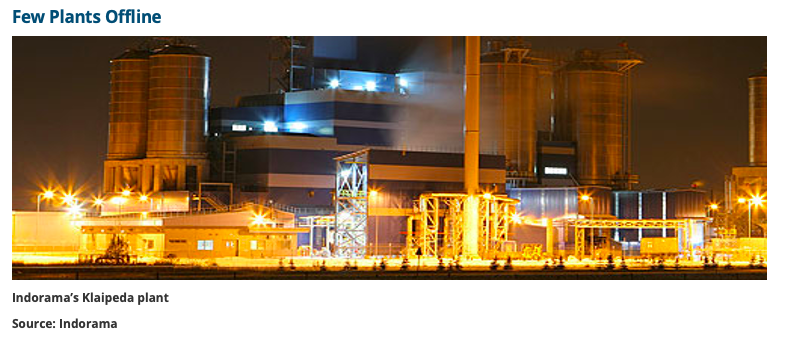

Except for a temporary technical issue at Indorama’s plant in Klaipeda, Lithuania, that is expected to be resolved this week, and the ongoing scheduled maintenance at the company’s plant in Spain, all other European PET resin assets are running well.

INEOS’ restart at Geel, Belgium in April also went as planned, meaning that there are currently few constraints on domestic PET resin production.

Cost of Living Crisis

High inflation and uncertainties surrounding the cost-of-living crisis also fed into the more cautious approach by European buyers.

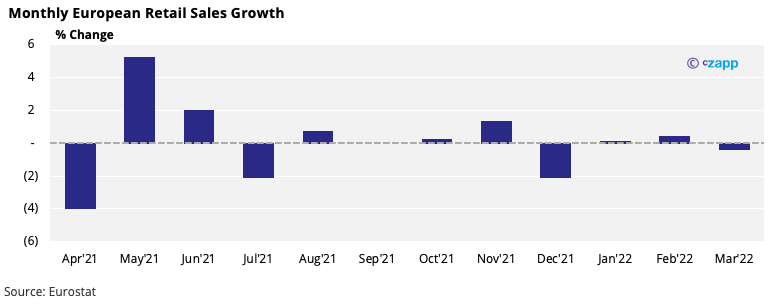

Latest Eurostat figures show that retail sales in the eurozone fell 0.4% month on month in March as higher consumer prices weighed on purchasing power.

However, food and beverage purchases, which most relate to PET resin consumption, bucked this trend and grew 0.8% on the month.

Despite the threat from inflation, leading bottlers in the region continue to report good sales growth, following a strong set of Q1’22 corporate results.

With warmer weather due in the coming weeks, consumer demand for food and beverages is showing little sign of waning, with growth expected to be maintained into the peak season.

Resin demand from Ukraine has also begun to recover, with demand for bottled water tripling. One of the country’s major beverage bottlers is also expected to restart production by end of the month.

Any notable curtailing of discretionary spend is now only expected to be felt towards the end of the year and will likely guide decision-making for 2023 rather than the summer ahead.

European Prices Look to Have Peaked in April

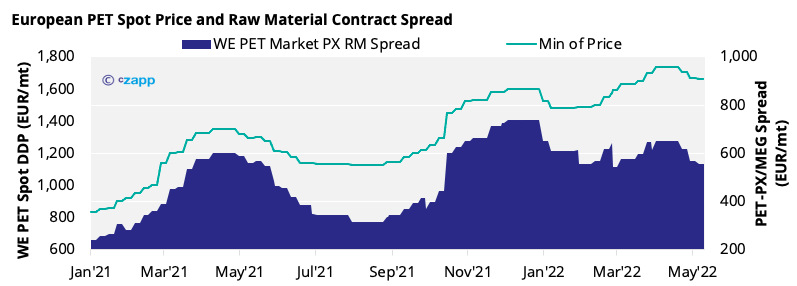

After racing up into the EUR mid-1700s in April, European PET resin spot prices fell due to weaker demand in May, averaging EUR 1,660/tonne, down EUR 75 from April.

Lower spot prices of EUR 1,620-1640/tonne were heard for local delivery in Northern Europe, whilst other producers reported prices as high as EUR 1,700/tonne for buyers of smaller volumes.

May’s monoethylene glycol (MEG) European contract price (ECP) settled at EUR 1,060/tonne, down EUR 75 from the previous month.

However, with a general expectation of a similar, lower paraxylene (PX) ECP settlement for May, and accepting downward pressure on prices, the market was thrown something of a curveball with an early settlement at EUR 1,240/tonne, an increase of EUR 75 from April’s settlement.

With PET resin spot prices and PX contracts heading in opposite directions, the PET – Raw Material spread narrowed by nearly EUR 100/tonne compared with a month earlier.

Import Parity Will Define European Prices in Q3

With stock to sell in the first half of the year and concerns around higher imports during the second half of the summer, European producers have cautiously pared prices back closer to import parity.

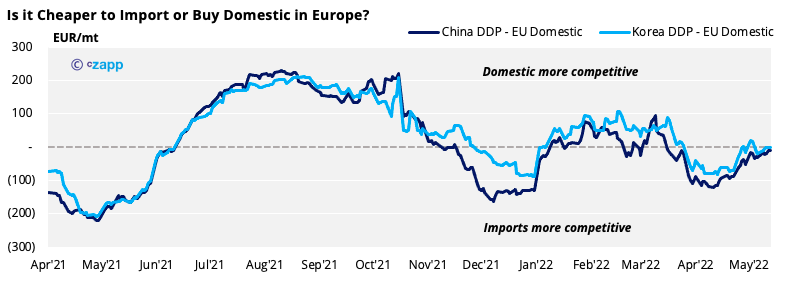

The delta between domestic and imported spot resin prices has swung back and forth several times over the last 12 months.

At points, European producers have been able to sell at large premium to import parity, at other times imports have been more expensive and priced out of the market.

Asian export prices, have themselves been on the rise those over the fortnight, by as much as USD 40/tonne from a month earlier. At the time of writing, export offers averaged $1230/tonne FOB China.

Import prices based on offers from Chinese producers are currently in a range of EUR 1,600-1,610/tonne CIF, putting them broadly on a par with average European spot prices on a delivered basis.

To defend market share from imports, particularly in the run-up to 2023 contract negotiations later in the year, European PET resin spot prices are now expected to track import parity closely through Q3.

Are High rPET Prices Sustainable?

RPET prices solidified gains going into May, with high bale prices and mounting logistics costs supporting high prices.

Whilst European producers continue to benefit from buyers switching over from rPET to virgin resin, the push back has failed to temper soaring prices, with the gap between recycled and virgin widening further in May.

There continues to be a wide range of prices for both products, and pricing is highly dependent on quality.

Food-grade rPET pellet prices have ranged from EUR 2,400 to 2,700/tonne delivered, with hot washed colourless rPET flake at EUR 1,900-2,000/tonne.

Even at the lower end of the range, food-grade rPET prices are more than EUR 740/tonne higher than the average European virgin price, with flake some EUR 240/tonne higher.

Market Outlook & Concluding Thoughts

- Despite a slower start to May, seasonal demand is expected to increase with the coming warmer weather, supporting growth in domestic sales over the next month.

- Producers cite concerns around increased import competition from mid-summer.

- However, Asian exports will continue to face delayed shipments and longer transit times due to COVID disruptions; breakbulk arrivals are also likely to be concentrated to just a handful of major buyers rather than disruptive to the wider market.

- Secure, reliable domestic supply, with short turnarounds, will still be prized by many buyers.

- However, there is a potential for recent PTA production cuts in China to reduce supply to certain European producers, and as a consequence PET resin production in Europe.

Other Insights That May Be of Interest…

China’s zero-COVID Approach Hampers PET Resin Exports

China’s Zero-COVID Policy Hits Domestic PET Resin Demand

European Buyers Under Pressure as PET Prices Hit New Highs

Will 2022 Be the Summer of Port Congestion?

Chinese PET Industry Faces Biggest COVID Outbreak Since 2020