Insight Focus

- Buyers keep to minimal stocks as summer demand disappoints and price plummet.

- Prices have steadily declined through June, as producers struggle to maintain breakeven costs.

- Some producers pinning hopes on early imposition of provisional ADD on Chinese resin.

Demand and Market Overview

Turgid PET resin demand continues to plague the European market.

Cooler and wetter weather in South France, Italy, and the Balkans impacted both beverage and sheet demand in May, whilst pressure on consumer spending continues to mount.

Northern Italy also experienced heavy rainfall in May resulting in extensive flooding, causing severe destruction. Beach resorts along the Adriatic Sea were also damaged, bruising the area’s tourism as a result.

Source: The Guardian

And whilst Spain experienced a blistering heat wave, high levels of Q1 imports has led to a delay on any domestic resin demand uplift resulting from the better weather.

With the weather now warming across the continent, converters have begun to report improved sales, although volumes are significantly below expectation and typical season levels. In some markets, preformers and converters cite double digit declines on past sales.

Despite producers continuing to operate at reduced rates, there is still ample supply available on the market. Several Spanish producers announced further reductions last week.

Indorama is also understood to be in the process of restarting its second line at its Rotterdam facility.

Overall, inventories across the chain are at low levels, with buyers holding minimal stock, purchasing hand-to-mouth.

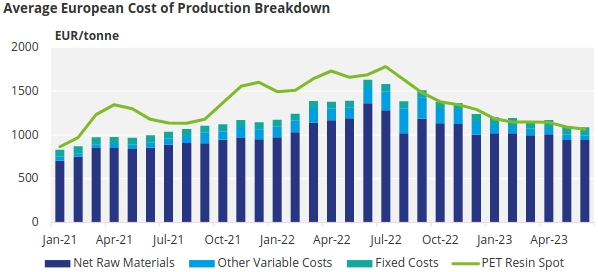

Most producers are also running stocks at relatively low levels, with production cost and volume finely balanced demand. Others face a running battle against costs amid poor volumes and weak margins.

European PET Spot Prices Consolidate Ahead of Potential Rise

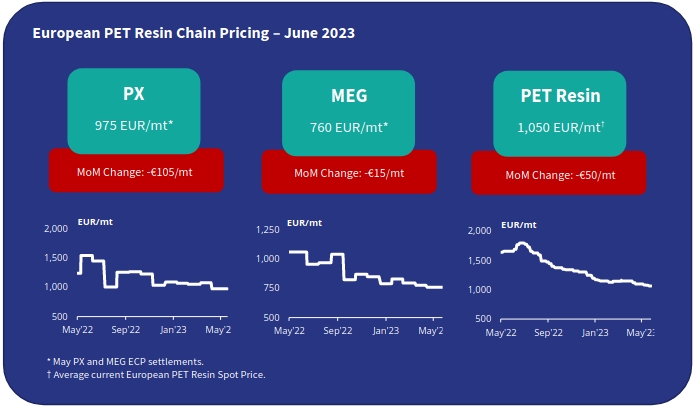

The current market price range is assessed at EUR 1030 to EUR 1070/tonne, with an average price of EUR 1050/tonne, down EUR 50/tonne versus mid-May.

As always, depending on volume and location, prices varied, with prices as low as EUR 1020/tonne offered within Benelux and Eastern European markets.

Whilst the drop in the May PX European Contract Price from EUR 105/tonne to EUR 975/tonne stimulated some demand, the steady price decrease has more generally caused buyers to hit the sidelines, further compounding the decline.

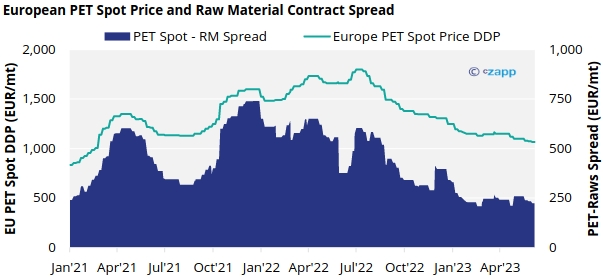

Aggressive spot pricing from some suppliers, wishing to stay in touch with import parity, also continues to add pressure on prices, keeping producer margins compressed.

Falling prices and a short peak season mean most converters are expected to continue to run hand-to-mouth on minimal stocks for the remainder of the summer.

And whilst PX prices are being forecast to firm slightly in the June Contract Price, most buyers and traders are expecting to see spot resin prices crash through the EUR 1000/mt level in the coming weeks.

European Producers See No Margin Recovery in Sight

European PET resin margins collapsed last September and have failed to recover, with producers continuing to run close to breakeven, with some running at a loss.

Asian producers also feeling the heat, with new capacity and lacklustre export demand, driving prices and margins lower (see latest report).

Therefore, if European producers are to maintain competitiveness, close to import parity, producers are expected to face a prolonged period of low margins through the rest of 2023, and into 2024.

Many will be hoping the imposition of provisional anti-dumping duties on Chinese PET resin imports could result in higher import prices and margin recovery for domestic producers.

Although, at present there has been little evidence for this, despite a slowdown of Chinese material into Europe.

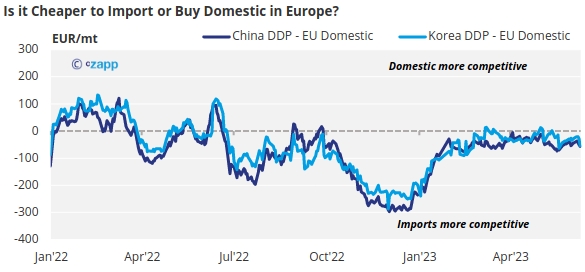

Is it cheaper to import?

Chinese PET export prices have also continued to weaken over the last month, with current prices averaging less than USD 900/tonne, representing a decline of around USD 40-50/tonne since mid-May.

Asian export prices have moved quickly downwards over the last week, with producers willing to heavily discount to secure volume due to concern around weak demand and increasing supply.

Prices as low as USD 850-860/tonne FOB are increasingly common for larger accounts.

Indicative import prices typically range EUR 925-935/tonne CFR customs cleared NWE, equating to EUR 1000-1010/tonne DDP, based on current average Asian export prices. Although deals are achieving a further USD 30-40/tonne saving on the FOB price.

The delivered spread between Chinese and other origins has increased to around EUR 40-50/tonne, based on mid-prices. However, lower-end domestic prices of EUR 1020-1030/tonne are only around EUR 20/tonne from indicative delivered import values.

Again, with many Asian export deals now achieving substantial discounts, actual import parity is a further EUR 40/tonne lower.

The recent downward shift in Asian prices places significant pressure not only on European PET resin pricing but also on June and July’s PX ECP settlement.