Insight Focus

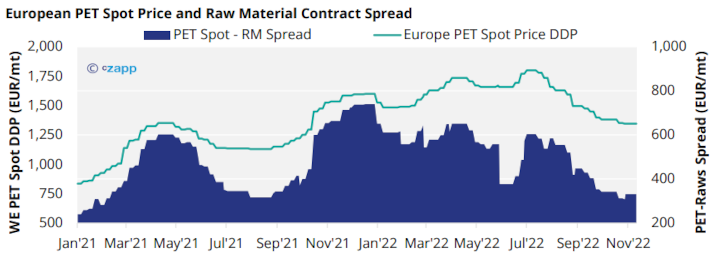

- European PET spot prices have continued to fall on the back of weak demand and ample supply.

- PET producer margins narrow with average spot prices only marginally above breakeven.

- Difference between domestic and import prices widen, threatening 2023 pre-season import wave.

Although now deep into the off-season, most domestic suppliers are experiencing weaker than typical demand levels for the time of year.

Buyers continue to destock, wanting to close the year in a better position, although some inventory overhang is still apparent.

Most are now taking minimum contract levels and only purchasing small spot volumes for immediate use.

Even with current production cuts, maintenance schedule, and Indorama’s recent outage at its Rotterdam plant there is no real tightening of supply or reaction from the market.

A situation that will only be exacerbated by the restart of JBF’s second line last month, and the imminent return of production at Indorama’s Rotterdam plant, expected mid-November,

European PET Spot Prices Continue to Tumble

European spot prices for virgin resin continued their slide through November, typically ranging between EUR 1330 to EUR 1360/tonne, averaging down around EUR 35/tonne for the month.

Prices were also heard either side of this range, depending on location and individual producer.

Higher prices up to EUR 1400/tonne, even some to the low 1420s, were reported. However, these were considered niche purchases and not representative of a broader market indication at the present time.

Equally on the lower end, some spot deals were concluded at EUR 1300-1325/tonne, largely for local delivery within the Benelux region.

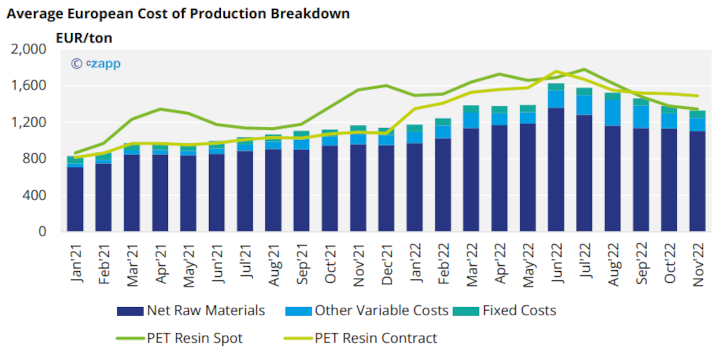

PET Resin Spot Prices Track Breakeven as Feedstock Costs Remain High

September’s and October’s PX European Contract Price (ECP) both finally settled following delays, and whilst PET resin spot prices have fallen over this period, European feedstock costs settled relatively flat in comparison.

Since August, PET spot prices have declined EUR 315/tonne, whilst the October PX ECP was only down EUR 10/tonne versus the August settlement.

As a result, producer spot margins have been squeezed. Current spot prices are estimated to be only marginally above the average European cash cost of production; meaning some European producers will already be in a loss-making position on certain spot sales.

However, sharp declines in European energy prices have meant that whilst spot margins have narrowed, producers recovered margin on any contracts still linked to raw materials contracts.

Although raw material-based contracts represent a much smaller proportion of total contracted volume than in the past.

With any new wave of imports not expected until Q1’23, buyers have little option than to purchase higher priced domestic resin in the interim.

The immediate risk to producer margins is versus the domestic competition. Any move to off-load stock or heavy discounting to retain clients through to year-end could see negative margins for the wider industry.

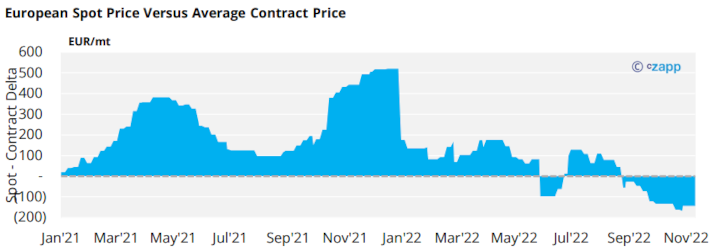

Contract Negotiations Progress

With 2023 contract discussions now firmly underway, expectations are for many of the larger buyers to increase their reliance on imports due to the current substantial price difference.

However, some small and mid-sized converters that lack either non-European producer relationships or are so risk adverse as to not consider imports, are a captive audience for domestic producers.

Energy price volatility this year has only cemented the market’s transition away from raw material-based formulas.

Buyers and producers will be looking to secure index-linked contracts, with little interest for either party in cost-plus agreements in 2023.

Since September, spot and market-linked prices have fallen below traditional raw material contracts by an estimated EUR 145/tonne.

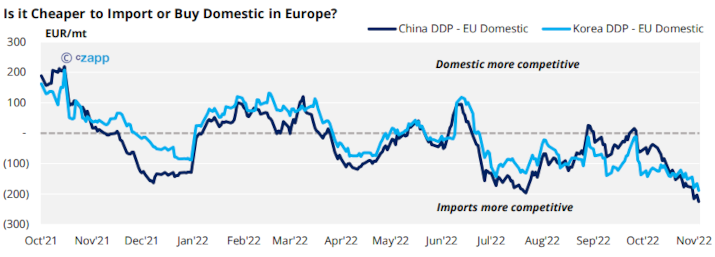

Is it cheaper to import?

At the time of writing, China PET resin export price averaged around USD 915/tonne, down around USD 55/tonne over the past month.

Import prices ranging USD 1000-1050/tonne CIF are now being heard on the market, facilitated by a sharp decline in ocean container rates.

As a result, the gulf between import and domestic pricing has continued to widen. Based on current average Asian FOB prices, imports EUR 225-250/tonne cheaper than domestic resin.

Most Asian origins also have ample supply and can ship within 4-weeks, a big change from where we were earlier in the year.

Although shipping times still mean that cheaper import material purchased now would only arrive towards the end of Q1’23. Timely enough for the run up to peak season though.

Market Outlook & Concluding Thoughts

- With Asian PET resin prices looking likely to stabilise in the coming weeks and projected to remain relatively flat through H1’23. Can European spot prices bridge the price gap?

- Whilst European PET producers look to have avoided the worst-case scenario in terms of energy costs, higher feedstock costs in comparison to Asian producers are keeping spot prices high.

- With European producers currently running close to cost, only a sharp downward correction in European PX values would enable producers to lower prices without losses and improve competitiveness over imports.

- Buyers also face great uncertainty, how will a potential European recession impact consumption this time around? Have consumers simply adjusted to new price levels?

- Any impact on European consumption, coupled with a loss of market share to cheaper imports, could pour the misery on European producers and Q1’23 sales.

Other Insights That May Be of Interest…

Plastics and Sustainability Trends in October 2022

PET Resin Trade Flows: Asian PET Exports Weaken in Q3 as Seasonal Demand Withers

European PET Market View: European PET Producers Facing Losses Contemplate Further Shutdowns

PET Resin Trade Flows: Brazil seeks to Export More PET to North America