Insight Focus

- European demand falls in September with no uplift from warmer weather.

- PET prices rise but may struggle to clinch further gains as buyers resist.

- Import competitiveness increases, European producers face continued low margins.

Hopes for a Late Season Demand Boost Fade

Hope has been a commonly used word this year by European PET resin producers.

After a poor summer season, European producers and preformers began to pin their hope on a late seasonal demand boost in September, following a period of warmer weather.

However, this too failed to materialize, with little change to the overall weak demand for domestic resin.

With low margins and weak demand, some producers have already moved into maintenance, with extended shutdowns anticipated this season.

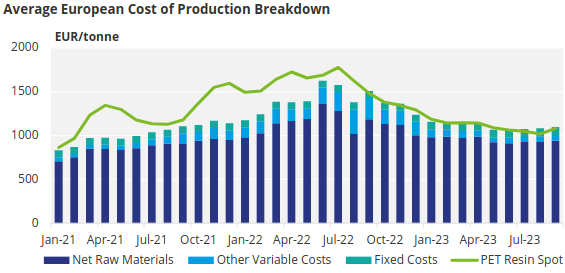

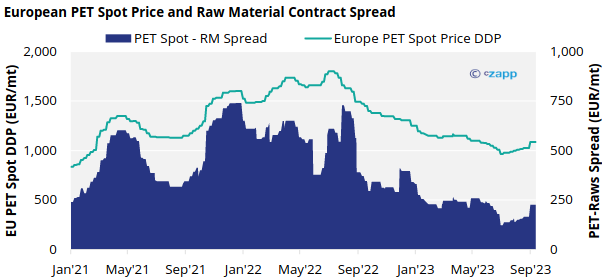

European PET resin prices continue to run close to the average European cost of production, having tracked the cost line closely over the last 12-months.

CZ’s current China PET resin FOB price forecast has prices in the range USD 940-960/tonne for Q1/Q2 2024.

Whilst Chinese PET producers are expected to see some margin recovery through the first half of next year, levels are expected to remain significantly below previous years.

This low margin environment is also likely to be reflected within other Asian export prices.

As a result, European buyers are likely to continue to see highly attractive low-priced imports in 2024, with European producers struggling to see any meaningful margin recovery when pricing at import parity.

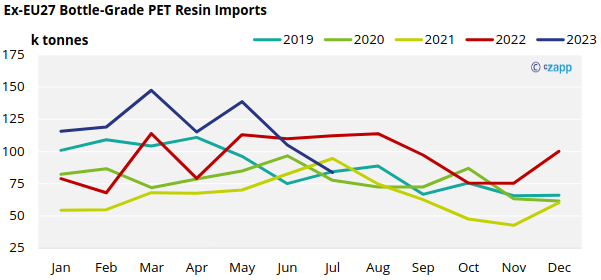

EU PET Resin Imports Set New H1 Record Even as June Volume Drops

Latest EU trade data shows PET resin imports (HS 390761) continued to fall in July to 83.8k tonnes, down over 20% versus the previous month.

Over the first seven months of the year, extra-regional imports into the EU27 trade block have totaled over 825k tonnes, a 22% increase on the same period the previous year.

The trend towards lower imports through the summer months also follows expectations set out in our previous report.

Volumes of Chinese PET resin into the EU have also slumped to their lowest monthly level this year, of around 11.7k tonnes, and are expected to continue to decline in coming months ahead of potential imposition of provisional ADD (Anti Dumping Duty).

In July, Vietnam was the largest source by volume, followed by Egypt, with 20.5k tonnes and 14.9k tonnes respectively.

European PET Spot Prices Press Higher as Producers Seek to Avoid Losses

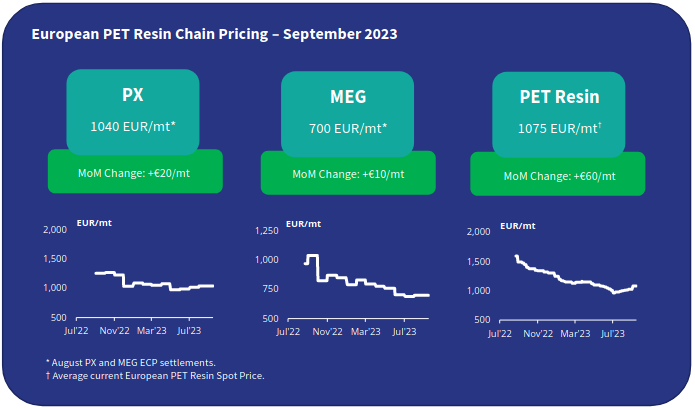

The current market price range is assessed at EUR 1060 to EUR 1090/tonne, with an average price of EUR 1075/tonne, representing an increase of around EUR 60/tonne versus over the last month; including a EUR 30/tonne uplift over the last couple of weeks alone.

Whilst PET resin producers have been keen to recoup recent raw material price increases, and push towards the next phycological barrier of EUR 1100/tonne, further price increases are meeting stiff resistance from buyers due to overarching poor demand.

The August PX European Contract Price settled at EUR 1040/tonne, a second consecutive monthly increase, up EUR 20/tonne versus the July settlement; up EUR 50/tonne since June.

With crude oil prices continuing to rally and looking likely to break through USD 100/bbl in Q4, European raw material prices are also anticipated to follow upstream costs higher.

If Asian export prices keep close current levels through Q4’23, are we about to see another divergence in European prices away from import parity?

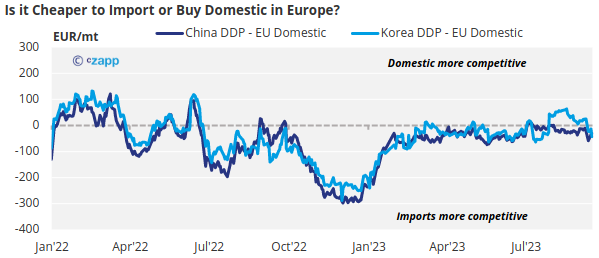

Is it cheaper to import?

Chinese PET export prices kept rangebound over the last month, between USD 890/tonne and USD 920/tonne. At time of writing, average daily Chinese PET resin export prices were USD 920/tonne FOB.

Chinese PET raw material costs continue to show minimal downside on the futures forward curve. As such, future PET resin export prices through the remainder of 2023 will rely heavily on the future direction of Asian PX and crude oil prices. (see latest weekly report)

Indicative import prices typically range EUR 950-965/tonne CIF customs cleared NWE, equating to around EUR 1030-1040/tonne DDP, based on current average Chinese and Korean export prices.

The spread between Chinese and Korean material has narrowed once again to just USD 10/tonne, with imports increasing in competitiveness over the last month versus domestic European prices.

Whilst the Euro has continued to weaken against the US Dollar, relatively flat Asian pricing and a fall in container freight rates from Asia to Europe have moved to advantage imports. Bookable rates as low as USD30/tonne are currently achievable into main Northern European ports.

Concluding Thoughts

European PET producers face a very challenging next 6 months. With the market entering the off-season, demand will only slow further before next season renews in February.

Although some producers have been quick to move into maintenance, with others expected to follow shortly, they cannot hide from the realities of the market for a prolonged period.

Ultimately, the health of the European industry is bound to the ability of producers to secure large enough contract volumes in 2024, and to do so at a commercially viable level.

However, domestic sales are once again expected to continue to face sizeable import competition throughout H1’24, despite the anticipated introduction of ADD against Chinese resin.

Expect fierce and prolonged 2024 contract negotiations over the next few months.