Insight Focus

- European demand shows modest improvement in August as buyers see prices rise.

- European PET prices gain upward momentum, bringing some added buyer interest.

- For producers facing the worst market in memory, all hopes now pinned on margin recovery.

European PET Producers Face Worst Market Conditions in Memory

Whilst domestic PET resin demand continued to be weak and far below typical seasonal level, some European producers experienced modest sales improvement coming into August.

Having run stocks down since the beginning of the year, recent increase in raw material and PET resin price increases led to some buyers rushing back to cover end-of-summer requirements.

Regional buyers are likely to continue to keep stocks low going into the off-season.

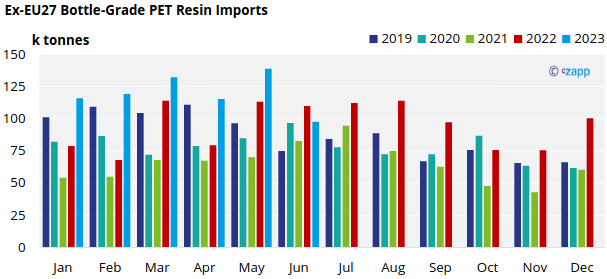

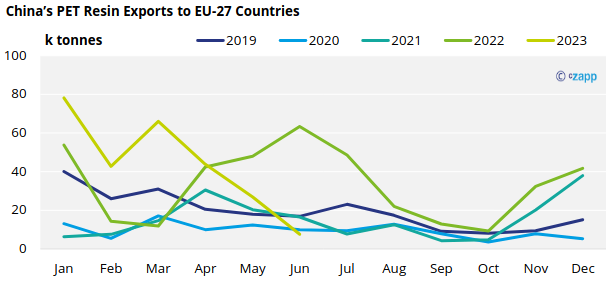

Whilst the deluge of imports has begun to slow, March’s antidumping notice against Chinese PET resin has failed to impact total import volumes.

Large brand buyers are instead trialing and switching to alternative origins, with likely continued expansion of import contracts in 2024.

Pressure on virgin resin is also starting to be felt from a partial rPET comeback, as Thermoformers reduce order volumes for virgin resin and switch back to cheaper rPET flake.

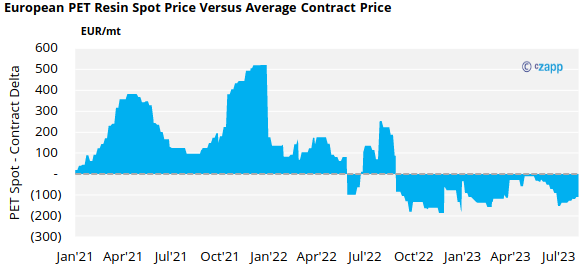

European PET resin producers with a greatest exposure to spot sales are feeling the heat the most.

Some struggle to sell at much above variable costs, meaning an environment of low operating rates, closed lines, and reduced headcounts.

Those producers with a larger proportion of contract sales have at least somewhere to shelter from the storm, with average formula contracts continuing to perform better than the spot market.

EU PET Resin Imports Set New H1 Record Even as June Volume Drops

Just released trade data shows PET resin imports (HS 390761) fell sharply in June to 97.6k tonnes, down 11.2% on the previous month and substantially below the higher levels seen earlier in the year.

However, H1’23 volumes, totaling 719k tonnes, were still up nearly 28% versus last year, over the same six-month period keeping 2023 on track to potentially surpass previous record year in 2022 and 2019.

Since the EC’s anti-dumping notice against Chinese resin back in March, imports from China have evaporated.

In June, China reported less than 8k tonnes of exports to the EU27 block, down 88% from a year earlier and down 54% versus an arguably more representative June 2021.

Instead, Chinese imports into the EU has been substituted by volume from Egypt, Vietnam, Pakistan, and Turkey.

Indorama, Europe’s largest PET resin producer also has assets in both Egypt and Turkey.

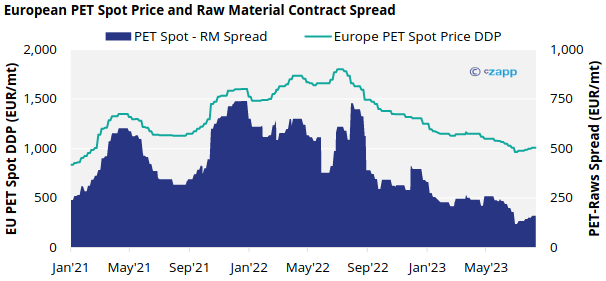

European PET Spot Prices Press Higher as Producers Seek to Avoid Losses

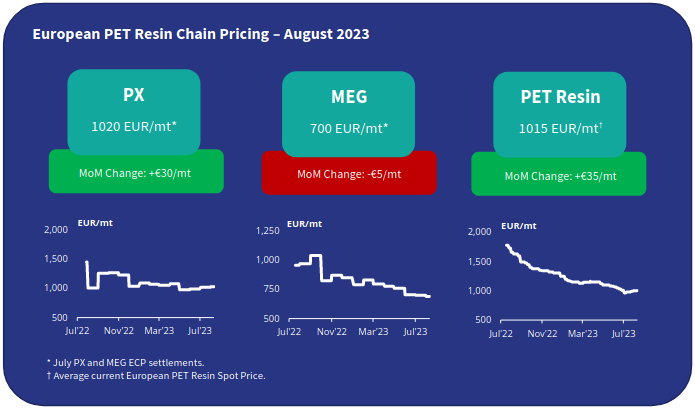

The current market price range is assessed at EUR 1000 to EUR 1030/tonne, with an average price of EUR 1015/tonne, representing an increase of around EUR 35/tonne versus mid-July.

As always, depending on volume and location, prices varied, with most producers reluctant to offer below EUR 1000/tonne to avoid losses; buyers continue to seek below the physiological USD 1000/tonne barrier.

Whilst deals as high as EUR 1050/tonne were reported for destinations requiring higher logistics costs.

Having seen the European PET – raw material contract spread fall to a record low at the end of June, just EUR 118/tonne, European producers have experienced a small amount of margin recovery over the last month.

Despite the July PX European Contract Price finally settling in August at EUR 1020/tonne, an increase of EUR 30/tonne over June, the average PET sport spread over raw material contracts rose to around EUR 150/tonne by the end of the month.

With PET resin prices firming over the last few weeks, and expected to push higher through August, European producers may continue to experience a modest increase in spread.

Current expectations are for the PX ECP to see a further slight increase in August, with some producers anticipating around a EUR 10/tonne increase.

It should also be noted that at least one new participant has now joined Indorama in the PX contract settlement mechanism, Indorama having been the sole participant since Oxynova’s exit in December 2022.

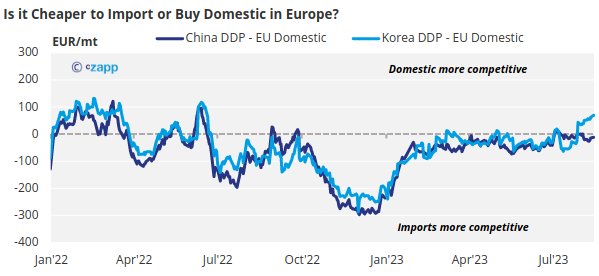

Is it cheaper to import?

After going through a period of stability over the last fortnight, Chinese PET export prices have begun to weaken once again, with current daily prices averaging USD 885/tonne, down USD 20/tonne since mid-July.

Chinese PET raw material costs show minimal downside on the futures forward curve, as such future PET resin export prices through the remainder of 2023 will rely heavily on the future direction of Asian PX and crude oil prices. (see latest weekly report).

Indicative import prices typically range EUR 915-945/tonne CIF customs cleared NWE, with the spread between Chinese and Korean material widening substantially over the last couple of weeks as demand from US picks up.

These indications equate to EUR 990-1020/tonne DDP, based on current average Chinese and Korean export prices, on par with domestic European prices.

Modest weakening of the Euro versus the US Dollar over the past month, coupled with a sharp rise in container freight rates from Asia to Europe have played to the advantage of European resin prices.

With Chinese resin imports into Europe drying up rapidly, are we now beginning to see a divergence towards import parity based on other origins?

This is not entirely evident at present, with other origins aggressively competing on price, particularly in Southern European markets. Further capacity additions in China is also expected to increase export competition into other regions, impacting global prices and indirectly those in Europe.

Concluding Thoughts

With peak-season effectively ended, the key question is, ‘What will it take for European producer margins to recover?’

European PET resin producers cannot continue to make losses over the longer-term. Domestic raw material contracts, specifically PX and PTA, need to become more competitive with Asian feedstock.

Downstream European consumer demand also needs to strengthen, in conjunction with a lesser reliance on imported resin in 2024.

However, with Europe stuck in an economic malaise and a flood of new Chinese capacity expected to suppress global PET prices, European PET producer will need to correlate prices closely with imports to attract 2024 contracts.

Even with provisional Chinese ADD in October, European margins may find it difficult to recover before Q1’24.