Insight Focus

- European PET resin producers continue to face weak demand amid fresh import arrivals.

- Prices soften further as producers attempt to close the gap with imports; production cuts accelerate.

- Producers face an extended period of low margins, potential extended shutdowns.

European PET resin is facing a difficult Q1. Faced with low margins and fresh import arrivals domestic producers are shutting lines and further cutting production.

However, whilst many have already written Q1 off, some producers are moving more aggressively on spot pricing, in the hopes of resting market share away from imports from Q2 onwards.

Despite raw material increases in January, European PET producers have continued to reduce spot offers narrowing the gap on some non-Chinese imports.

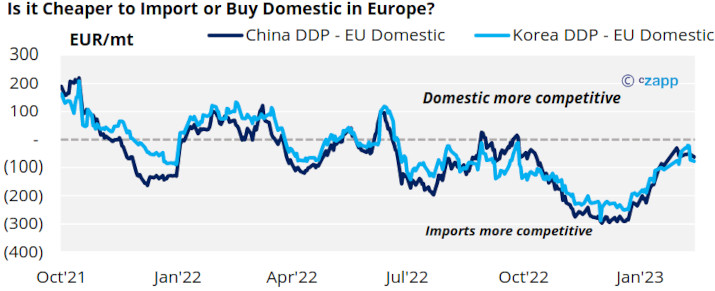

Whilst Chinese imports are still competitive, buyers are taking a more cautious approach with the increased risk of a future anti-dumping investigation.

However, some large buyers have already brought forward coverage for later in the year, arriving in Q1 and being stored in European warehousing, having snagged low priced deals back in November.

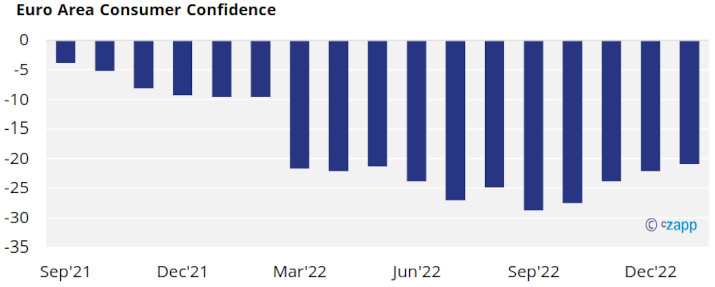

Consumer Confidence Grows

Consumer confidence within the Euro area and wider EU continues to show steady improvement, reaching its highest level since February 2022 on hopes lower energy prices and recovery fund spending might help avoid a recession this year.

With near-term inflation figures looking to have potentially peaked, the more optimistic trend in consumer confidence is a positive sign for the PET resin demand outlook within Europe.

The trend has also been echoed by several European converters who expect modest growth in 2023, with indications of sales beginning to pick-up again in the first part of 2023.

Demand from beverage and dairy sectors remains relatively buoyant, some weakness in the household product sector has been noted.

European Producers Shut Lines to Stem Losses

Most European PET resin producers have been running at reduced rates for the past 6 months. However, over the last month several other producers have joined a growing list to have also shut lines, or production at sites entirely.

At present, we estimate that around 977k tonnes of European PET resin capacity is offline, equivalent to 29% of total European production.

With average rates of around 70% for other producers, the average operating rate across all assets is currently estimated to be just 51%.

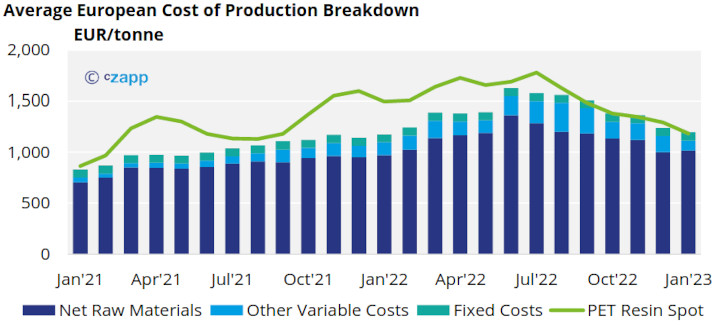

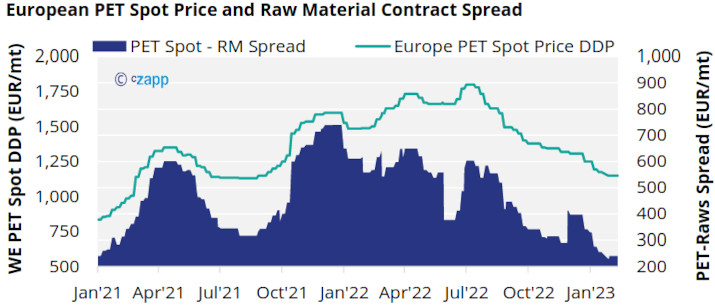

Despite energy and raw material costs falling since the end of last summer, the estimated PET resin cost of production has been close to breakeven, or in loss making position, versus domestic spot resin prices.

Whilst Europe has a diverse asset base, with a wide range of size and integration, this assessment still paints the industry to currently be in relatively poor health.

Domestic PET resin producers are pinning much on a recovery of market share based on increased competitiveness with imports.

However, with continued disparity between European and Asian energy costs, targeting import parity comes with a cost.

The market could enter an extended period of very low margins, with extended shutdowns, and the potential for rationalisation of European production.

European PET Spot Prices Soften, Further Downside Apparent

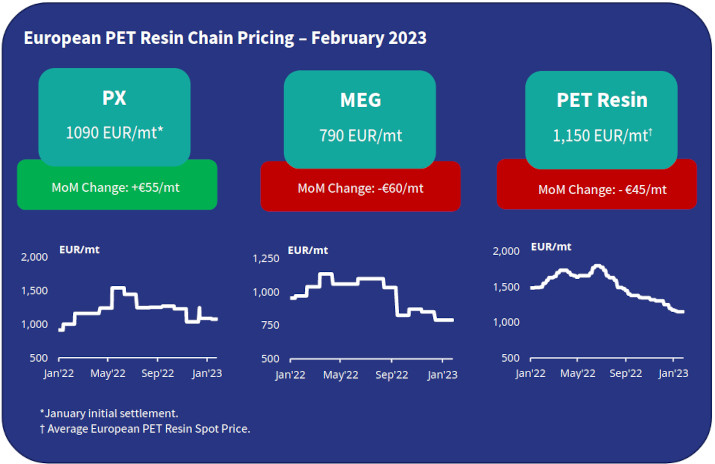

European spot prices softened further following January’s sharp decline. Prices typically ranged between EUR 1130 to EUR 1170/tonne. With an average price of EUR 1150/tonne, February prices were down around EUR 45/tonne for the month.

Prices were also heard either side of this range, depending on location and individual producer.

Higher prices up to EUR 1180/tonne were reported. Equally on the lower end, spot deals were concluded at as low as EUR 1120/tonne, for local delivery within the Benelux region.

Initial settlements for December’s and January’s PX ECP were also confirmed in early February, at EUR 1035 and EUR 1090/tonne respectively.

Whilst few PET resin contracts are now tied to “raw material plus” style formulae, several European PET producers are reliant on the PX ECP settlement for their own PTA supply contracts.

Although having only Indorama as the sole buyer in the settlement process is far from ideal, timely and relevant initial settlements going forward may enable PET resin producers to respond better to a changing price environment and import competition.

Buyers are now anticipating prices to move down closer to EUR 1100/tonne through the rest of February and into March, further closing the gap on imports.

Is it cheaper to import?

China PET resin export prices currently average around USD 960/tonne. Having pushed higher through the second half of January ahead of the Chinese New Year holiday, export prices have since weakened falling back to levels seen a month earlier.

With this month’s decline in domestic European PET resin prices, the gap to import parity has narrowed to around EUR 60/tonne, less than half of what it was mid-January. Prices at the lower end of this month’s range are closer still.

Market Outlook & Concluding Thoughts

- European producers are targeting a Q2 recovery in demand and profitability.

- However, Asian export prices look to remain subdued; some Chinese producers are already offering H2’23 PET resin export prices on par with current levels.

- With new Chinese PET resin capacity expected early April, and further significant additions through the remainder of 2023, Asian export competition is also expected to intensify.

- Whilst domestic producers will always argue for a premium versus imports, producers look to lack strength to retain a premium at present as converters watch costs amid economic uncertainty.

- To compete at import parity European producers could be faced with an extended period of low margins, and production cuts, raising the risk of future rationalisation.