Insight Focus

- European PET resin demand remains weak as wave of new import arrivals beckon in Q1’23.

- Intra-regional competition between PET producers to increase on lower contract volumes.

- Import parity gap narrows, still in triple figures. Spot prices may close gap in Q1’23.

The beginning of the New Year is usually a quieter period, new contracts settled, a rollover month from December; 2023 is already shaping up to be anything but typical.

The challenges facing European PET resin producers are mounting. Demand is weak, as the negative economic outlook clouds future consumer trends.

Having destocked through much of H2’22, buyers are only purchasing small parcels from domestic producers on a just-in-time basis.

Buyers want to avoid holding as much stock in the event of a consumer downturn, whilst also conscious of the downward trend in European PET resin prices.

On the flip side, many large and mid-sized converters took advantage of the recent drop in Asian PET resin prices, buying into a potential near-term market bottom for Asian export prices.

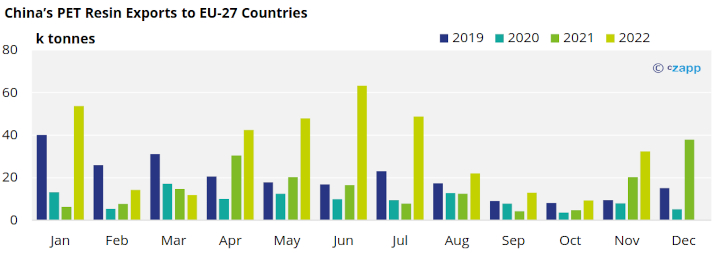

Latest Chinese trade data shows that PET resin exports to EU27 countries leapt in November, increasing 250%; December volumes are also expected to high, potentially surpassing Dec’21.

With large volumes of cheaper imports booked for Q1, as well as Q2 and Q3, European PET producers could face a challenging and stagnant demand environment over the coming months.

Intra-Regional Competition for Spot Sales to Intensify

Whilst much of the attention over the last year has been on the import situation, intra-regional competition for PET sales is now beginning to ramp up.

Buyers have been reluctant to settle large contract volumes for 2023, moving much more to the spot market instead.

This gives buyers the flexibility to adapt to changing market conditions without the burden of contractual commitments.

For European suppliers though this means a much greater exposure to the spot market than in previous years.

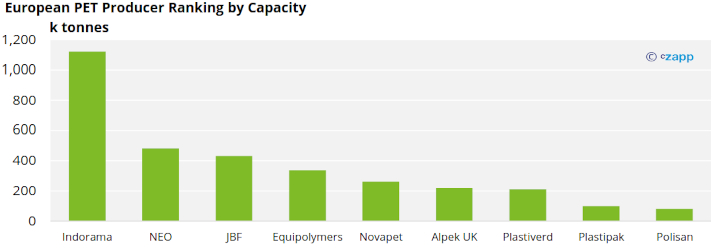

Added intra-regional competition for spot sales, in an already weak market, could prompt a race to the bottom between European PET producers.

Despite higher energy costs and the risk of anti-dumping, European producers may lack the strength to maintain any sort of premium over imports, potentially closing the import parity gap over the coming months.

European Producers Maintain Reduced Rates on Weak Demand

European PET resin producers continue to run at reduced rates, with several producers having lines out of action in January.

At least one major producer has already decided to keep a line down for the entirety of 2023.

With a weak demand outlook for European resin and lower contractual volumes, production cuts are expected to remain through Q1.

European PET Spot Prices Continue to Tumble

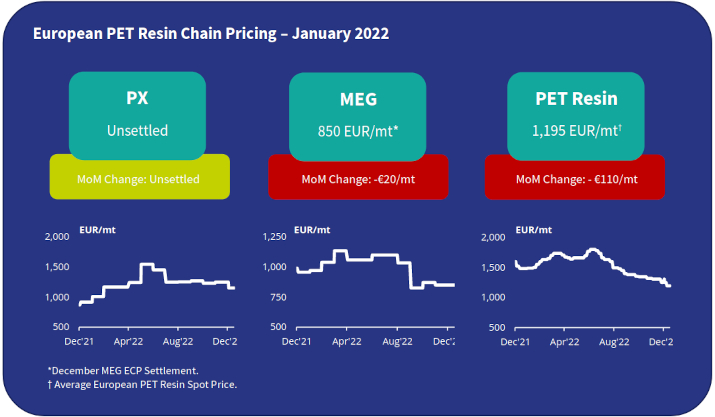

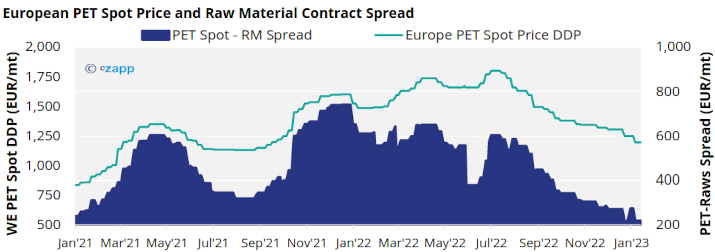

European spot prices fell sharply through the first half of January, typically ranging between EUR 1170 to EUR 1230/tonne. With an average price of EUR 1195/tonne, January prices were down around EUR 110/tonne for the month.

Buyers are now anticipating prices to move down to EUR 1100-1150/tonne in February, and for prices to trace lower still into March, potentially closing the gaps on imports.

European producers are however stuck in a bind on raw materials; despite heading into the 2nd half of January, there has still not been a December PX ECP settlement.

Whilst few PET resin contracts are now tied to “raw material plus” style formulae, several European PET producers are reliant on the PX ECP settlement for their own PTA supply contracts.

Without an agreed settlement, these PET producers continue lack clarity on their own cost position, poising risk as PET resin prices move sharply downwards.

Is it cheaper to import?

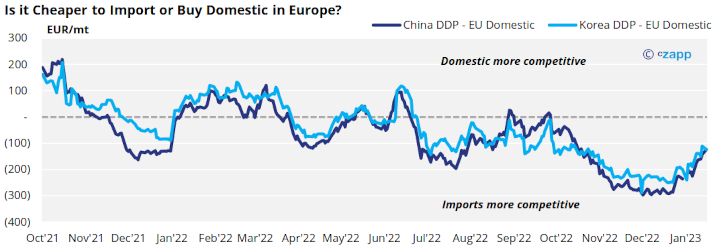

Before the Chinese markets closed for Spring Festival, daily China PET resin export prices averaged around USD 965/tonne, an increase of around USD 70/tonne over the past month.

With domestic European PET resin prices moving down sharply, and Asian exports steadily gaining in value over the last month, the gap to import parity has narrowed to around EUR 125/tonne, down from more than EUR 275/tonne in December.

Appreciation in the Yuan against the US Dollar has supported the increase in US denominated Chinese PET resin export prices. Whilst a modest up-lift in container rates has also increased the cost of imports on a delivered-duty-paid basis into Europe.

Market Outlook & Concluding Thoughts

- Falling energy costs have enabled European PET producers to drop spot prices relatively aggressively in January.

- However, the import parity gap is still in triple figures, leading to a reluctance from buyers to purchase beyond short-term requirements.

- Although European PET producers maintain production cuts, intra-regional competition is expected to increase through Q1 leading to a continued decline in spot values.

- Spot prices are now expected to close the gap on import parity. Although, a lack of PX settlement puts some PET producers in a precarious situation, without clarity on their cost position.

- Given the continued energy price disparity between Europe and Asia, if European spot prices reach import parity, margins for European PET producers will be severely squeezed.

Other Insights That May Be of Interest…

Czapp Explains: Global PET Resin Capacity and Projects

PET Resin Trade Flows: EU PET Resin Imports Surge in Q3 Driven by Chinese Wave

European PET Market View: European PET Producers Face Difficult Q1 as Import Delta Widens

European PET Market View: European PET Producers Facing Losses Contemplate Further Shutdowns