Insight Focus

- European market faces off-season lull and uncertainty for 2024, affecting contract negotiations.

- Red Sea attacks disrupt ocean freight, increased costs and delays for PET and PTA imports.

- European PET resin prices weaken in December, disruptions may elevate prices in January.

Market Overview

Deep into the off-season and heading into the Christmas break, the European demand has quietened. Looking forward into 2024, downstream demand is still clouded in uncertainty, with equal amounts of pessimism and hope all around.

Whilst lower inflation and stronger economic growth prospects may feed into a gradual recovery at the consumer level, price sensitivity and substitution towards recycled content could cannibalise virgin resin growth prospects.

Reflecting this uncertainty, contract negotiations have moved towards greater of spot and free negotiated volume in 2024. With buyers preferring to contract with only with “reliable” supply partners.

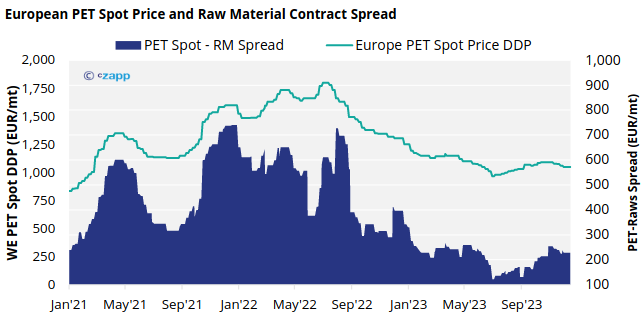

Market-linked pricing has also seemingly lost its shine, due to the unsustainable price requests from buyers linked to indices, as well as the poor performance of these contracts in 2023.

Instead, producers are favouring a return to traditional raw material plus contracts aimed at derisking their raw material exposure in 2024.

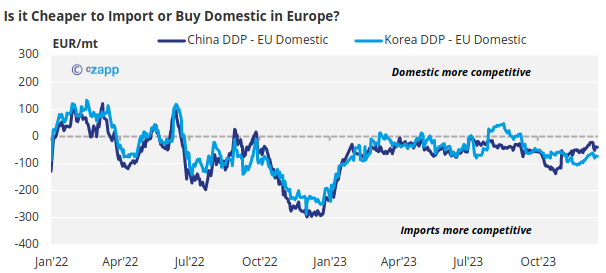

Whilst for some buyers, the gap between domestic offers and import parity has put constraint on their domestic commitments.

However, the last few days may have dealt another curveball to 2024 purchasing strategies, with PET resin and raw material imports facing additional costs and disruption following ocean freight disruption in the Red Sea.

Freight and Resin Offers Paused Following Red Sea Disruption

Following attacks on ships passing through the Bab al-Mandab Strait in the Red Sea, no major ocean carriers is now going past the conflict zone, pausing journeys, and learning towards rerouting around the Cape of Good Hope, the Southern tip of Africa.

Carriers are still offering quotes, for alternative routing, but with significant additional costs and surcharges, double to triple in some cases, and subject to availability.

On 20th Dec, Hapag Lloyd announced “an Operational Recovery Surcharge (OCR) is coming into effect for shipments between North Europe & South Europe to Arabian Gulf & Indian Subcontinent & Red Sea, in both directions. The OCR will be in effect from January 1, 2024 and is applicable to all containers and cargo types until further notice.” Other major carriers are also following suit.

Several Asian PET resin producers have also withdrawn pending offers whilst shipping costs are confirmed.

The disruption will see an immediate price increases on raw material and PET resin supply from Asia to Europe, as well as delays to arrivals, tightening PET supply and constraining production in Europe, Egypt, and Turkey.

Even if the crisis is quickly resolved, the impact is likely to be felt for weeks and even months. The effects of the Suez Canal blockage in March 2021 resonated for 3-4 months, before containers were back in their right place again.

A more drawn out crisis could see a domino effect, and contagion across global supply chains, particularly with the current challenges in passage through the Panama Canal.

European Producers Eye Higher PET Prices Amid Tighter Supply

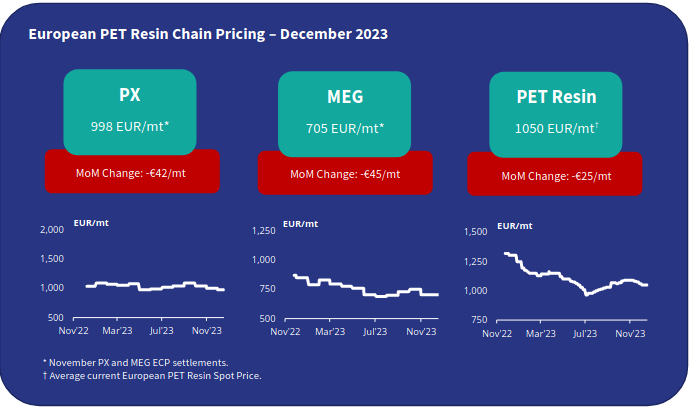

The current market price range is assessed at EUR 1030 to EUR 1070/tonne, with an average price of EUR 1050/tonne, representing a decrease of around EUR 25/tonne over the last month.

Large buyers are typically seeing offers at the lower end of this range at around EUR 1030-1050/tonne.

The November PX European Contract Price had an average settlement of EUR 998/tonne, representing a EUR 42/tonne decrease from the previous month, following a sharp downturn in crude oil prices. At the time of writing, the December contract was still unsettled.

However, following the global disruption in shipping lanes and the PKN force majeure, the big question now is ‘Where will European values go now?’

With import arrivals facing delays, domestic PET resin producers are hoping for a flurry of panic buying given the low inventory levels being held through the chain.

Many buyers are anticipating an increase in European prices in January due to tighter supply, additional surcharges, and increased freight rates.

However, this also comes at the quietest point in the season, when most European businesses are shutting for the Christmas period, an ideal moment for any buyers to hit the sidelines rather than panic buy.

EU Set for Record PET Resin Import Year Despite Chinese ADD

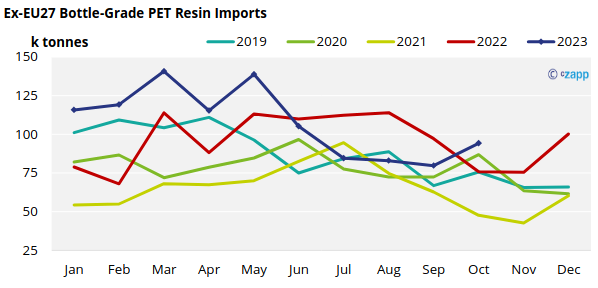

According to the latest PET resin trade data (HS 390761), the EU27 block of countries imported around 94k tonnes in October, increasing 18% from the September low; reaching a multi-year high for October, and a 24% increase from the same period a year earlier.

Despite the many challenges the European market has faced, from weaker consumer demand to provisional ADD against Chinese resin, the EU block remains on track to post a new annual import record.

Over the last ten-months, extra-regional imports into the EU27 trade block have totaled over 1.077m tonnes, a 10.8% increase on 2022 levels.

Levels are expected to remain elevated in November and early December, given price competitiveness of imports; the current Red Sea crisis has occurred to late in the year to derail 2023 volumes.

Turkey was once again the largest origin in October with 26.6k tonnes; Vietnam on 22.6k tonnes, and Egyptian import volumes steady at 16k tonnes.

Turkish and Vietnamese imports recorded strong increases off the back of highly competitive pricing, up 48% and 30% respectively.

Despite the imposition of provisional anti-dumping duties on Chinese rein, imports from China more than doubled to 8.4k tonnes, bucking the recent downward trend.

Looking at Chinese export data, monthly export volumes destined for EU27 countries increased in October and November to average around 24.5k tonnes, indicating future increases in imports landing into the EU.

Is it cheaper to import?

Chinese PET export prices have stagnated, remaining within a tight price range. At the time of writing, average Chinese resin export prices averaged USD 880/tonne, unchanged for a month earlier.

Whilst some weakness in Asian values was noticeable last week, the recent rebound in crude and upstream costs associated with the middle east conflict has lifted values through the polyester chain. (Please read our Asian Weekly report for further insight)

Other Asian export prices has also been relatively steady over the last month, with South Korean export prices also unchanged.

However, Vietnamese prices have continued to sharpen, with an estimated decrease in USD 30/tonne since mid-November. Turkish prices also remain competitive around the EUR 930/tonne mark.

Indicative import prices typically range EUR 915-950/tonne CIF duty paid NWE, equating to around EUR 975-1000/tonne DDP.

Even when including the new provisional anti-dumping duties into the calculation (at the lower level of 6.6% for Sanfame), Chinese resin is running at around EUR 40/tonne discount to import parity; ‘Duty-free origins’ are around a EUR 75/tonne discount to the current European mid-price