Insight Focus

- JBF Belgium announces ‘temporary’ shutdown due to poor market conditions.

- European PET prices increase as producers continue to be pressured by raw material costs.

- Imports increase competitiveness as freight and Asian export prices drop.

Is JBF the First Domino to Fal

Market discussion this week is dominated by the news that JBF will be ‘temporarily’ stopping production at the end of the month due to the poor market conditions.

The company group is also understood to be undergoing a financial restructuring, prompting rumours that the site may find itself under new ownership at some point.

Either way, future production at the site is highly reliant on an improved market condition. And as discussed in previous report, European PET producers look set to continue to face a highly challenging, low margin environment through the next 6-9 months.

At present, Europe is facing a historic loss of production with lines stopped at several PET producers, including JBF, Equipolymers, NEO Group, and Polisan.

European PET production is estimated to be running at an average operating rate of just 50%, with over 1.7 million tonnes of capacity either shutdown or underutilized.

Even with these supply constraints, buyers across Europe still report plenty of availability, a reflection of weak off-season demand and ample import coverage.

With plants in Rotterdam, Poland, Spain having all experienced outages over the last 12-18 months, and further shutdowns by other producers also not off the cards, domestic supply security in 2024 will be a major concern for many buyers.

EU PET Resin Imports Steady in August, Market Awaits ADD Decision

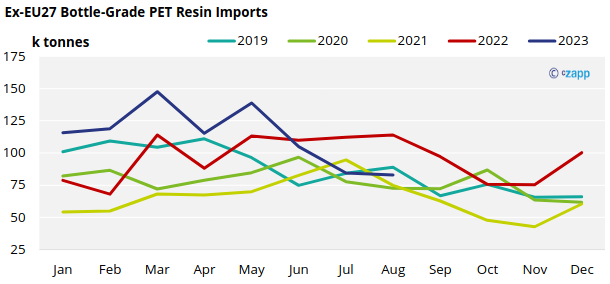

Latest EU trade data shows PET resin imports (HS 390761) steadied in August having fallen sharply in July. The EU27 bloc of countries imported 82.9k tonnes of PET resin in August, down around 2% versus the previous month.

Over first eight months of the year, extra-regional imports into the EU27 trade bloc have totaled over 909k tonnes, a 14% increase on the same period the previous year; still on track to set a new annual record level.

For the second month in a row, Vietnam was the largest import origin with over 18k tonnes, followed by Turkey and Egypt with between 16k-17k tonnes each.

As anticipated, Chinese PET resin imports continue to decline, down to just 5k tonnes in August, and are expected to continue to dissipate in coming months if provisional anti-dumping duty (ADD) are successfully applied.

If the ADD investigation, which was recently described by one of the lawyers working the case as being the, “weakest case he has ever dealt with”, is unsuccessful the flood gates for Chinese resin are likely to open once again.

Next official update from the EC is expected at the end of October.

European PET Spot Prices Drift Higher; Further Increases Face Stiff Resistanc

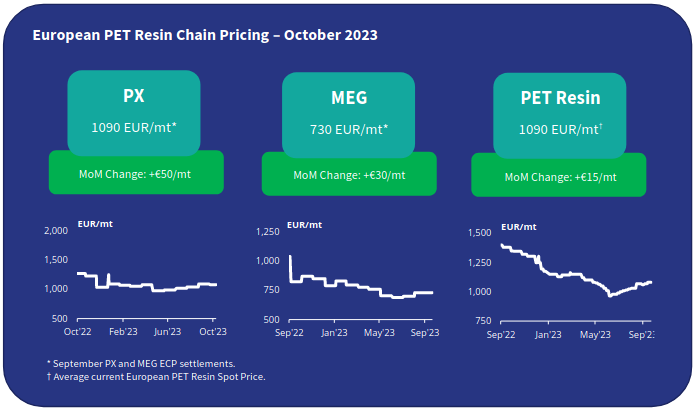

The current market price range is assessed at EUR 1070 to EUR 1120/tonne, with an average price of EUR 1090/tonne, representing an increase of around EUR 15/tonne over the last month.

Whilst prices have drifted higher over the month, JBF’s shutdown has not yet prompted any immediate price reaction, and may already be priced in.

European producers may attempt to capitalise on JBF’s closure and press for further price rises in the weeks ahead. However, would likely see resistance due to slow off-season demand and ample availability of resin.

2024 Contract negotiations are also underway and it’s imperative that European PET producers secure maximum contracted offtake to run lines at cost efficient levels.

Further domestic price increases, raise the prospect of a divergence from import parity, risking a repeat of the last two years, which have seen record import levels during the first half of the year.

The September PX European Contract Price settled at EUR 1090/tonne, representing a EUR 50/tonne increase versus the August settlement. Whilst September MEG contracts also increased, to EUR 730/tonne, up EUR 30/tonne on the previous month.

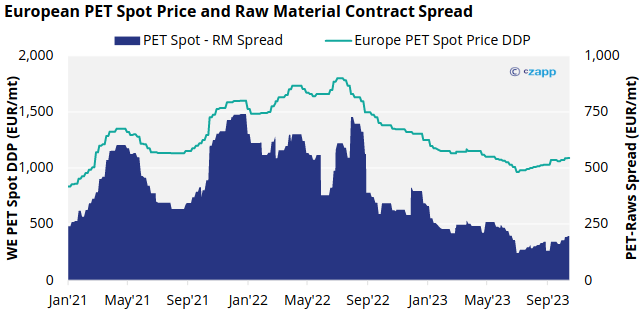

Despite increased feedstock costs, European PET producers have experienced a slight improvement in raw material spreads since mid-summer, although margins for most producers are still close to cash cost level.

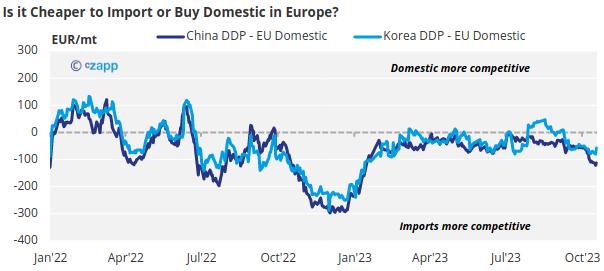

Is it cheaper to import

Chinese PET export prices have fallen sharply post-holiday, with the average daily price dropping to USD 875/tonne FOB, a new low point for the year.

Chinese PET raw material costs continue to show minimal downside on the futures forward curve. As such, future PET resin export prices through the remainder of 2023 will rely heavily on the direction of Asian PX and crude oil prices. (see latest weekly report).

Indicative import prices for duty-free Korean and Vietnamese resin typically ranges USD 1025-1035/tonne CIF NWE, equating to around EUR 1030-1040/tonne DDP.

The spread between Chinese and ‘duty-free origins’ has increased sharply to EUR 55/tonne; with the next update on the EU ADD investigation due end of October, these alternative non-Chinese origins may begin to hold a premium in Q4.

However, whilst the Euro has continued to weaken against the US Dollar, the continued fall in ocean freight rates and a slump in Asian PET prices means imports are looking increasingly attractive.

Concluding Thoughts

The European PET market has entered a period of peak uncertainty.

Will JBF’s shutdown help stabilize the market or bring about contagion? Will other distressed producers now follow suit by shutting down to stop losses?

Not only are buyers faced with issues of supply security, but also massive price uncertainty. Crude and upstream costs are highly volatile, swinging wildly on daily sentiment changes.

Further increases in European feedstock prices are only likely to worsen the competitiveness of domestic resin, prompting buyers to favour imports next year.

This is already being played out in 2024 contract negotiations, which some producers report are proceeding at much slower pace than they traditionally would at this time of year.

Asian PET producers on the other hand are offering highly competitive Q1 fixed prices, at a relatively small premium to current prices levels.