Insight Focus

- Suppliers continue to report slow spot sales in the first part of June.

- PET resin prices rollover in June, with the PX contract price poised to leap once again.

- Spot prices may move higher in H2 June and July, but rally looks limited.

The European PET resin market has experienced a relatively tepid start to the summer.

Whilst PET producers have reported robust contract offtake, with customers taking medium-high volumes, spot sales for European PET resin producers have been underwhelming.

Buying has been slowed by a combination of price volatility, the arrival of delayed imports, and weaker than expected consumer demand, that has yet fully to kick into summer mode.

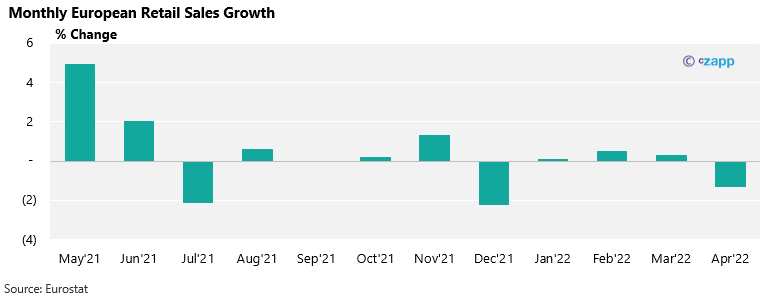

Latest EU retail sales data highlights the weakness of consumer demand in recent months, with a month-on-month fall in April, albeit still 5% higher than a year earlier.

Sales of food, drinks and tobacco fell 2.6% on the previous month, in a sign rising prices may have started to weigh on affordability.

Optimism on Consumer Boom Grows

However, despite the spectre of inflation and persistent supply chain issues, the outlook for the tourism sector and consumption of PET packaged food and beverages is looking bright ahead of the summer season.

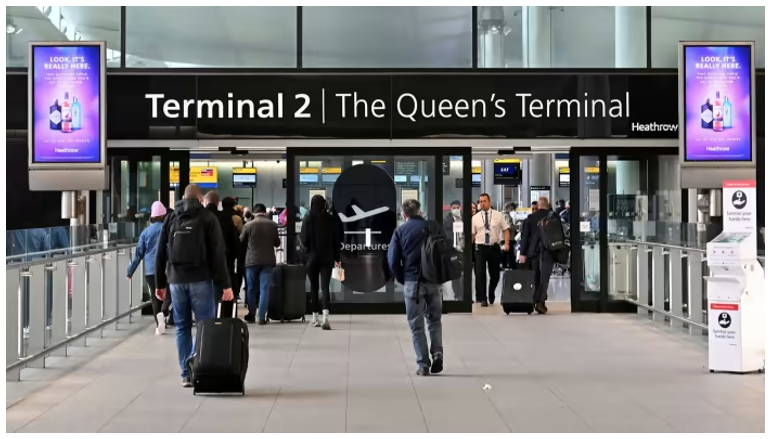

Revenge spending and a desire to travel has been all too clear to see in recent weeks, with transportation hubs across Europe at capacity, and cafes, restaurants, and venues in major cities lined with tourists.

In May, Europe’s busiest airport, London’s Heathrow, recorded its highest number of travellers since the onset of the pandemic in March 2020.

Over 5.3 million people travelled through Heathrow last month, nearly an eight-fold increase on

May 2021.

The return of major sporting events and music festivals, for many the first time in three years, is also helping to boost consumption of PET packaged products.

Leading brands have reported growth in bottled water sales in Spain, France, and the UK, and some have now revised sales forecasts for the UK and Spain upwards.

Pricing and Margins

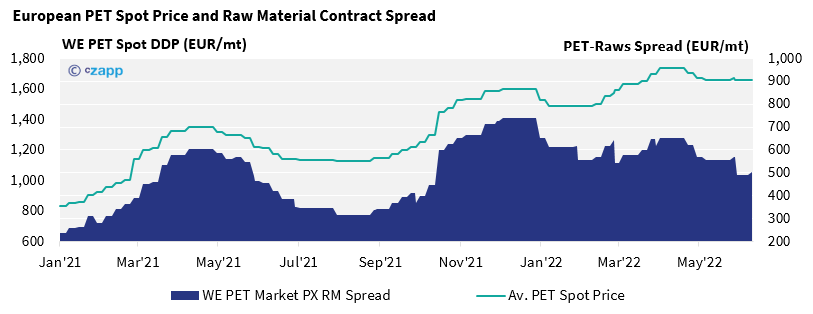

After a weaker spot market in May, when some Northern European spot prices dipped below EUR 1600/tonne in the second half of the month, the market is beginning to look more bullish.

Mid-June spot prices ranged from EUR 1620 to EUR1680/tonne, averaging EUR 1660/tonne. Although representing a rollover from May, uncertainty about future price direction is rampant.

Spot prices in the South, a region traditionally more reliant on imports, have already begun to move up sharply, following the recent jump in Asian export prices.

Prices of over EUR 1700/tonne have been reported in Italy and Southeast Europe.

Asian Export Prices Reach Highest Levels in Over a Decade

On 13th June, export offers averaged USD 1300/tonne FOB China, up USD 80/tonne since the beginning of the month.

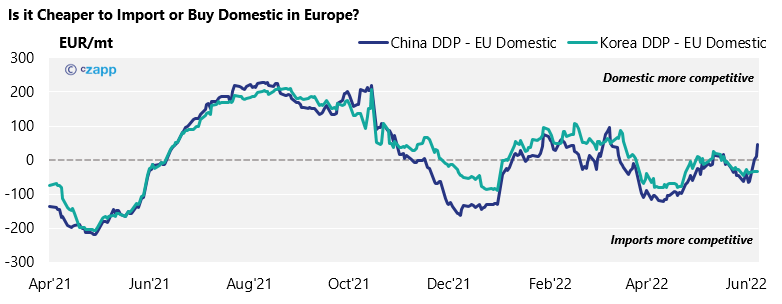

European import prices based on containerised flows are currently in a range of EUR 1,725-1750/tonne delivered, putting them above domestic offers and uncompetitive into Northern Europe, but closer to prices now heard in Southern European markets.

Feedstock Costs Poised for Another Increase

Having increased EUR 75/tonne in May, the European contract price (ECP) for paraxylene (PX) is poised to leap once again in June.

Given recent volatility in the Asian and global aromatics spot markets, speculation around June’s PX ECP is rife, with forecasts in a EUR 1300-1500/tonne range.

Even with a conservative forecast of EUR 1350/tonne, representing an increase of EUR 110/mt, the PET spot price–raw material spread would be slashed to a nine-month low.

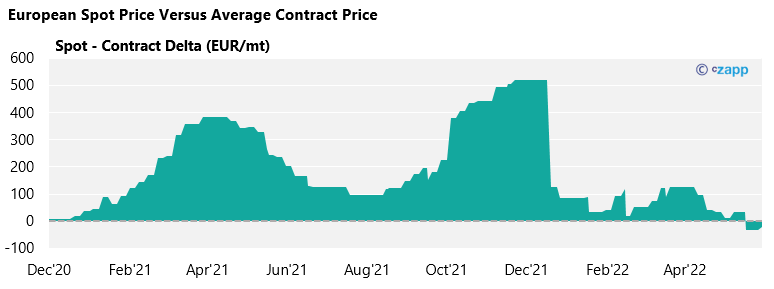

Whilst June’s PX CP remains unsettled, using a PX price of EUR 1350/tonne as a benchmark, PET resin spot prices look set to fall below the average European contract for the first time since October 2020.

Market Outlook & Concluding Thoughts

- Food and beverage brands look set to reap the benefits of a potential consumer spending spree this summer.

- However, a deepening cost of living crisis may provide headwinds for some discretionary spending on non-essential consumer goods and luxury items.

- A combination of stronger consumer demand, higher Asian PET resin prices, and increases in the PX ECP, could drive spot prices higher in H2 June and July.

- However, any potential rally in the spot market over the next month may be limited by high contract coverage and import arrivals.

Other Insights That May Be of Interest…

PET Raw Material Futures Outlook: PTA, PET Producers Struggle to Pass on Feedstock Price Rises

PET Resin Trade Flows: EU PET Imports Surge Despite Chinese Export Constraints

European PET Market Loses Momentum as Demand Slows

China’s zero-COVID Approach Hampers PET Resin Exports

Chinese PET Industry Faces Biggest COVID Outbreak Since 2020