- European PET buyers are still battling with supply shortages.

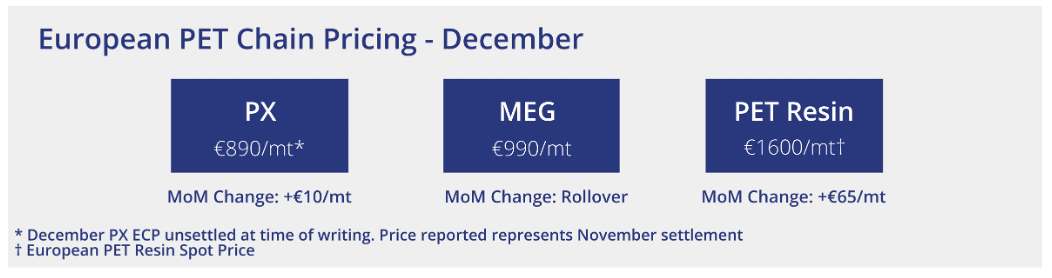

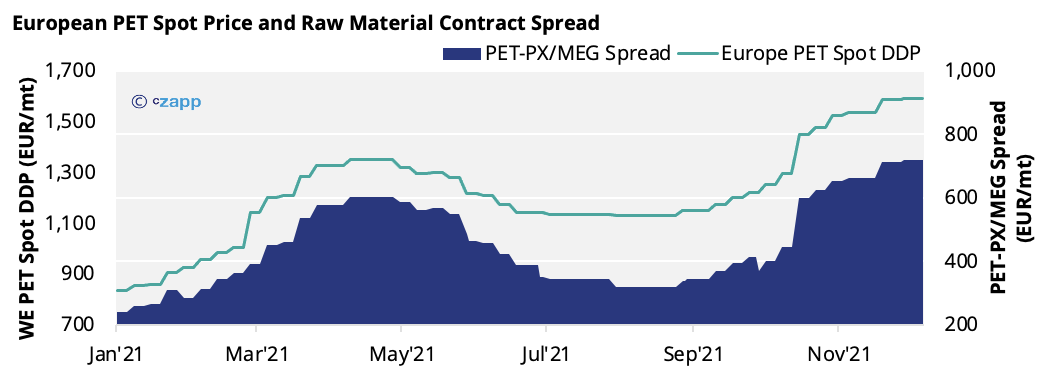

- Domestic prices have therefore escalated, averaging 1,600 EUR/mt in mid-December.

- Supply should remain tight through Q1’22, with producers increasingly sold out and lacking stock.

No Let-Up for European Buyers

- European PET buyers are still facing supply shortages, whilst enquires remain at good levels.

- Most European producers are already reporting sold out volumes through December and January.

- Some are even reporting sold out production through Q1’22, depending on contract uptake, which is a clear indication that availability issues will likely persist through H1’22.

- The shake up in the traditional contract market has prompted record new contract volumes as buyers look to secure European supply.

- The combined effect of the highest demand for contracts seen in years, and reallocated or backlogged orders means, for many producers, much of their Q1 production has already been sold forward.

Spot Prices Continues to Rise in December

- PET spot prices have continued their upward trajectory in December, averaging around 1,600 EUR/mt mid-month, up 65 EUR/mt from just a month earlier.

- However, a wide range in pricing has also developed, reflecting the uncertainty of the market.

- Whilst some free negotiated pricing has been heard in the mid-to-low €1,500s, spot prices at the other end of the market have typically consolidated around 1,600 EUR/mt, with higher prices upwards of 1,650 EUR/mt also reported.

- At the time of writing, the PX European Contract Price (ECP) for December was yet to settle, having reached 890 EUR/mt in November, up 10 EUR/mt from the previous month.

- MEG ECP has reached final settlement for December at 990 EUR/mt, a roll-over from the November level.

Production Issues Continue to Constrain Supply

- Most European producers are currently operating at high rates due to the good demand, although issues surrounding PTA imports for some producers continue to persist due to container freight issues.

- However, PKN Orlen’s PTA unit in Poland is still unable to operate fully due to the previously reported equipment failure.

- As a result, Indorama Poland (230kta) remains on force majeure and unable to run fully, limiting regional PET supply.

- Although Indorama’s now exited its scheduled maintenance on PET and PTA in Rotterdam (426kta PET), production at its San Roque plant in Spain (203kta) should undergo planned maintenance over February/March.

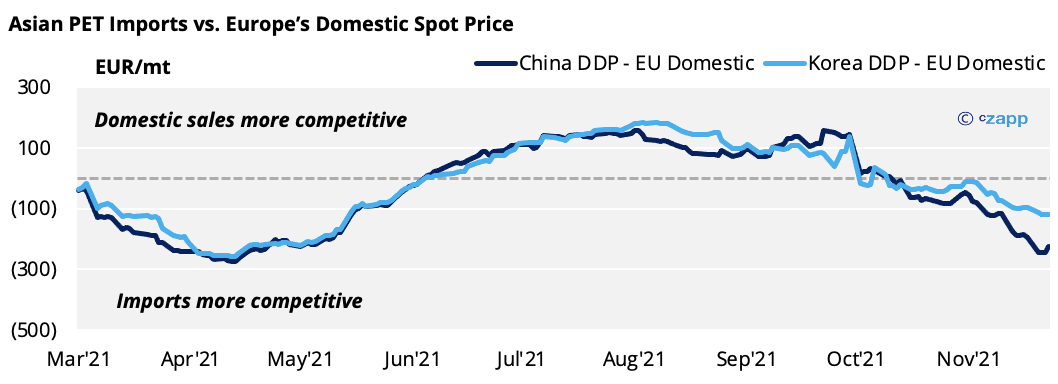

European Resin Holding Large Premium over Import Parity

- In comparison to the European domestic spot levels, Asian FOB prices have been in free fall since the end of October, from around 1,190 EUR/mt FOB China to 1,040 EUR/mt at the time of writing.

- Whilst Asian producers continue to experience strong demand for exports, and maintain good margins, the downturn in raw material pricing has been the principal driver forcing PET resin export prices lower.

- Diverging regional prices mean imports are competitive against European prices.

- With Northeast Asia to Europe freight at around 8,000 USD/TEU, indicative prices for imports are now estimated at around 1,479 EUR/mt for Korean origin and as low as 1,375 EUR/mt for Chinese resin on a delivered basis.

- That said, many Asian exporters sold out of 2021 volumes months ago and are now virtually sold out for Jan/Feb 2022.

- Recent quotes for March/April shipment from leading Chinese producers currently range between 1,450 and 1,500 EUR/mt CIF, equivalent to around 1,450 EUR/mt delivered (around 150 EUR/mt cheaper than current European prices).

- Therefore, to benefit from these deltas, buyers need to gamble that European prices will stay firm through the next two quarters.

- And this is the crux, most large buyers feel well covered into Q1 so have been hesitant to this point, instead believing and hoping domestic European prices will ease through the first half of 2022 (a bold gamble indeed).

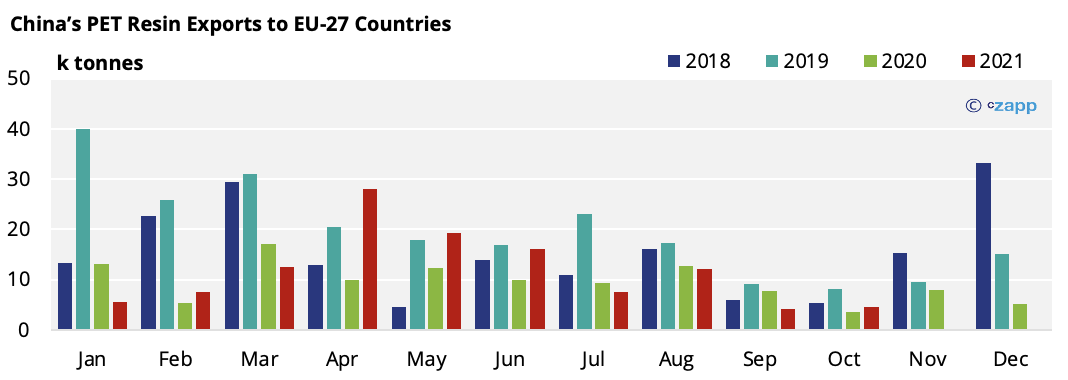

China’s November Exports Set to Confirm Trend

- Although Asian exports to Europe have been quiet since the end of the summer, Chinese exporters have reported large export sales.

- The big question is: how much of this will be destined for Europe in 2022, and to what extent have European buyers covered requirements via imports?

- Compared with the large European import wave in H1’19, large volumes were initially shipped in November/December 2018 for Q1’19 arrival.

- At this stage, we’re not seeing the same pattern emerge, which suggests that imports may only slowly return to a normalised flow through the first part of 2022, similar to Q1’21, instead of any large response to the high European prices.

- All eyes will now be on the November trade data due later this month, confirming which way this trend will play.

Market Outlook & Concluding Thoughts

- Will hesitancy leave buyers exposed in the pre-season buying period?

- Domestic producers are already reporting good sales for Q1, and expectations are for availability to remain tight, supporting a price premium over imports in the near-term.

- The recent Omnicom outbreak has heightened uncertainty, however.

- Whilst any contagion in COVID restrictions could dampen demand appetite, strong buying in March/April could equally aggravate availability issues in an already stretched market.

- The latter would pour cold water on any hopes for a let-up in European prices in H1’22.

Other Insights That May Be of Interest…

European PET Surcharges Shock Market Amid Record Price Hikes