Insight Focus

- Bottle demand boosted by warm weather, but resin buyers are cautious and shunning high prices.

- European PET needs PX price drop to compete against Asian imports.

- PET producers to target import price parity aggressively despite facing a squeeze on margins.

Low-priced imports and rising European PET production costs have defined the last month for the European PET resin industry.

The widening energy and raw material price disparity between Europe and Asia has given Asian PET resin imports an advantage over domestic material.

Whilst rising production costs have squeezed European producer margins.

European producers now hope there will be a marked correction in feedstock costs in the coming off-season, enabling domestic product to compete more effectively.

Bottle Demand Boosted by Warmer Weather

Although domestic resin demand has slowed since May, recent corporate results from major brands within the food and beverage space highlight the robust performance of the downstream sector.

Beverage sales have been boosted by the recent hot weather and the return of mass tourism across Europe.

Source: Shutterstock

Coca-Cola Europacific Partners (CCEP) reported 14% year-on-year growth in volume in the first half of the year, whilst Nestlé Waters also reported double-digit sales growth over the same period.

Coca-Cola HBC also reported strong growth in its established and developing European markets, 11.4% and 20.7% H1 volume growth, respectively.

Importantly, CCEP also highlighted strengthening demand during the summer season, with no indication of sales attrition associated with the rising cost of living.

Could Converters Replenish Stocks in September?

Whilst experiencing strong consumer demand, buyers have been cautious, not wanting to be caught holding expensive stock due to the recent volatility in European resin prices.

Instead, both preformers and thermoformers have been whittling down stocks instead of accepting high prices.

PET resin inventories are low across the supply chain, with converters generally only supplementing contracts with small, just-in-time orders.

However, with prices in correction mode and a return from the August holiday lull, producers are hoping that there might be a flurry of fresh buying in September.

EU PET Resin Imports Set Record High for May

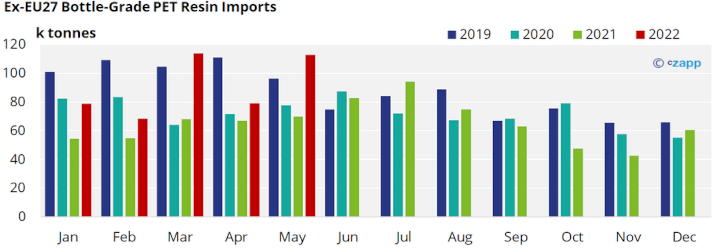

So far this year, EU27 countries have had some of the highest PET resin imports since early 2019, setting record highs for both March and May.

EU27 countries received over 453k tonnes from outside the bloc in the first five months of 2022.

Year-to-date import volumes are 44% higher than in 2020, but still 17% less than in 2019.

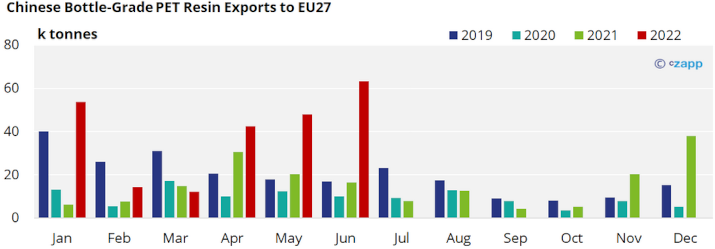

Around 25% of all extra-regional imports, through to May, have originated from China.

Since COVID restrictions and port disruptions began easing, Chinese PET resin exports to EU countries have risen sharply.

Imports are expected to continue rising through June and July, given higher Chinese exports in May and June, and taking shipping times into account.

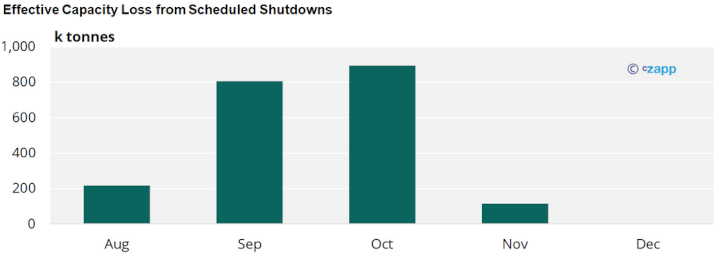

Production Shutdowns to Tighten PET Resin Supply in Q3

Facing the arrival of large import volumes and rising feedstock costs, European PET resin producers have slashed production rates over the last couple of months.

Most producers are now operating with 20-30% spare capacity.

JBF has shut-down an entire production line (216k tonnes) due to poor spot market sales, and says it will only bring it back online when market conditions improve.

JBF has also declared force majeure on its raw material suppliers, but PET resin contracts have not been affected.

Over the course of the next few months, capacity loss is expected to peak at around 895k tonnes in October, equivalent to around 27% of European PET resin production capacity.

Although PET resin producers will have built sufficient stocks to service contracts through shutdowns, many hope that reduced production may precipitate a correction in European PX prices.

A downward price correction that has already begun in European PET spot prices.

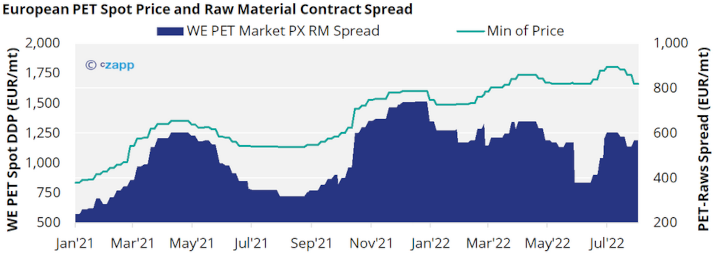

European PET Spot Prices Begin Sharp Downward Correction

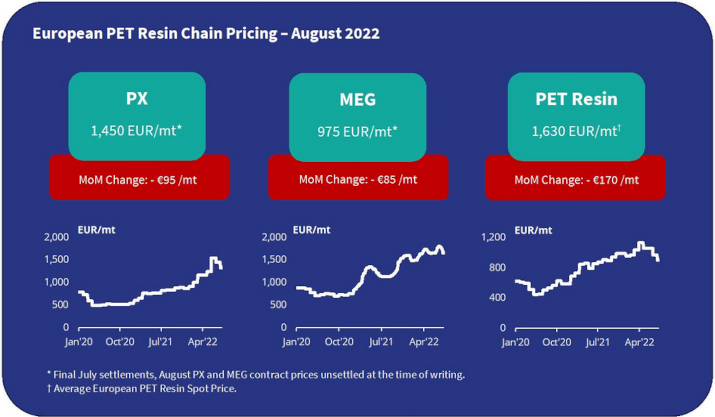

In August, European spot prices for virgin resin typically ranged from EUR 1,600 (USD 1,633) to over EUR 1,660/tonne, averaging EUR 1,630/tonne mid-August; an average EUR 170 decrease from July.

Prices below EUR 1,600/tonne were also heard, with free-negotiated prices as low as EUR 1,570-1,580/tonne. Other producers held higher average positions due to restricted spot availability.

However, across Europe there was a clear expectations prices may go lower based on projected feedstock costs and pressure from cheaper Asian imports.

After a volatile month for raw material contracts, July’s paraxylene (PX) European Contract Price was fully settled at EUR 1,450/tonne, down EUR 95 from the previous month.

July’s monoethylene glycol (MEG) ECP settled at EUR 975/tonne, down EUR 85 from June.

As of 12 August, both MEG and PX August ECPs remained unsettled.

However, there is a general expectation within the PET market that the August PX ECP could settled in the EUR 1,300-1,350/tonne range, with further reductions in September.

Whilst these prices are purely hypothetical, one thing is clear: for European PET resin producers to compete with lower-priced Asian imports, European PX prices need to drop sharply over the coming months.

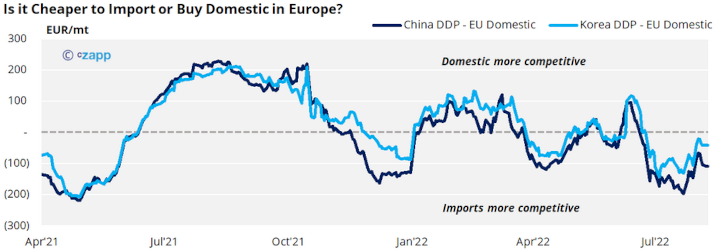

Is it cheaper to import?

On 12 August, China PET resin export price averaged around USD 1,120/tonne, down around USD 35 over the past month.

Whilst European spot prices have fallen, the delta between containerised imports and domestic European PET resin on a delivered basis is still considerable, at around EUR 85/tonne.

A combination of lower Asian PET resin prices and reduced freight rates have enabled imports to remain competitive against domestic spot material.

The euro’s recent strength against the dollar has also helped maintain the import parity delta.

Market Outlook & Concluding Thoughts

- Although a downward correction in PET spot prices has started, PX contract prices will need to drop much further to enable European PET producers to compete with imports from Asia.

- European producers look set to target import price parity aggressively before they go into 2023 contract negotiations.

- Even if some level of stock replenishment occurs in September, spot prices are projected to move sharply lower through Q3 following feedstock projections.

- However, high forward energy prices are set intensify cost pressures on producers in the run up to the European winter.

Other Insights That May Be of Interest…

US PET resin Imports Hit New Highs as Volumes from Oman Leap

What Europe’s Deepening Energy Crisis Means for PET Resin

PET Supply Chains Groan Under Global Heatwaves

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs