Insight Focus

European PET resin producer sales steadily improve, spot availability tightens.

Warmer summer weather in N Europe could push prices higher, on low stocks and low imports.

European PET resin prices already firming, with a push towards EUR 1200/tonne anticipated.

Market Overview

The stage is being set for a potential demand squeeze in July, which could see European PET resin prices breakout of the current price range.

Most domestic PET resin suppliers are reporting continued steady improvement in sales, with most having sold-out May and June, with July expectations also looking strong. That said some producers still have spare capacity since restarting lines early this year, although operating rates are increasing.

Seasonal demand is also lacking uniformity. Southern Europe has been enjoying a long-warm summer, with preformers reporting strong sales across multiple Mediterranean countries. Whereas, in Northern Europe for many the summer is still to begin.

However, runaway ocean freight rates have meant buyers are favouring the local market, with high rPET prices also supporting virgin resin demand.

As a result, market fundamentals are steadily improving, and with producers and buyers alike running minimal stocks, conditions are set for a potential demand squeeze in July, if weather conditions improve in Northern Europe.

Major sporting events, such as the Euros and Olympics will undoubtedly provide another demand boost, whilst availability out of Rotterdam is curtailed.

European Economic Outlook: Forecast to Improve, Confidence Lacking

The economic situation within the EU is also showing some positive signs, but these are being accompanied by less positive expectations.

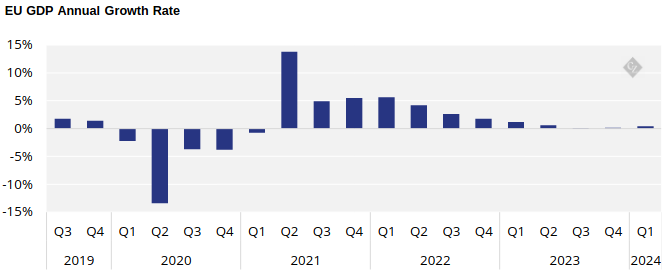

After falling flat in the second half of last year, EU GDP expanded 0.40% in the first quarter of 2024 versus the same quarter of the previous year.

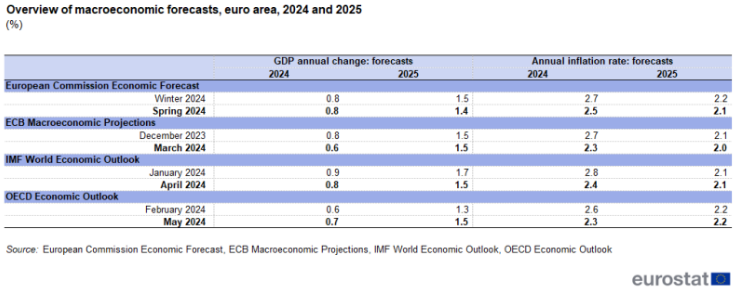

According to the European Commission Economic Forecast, the GDP Annual Growth Rate in the EU is expected to see some modest improvement through 2024 to average 0.80% for the year, rising to 1.4% annual growth in 2025.

In addition to steadily improving GDP, other positive signs of economic recovery include increased industrial and construction production, and retail trade sales, as well as stable inflation and unemployment rate

However, consumer confidence still languishes deep in negative territory, and even though some green shoots for economic recovery are showing, economic sentiment, and employment expectations both decreased in latest April data.

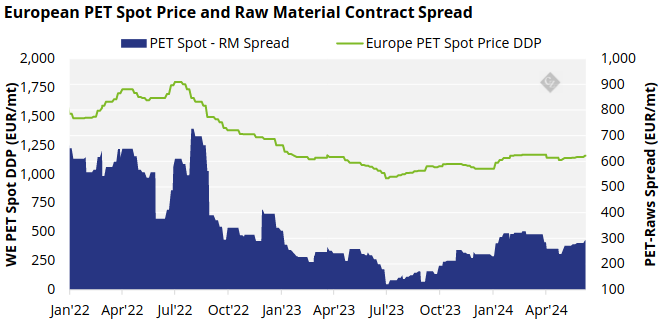

Domestic European Prices Edge Higher, Keeping Rangebound Overall

European domestic PET resin prices are slowly rising, on improved demand and higher import prices. At the same time, spot availability is being whittled down.

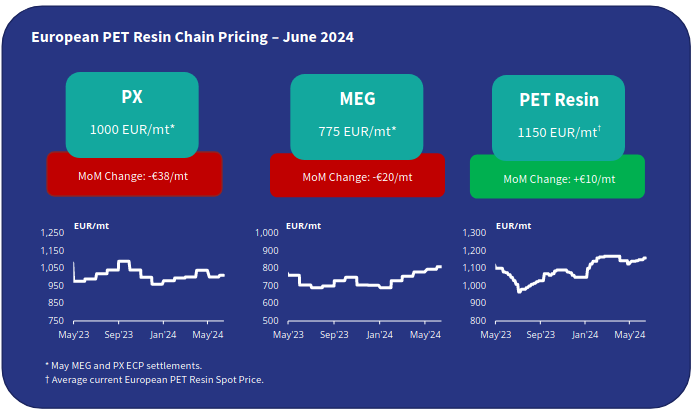

The current full market price range is assessed at EUR 1130-1170/tonne, with an average price of EUR 1150/tonne, an increase of just EUR 10/tonne versus last month.

Low-end offers at EUR 1130/1135/tonne were heard on the market in early June, but prices have firmed as availability has become increasingly limited. Most spot prices for larger volumes are closer to the EUR 1150/tonne.

Expectations are for prices to continue to firm into July, as seasonal demand strengthens, inventories are eroded, and availability tightens further.

Most buyers currently hold relatively low inventories, on the belief that the market would be long this year. At the same time, many were also relatively reluctant to seize upon lower priced import before the freight market imploded.

In May, PX European Contract Price decreased by EUR 38/tonne to EUR 1000/tonne, June remains unsettled. Whilst June’s initial MEG ECP settlement decreased EUR 20/tonne to EUR 775/tonne.

Tighter PTA Supply Could Cause PET Prices to Accelerate Further

Although the raw material spread showed a partial recovery in May, those producers reliant on imported raw materials have also experienced a sharp increase in ocean freight, driving up production costs.

Whilst some PET resin producers have already switched to larger Asian PTA breakbulk shipments, helping to alleviate future cost pressures, others are at the mercy of import delays and lack of container availability.

Some carriers are already pulling allocations for previously booked July shipments.

Domestic PTA production has also been hit, following shutdown of PTA production in Portugal last month, PTA production on both lines at Indorama’s site in Rotterdam is believed to have entered maintenance turnaround.

In addition, PKN Orlen was also reported to have experienced an unplanned outage. And also this is believed to have been resolved, the occurrence nevertheless raised concerns of a potential shortage of PTA supply within Europe.

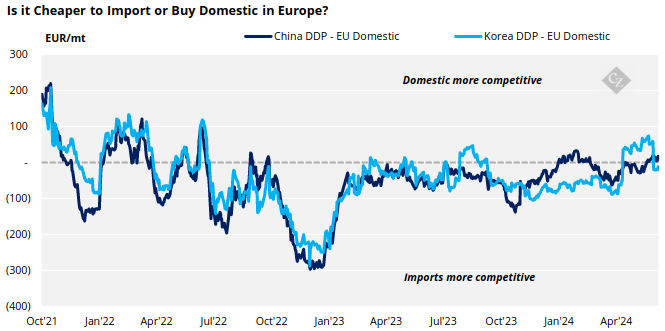

Is it cheaper to import?

Asian PET resin export prices have remained with a tight range since early May. At the time of writing, average Chinese resin export prices averaged USD 905/tonne. (Please read our Asian Weekly report for further insight).

Domestic PET resin has increased in competitiveness through May, as ocean freight rates have escalated, significantly increasing import prices.

For example, freight rates out of Vietnam have risen from less than USD 2500/TEU in March to over an average of around USD 7400/TEU for July shipment, adding an extra USD 215/TEU in freight costs alone.

Indicative import prices typically range EUR 1090-1120/tonne CIF (duty paid), equating to an average of EUR 1130-1160/tonne DDP, on par with current domestic prices.

Depending on the grade required, one Vietnamese producer still offers the best value with prices available towards the lower end of the above range.

Given the expected rise in domestic prices over the next month, near-term competitiveness in domestic resin may once again begin to fade, swinging back to an import advantage in Q4’24.