Opinions Focus

- Carbon is no longer able to price coal out of the EU power sector.

- This is due to extremely high natural gas prices in Europe.

- Does this mean EU emissions allowances are no longer fit for purpose?

Europe’s Emissions Trading System (EU ETS) has been buffeted by the region’s energy crisis and now finds itself searching for relevance as natural gas prices remain at historic highs.

Until mid-2021, the price of carbon was actively reducing coal use in the bloc’s power sector, leading to record low total emissions in 2020 of just over 1.2 billion tonnes.

The rising cost of EU emissions allowances (EUAs) had made burning coal for power economically uncompetitive with natural gas, while a large number of governments across the bloc announced mandated phase-outs for all coal-fired generation.

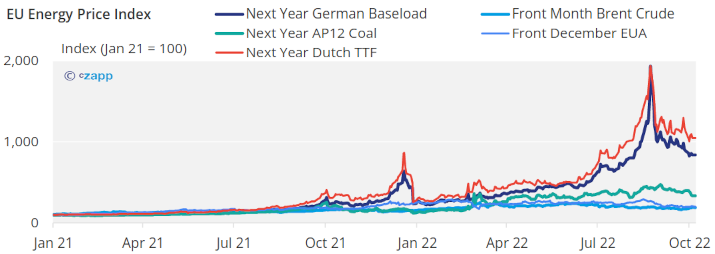

However, growing tensions around delays to the commissioning of the Nord Stream 2 pipeline in early 2021 began to feed into natural gas prices, making the fuel less competitive.

In order to maintain gas’ advantage over coal, EUA prices also started to rise.

But by autumn 2021, with gas prices showing no sign of slowing their steady increase, carbon was no longer able to price coal out of the power sector merit order.

Consequently, EUA prices capped their increase at just over €90/tonne, while gas and power prices rose ever higher.

The story has not changed in 2021. While Russia’s invasion of Ukraine in March triggered an even bigger jump in gas and power prices, carbon has been (relatively) stable.

The EUA market faces a conundrum – while gas prices have risen to new highs, reflecting the steady reduction in Russian gas supply, Europe gets much more coal from other parts of the world, and prices for the solid fuel are nowhere near as high.

This means that coal is now back in fashion. EUA prices simply cannot rise high enough to push coal aside and maintain the profitability of natural gas – nor do EU governments want it to.

Many European countries have paused their coal phase-outs and are bringing old plants back on line to provide cheaper electricity.

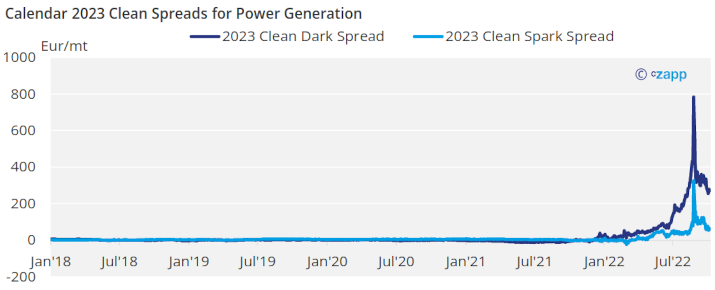

The chart below shows the so-called clean-dark spread – the operating margin for coal-fired power plants selling power for 2023 delivery – compared to the “clean spark spread” – the same margin for gas-fired power.

While gas was favoured over coal until late 2021, the soaring cost of gas has given coal a new lease of life and margins that coal-fired power has never seen before.

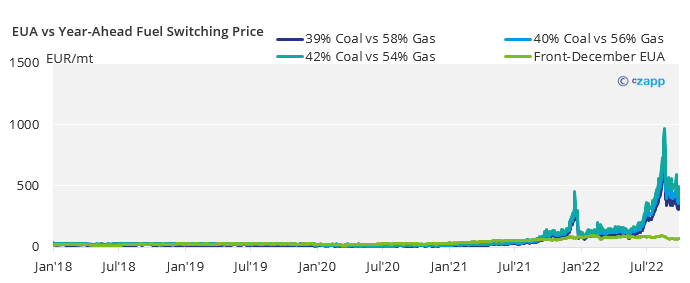

The chart below shows the price of carbon that would be required to profitable than coal.

Currently, EUA prices are between €280-€400 lower than where they would need to be to force utilities back to natural gas.

But with governments actively looking to reduce gas consumption over the winter, carbon prices at their current level of around €65-€70/tonne are helping them to realise that aim.

Clearly, carbon is not going to rise to €470/tonne, so EUAs are not currently able to do the job they were invested to do.

But the energy crisis is boosting the EU’s determination to transition its energy sector away from fossil fuels. The REPowerEU initiative is set to boost funding for clean energy by €250 billion or more.

Once the region has established secure sources of gas supply and prices have come back from their current record levels, the EUA price will once again maintain the pressure on industry to decarbonise.