- Omicron has hit retail footfall across Europe, weakening packaging demand.

- PET resin prices have dropped to around 1,485 EUR/mt this month and could fall further still.

- The threat of an import wave is growing as Chinese export orders hit a record high in December.

Weaker Consumer Demand and Fresh Contracts Soften European PET Resin Prices

- January has started on calmer footing than has been seen in previous months.

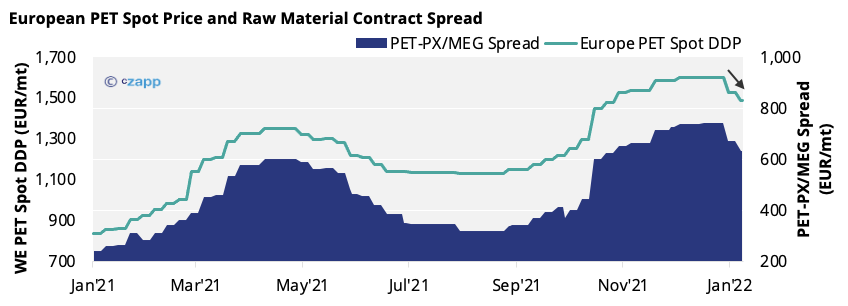

- Between October and the end of December, European PET resin prices surged by around 350 EUR/mt.

- With European producers now running full capacity right across Europe, and converters having secured new 2022 supply contracts, the spot market has started to normalise as supply worries ease.

- Weaker consumer demand has also contributed to a recent fall in spot prices.

Omicron Hits Retail Footfall and Packaging Consumption

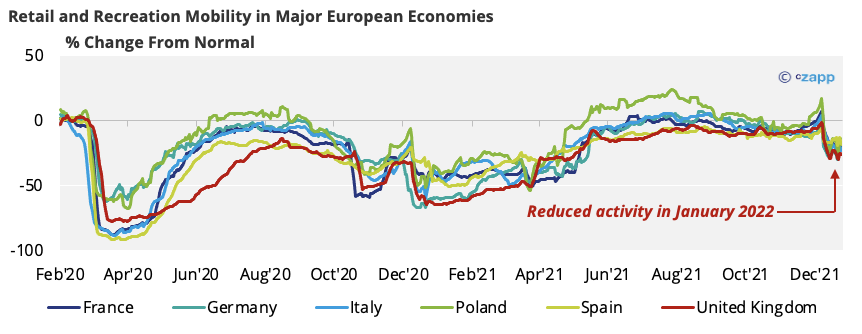

- Retail footfall over Christmas was lower than expected in Europe’s major economies due to Omicron.

- Over the last month, the latest variant has spread across Europe, prompting a wave of new restrictions.

- Although daily cases across Europe seem to have peaked, retail and recreation footfall remains below pre-pandemic levels.

- The latest Google mobility data for Europe shows that the number of people visiting places of retail and recreation is down 20-25% from pre-pandemic levels.

- Places of retail and recreation include the likes of restaurants, cafes, shopping centres, theme parks, museums, libraries, and cinemas.

- Lower activity within these areas correlates with reduced consumption of PET packaged items, such as bottled water and soft drinks.

Omicron Hasn’t Phased Europe’s PET Producers, Though

- Fortunately for the food and beverage sector, PET consumption is typically at its lowest during the winter in Europe.

- So, with indications that Omicron is milder than its predecessors, many expect to see another year of demand recovery, potentially reaching pre-pandemic levels.

- As such, Omicron doesn’t seem to have changed overall buyer sentiment.

- Most European producers are reporting strong sales and have secured large contracts for 2022.

- Also, in what seems a rare instance over the last two years, most European producers are finally running at full capacity, helping them maximise efficiency and absorb today’s high energy costs.

- The immediate demand trends and greater domestic contract coverage have therefore enabled PET spot prices to retreat from December’s highs.

- In January, PET spot prices averaged around 1,485 EUR/mt mid-month, down 115 EUR/mt from December levels. Prices as low as 1,440 EUR/mt were also heard.

- Although producers were attempting to hold close to 1,500 EUR/mt, some converters are expecting further weakness into February, targeting prices approaching the 1,400 EUR/mt mark.

- In the absence of sizeable imports, PET resin prices in Italy and the Balkans remained firm, with levels averaging higher than some Northern European markets at around 1,525 EUR/mt.

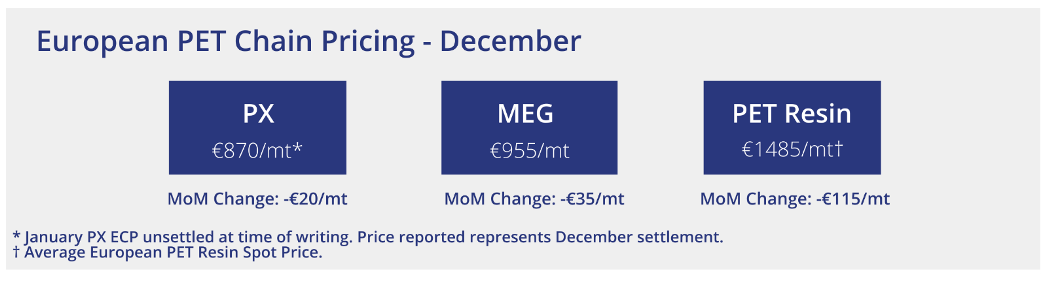

- December’s PX European Contract Price (ECP) settled split at 850 EUR/mt and 890 EUR/mt, representing an average of 870 EUR/mt for the month, down 20 EUR/mt from November levels.

- At the time of writing, MEG ECP has reached an initial settlement for January at 955 EUR/mt, representing a fall of 35 EUR/mt from December.

Import Threat Grows as Chinese Exports Hit Record High

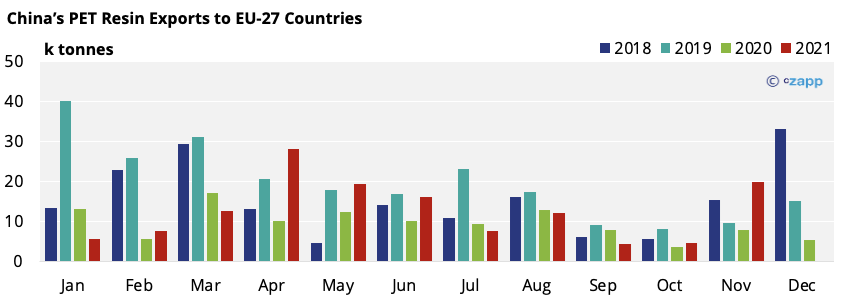

- Although Europe’s PET resin imports neared a four-year low in October, the threat of a new wave of imports is becoming more apparent.

- Chinese export orders are at record levels and its November export data revealed large shipment volumes destined for Europe, targeting delivery in the pre-season period of March-April.

- Rising sea freight charges in 2022 and persistent shortages in overseas supply means orders from Europe and the USA were unexpectedly good before Christmas, reaching another record high for the period.

- China’s export data for December, when published, should therefore show a continued increase in shipments to Europe.

- With Q4’21 volumes to Europe mirroring levels last seen in Q4’18, will we see a comparative import wave arrive in Europe during H1’22?

Market Outlook & Concluding Thoughts

- Although Asian exports to Europe are starting to ramp up, logistics are still challenged, highlighted by recent port closures due to COVID outbreaks in China.

- Delays to shipping schedules are expected and may help stagger European arrivals over the coming months.

- Disruption to the spot market from imports may also be mitigated by large PET cargoes arriving in breakbulk.

- Although breakbulk vessels can ship between 15-25k tonnes of PET resin, only a select number of large buyers will be involved, meaning the impact may be felt less across the wider market.

- With European producers heavily contracted in 2022, domestic availability for additional spot purchases will remain constrained. As previously reported, many European producers have already sold out for much of Q1.

- Producers may find themselves under no pressure to reduce prices further, with a premium over import parity set to be maintained.

Other Insights That May Be of Interest…

European PET Prices Jump with Supply Shortages

Chinese PET Exports Rebound Following Logistical Mayhem

European PET Prices Jump with Supply Shortages

European PET Surcharges Shock Market Amid Record Price Hikes