Insight Focus

The Real depreciation has provided some respite to Brazilian corn prices. But some traders and producers have discovered the hard way that the cauldron of variables influencing prices is much more diverse and complex than it may seem.

The Depreciation of the Brazilian Currency

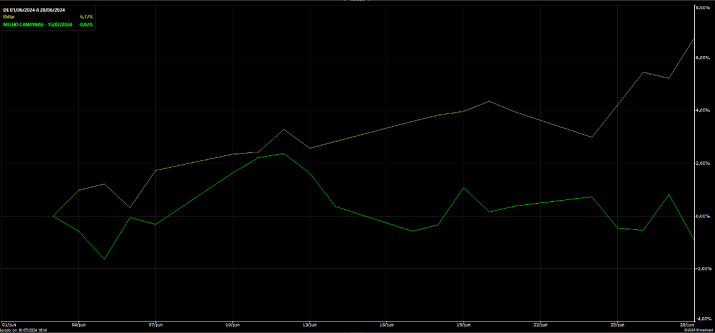

The current government’s fiscal policy has led to widespread doubts, leading the Brazilian currency to be one of the most devalued in the year worldwide, losing 15% by June 28th (BRL/USD 4.85 => 5.59).

The current exchange rate depreciation, combined with players’ fear of an even weaker Brazilian Real, has caused a rush to buy corn, mainly in B3 futures (the Brazilian Futures Exchange), sustaining some price appreciation for part of last month.

BRL/USD x B3 Corn Front Month (Source: Broadcast)

Safrinha Harvest Reaches Historic Pace

However, the harvest of the Brazilian safrinha crop (2nd crop), responsible for 80% of the country’s supply (88.12 million metric tonnes, or 3.47 billion bushels, according to the CONAB report in June), is almost half complete. According to the private consultancy AgRural, 49% of the cultivated area in the Centre-South of the country had already been harvested by June 27, compared to 16% at the same time last season, the most advanced pace since 2013.

Although CONAB’s forecasts for the 23/24 crop are around 114.15 mmt (4.49 billion bushels), it would not be surprising if the final numbers for the Brazilian crop reached 120 mmt (4.72 billion bushels), contributing to the realization of a generous final global stock estimated by the USDA in June, of 312 mmt (12.28 billion bushels).

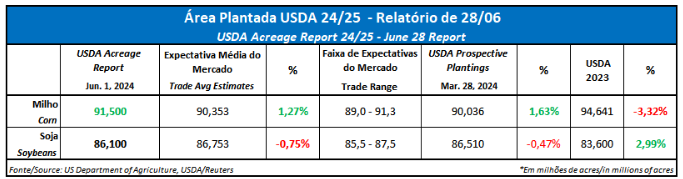

US Planted Area and Stocks Exceed Expectations

The global supply side weighed even more with the release of USDA reports, on acreage and stocks, on the 28th, with numbers well above expectations, estimating a planted area of 91.5 million acres (37 million hectares) and stocks of 4.993 billion bushels (126.8 million metric tons) on June 1.

Supply to Continue Dominating

However, the harvest of the Brazilian safrinha crop (2nd crop), responsible for 80% of the country’s supply (88.12 million metric tonnes, or 3.47 billion bushels, according to the CONAB report in June), is almost half complete. According to the private consultancy AgRural, 49% of the cultivated area in the Centre-South of the country had already been harvested by June 27, compared to 16% at the same time last season, the most advanced pace since 2013.

Although CONAB’s forecasts for the 23/24 crop are around 114.15 mmt (4.49 billion bushels), it would not be surprising if the final numbers for the Brazilian crop reached 120 mmt (4.72 billion bushels), contributing to the realization of a generous final global stock estimated by the USDA in June, of 312 mmt (12.28 billion bushels).