Insight Focus

New Zealand’s milk production surged by 10% YoY in August. Chinese demand for WMP remains robust, but returns on other dairy products remain stronger so processors to continue focus on butter and AMF output. SMP markets have shifted post-COVID, with EU origin now holding a premium over NZ. European milk collections are down due to hot weather and bluetongue virus.

Strong September Expected for NZ Milk Collections

The latest milk collection figures for the month of August have been reported by all dairy processors. The third warmest winter ever experienced in New Zealand has led to impressive milk collections for August, with nationwide milk up a whopping 10% year over year. This is the second highest August milk production ever, only behind August 2020 and is very notable as the milk collected across Fonterra’s 2020/21 Financial Year went on to be the record.

If we apply the average percentage increase from August to September, then we could expect to see September collections total 227.9 million kgMS. This would be the strongest September ever and would mark an 8.3% YoY increase in one of the peak production months. I cannot see a situation where September lands below 221 million kgMS (up 5%).

Fonterra itself starts its FY up 9.62%, while the non-Fonterra group begin up 11.48%. The non-Fonterra group continues its solid growth, with market share for August at an impressive 20.9%. This is 0.7% above trend.

NZ Temperatures Boost Production

New Zealand’s average temperature in September 2024 has continued to be on the warmer side. We are told that cows are in good condition nationwide and there is plenty of grass available. This combined with many farmers beginning calving earlier this year leads us to expect that the September milk production numbers could be very strong.

Spring temperatures are likely to be above average in the north and east of the North Island and east of the South Island. NIWA are forecasting that periods “of unusual Spring warmth are likely as warm air masses from Australia occasionally flow eastward into New Zealand.”

These westerly winds are expected to subside in mid-spring and from this time a potential La Niña may begin to develop.

During a La Niña event northeasterly winds tend to become more common in New Zealand. This usually brings moist, rainy conditions to northeastern areas of the North Island and reduced rainfall to the lower and western South Island. Warmer than average temperatures often occur around New Zealand during La Niña. The combination of these effects is generally positive for milk production across the country, though there can be distinct regional effects which may impact the nations production mix.

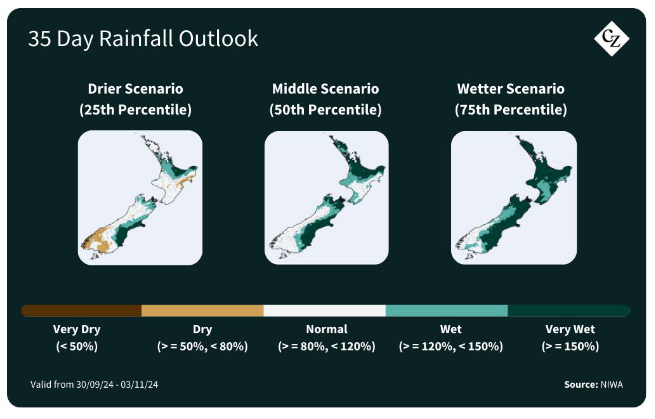

NIWA’s Rain Forecasting tool shows that such rain patterns are likely in the coming 35 days:

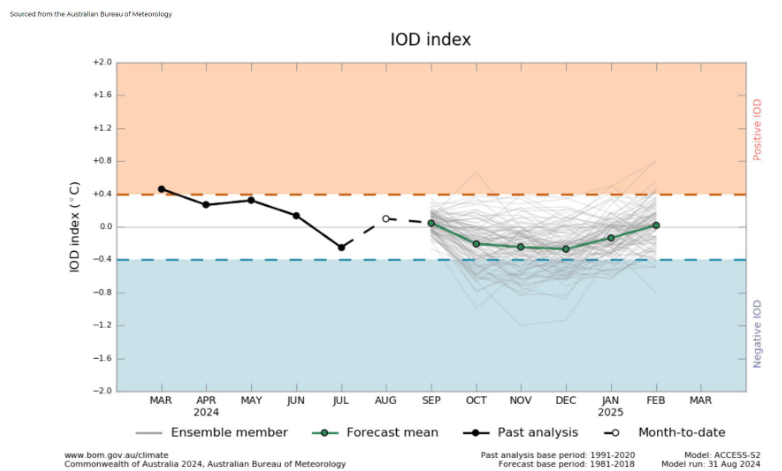

The Indian Ocean Dipole (IOD) maintained a second positive value at the start of September, reaching +0.15. Typically, positive IOD phases are associated with El Niño events – not a developing La Niña. However, most international climate models surveyed by the Australian Bureau of Meteorology suggest a neutral IOD until the end of Spring and increasing likelihood of a negative IOD by December, thus reinforcing the potentially developing La Niña.

Source: BOM

High Milk Volumes to Impact NZ Production Decisions Over Peak

Whole Milk Powder prices reached their highest level since October 2022 on GDT this week, up 3%. This was even as WMP offer volumes are at their seasonal peak. We understand that demand from China remains robust and has been the key driver of the recent strength. I would also point readers back to the “Earlier Holidays May Drive Continuation of Old Seasonality” section of my September Article for some thoughts on this.

Even still, the relative stream returns continue to favour most products over WMP. Given this, we can expect that most New Zealand supplier production plans will be maximizing non-WMP production. We already know that New Zealand butter production is planned to be completely full, so we can only assume that increased milk will now be expected to fill any and all remaining AMF capacity too.

The New Zealand production network is essentially built to process all the milk collected on the very few days of “peak production” so there will still have been plenty of latent capacity available to get through a strong September milk flow. Given the relative weak returns from WMP, much of this marginal production is likely to have come in the form of additional WMP production.

SMP Spreads Surprisingly Balanced

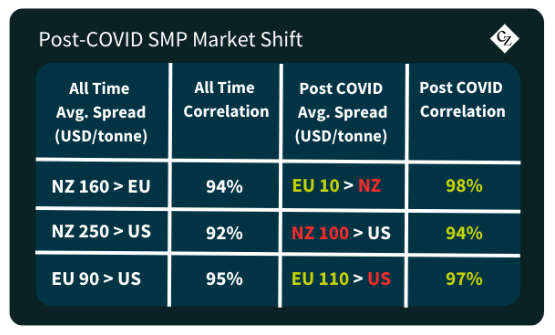

Since COVID the SMP markets have settled into a new rhythm. Part of this is probably due to the various global container freight disruptions.

New Zealand SMP used to achieve on average a USD 160/tonne FOB premium to EU product, we have seen that flip entirely and EU SMP now averages a USD 10/tonne FOB premium to New Zealand product.

As these two origins compete on a CFR basis, we can only assume that a considerable portion of this USD 170/tonne change has gone to shipping lines.

In general, correlations have strengthened across global SMP markets. At present the spreads for SMP are all in the 60th percentiles.

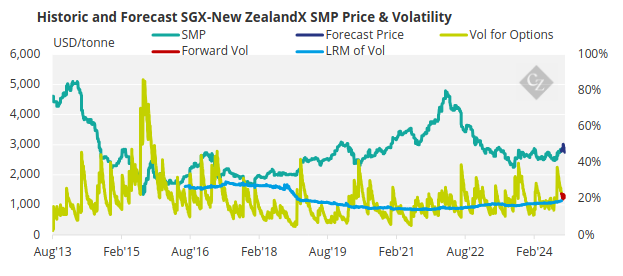

I took a look at SGX-New Zealand SMP volatility and this is currently on the higher side but trending down toward its own long-run mean (LRM). The outright pricing for New Zealand SMP is still over USD 500/tonne below its LRM, but we expect the LRM will drop toward current levels by July 2025. So, the upward pull on New Zealand SMP pricing may reduce along with its volatility.

This begs the question: with the wind coming out of the fat markets sails and WMP catching a bid, do we expect these two products moving in opposite directions to close the stream return gap? Or is the market simply not going to be able to cope with a bumper season in New Zealand?

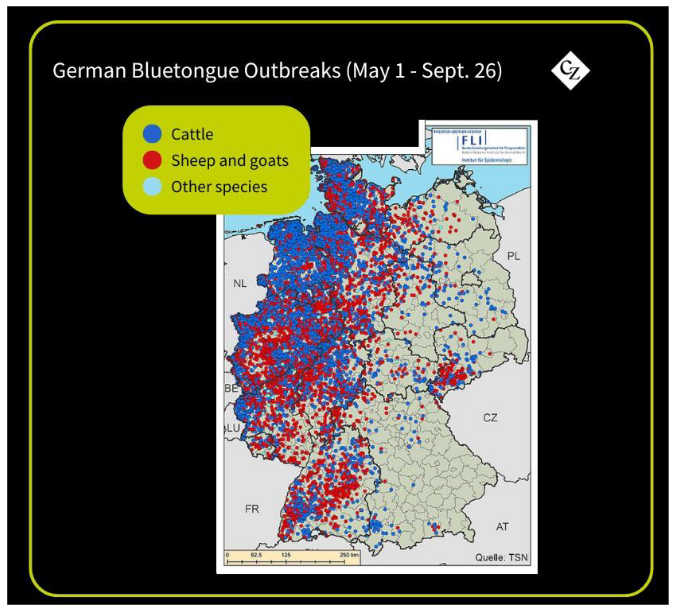

Bluetongue and Heat Impact EU Supply

Meanwhile, milk collections in the major producing countries Germany, UK and France are down by a cumulative 0.6% in 2024 year to date according to our calculations. German weekly figures are coming in more than 2% down year over year and are the main force dragging the group down. This can be explained by a combination of the persistently high temperatures and the continued spread of bluetongue virus.

As a reminder, BTV-3 is insect borne and can reduce yields by 8% for an infected animal and they are unlikely to ever fully recover.

It should be noted that as temperatures in Germany have begun cooling, that the rate of new cases reported per week is falling. At the current trend we might expect cases to peak toward the end of October and begin falling from this point.

Source: Friedrich-Loeffler-Institut (FLI)

With significantly higher New Zealand SMP production and exports expected, many EU processors have been selling as much Skimmed Milk Concentrate (SMC) as they can to avoid competing in the global SMP market. SMC had recently held a large premium over SMP in Europe, driven by ice cream production during the recent hot spells in Europe. That premium is now eroding quickly. It will be interesting to see whether processors continue to prefer SMC production. As both milk supply and demand for fluid applications seasonally drop off, will it become less profitable than drying SMP?

US Milk Solids Strong but Port Strikes Could Impact

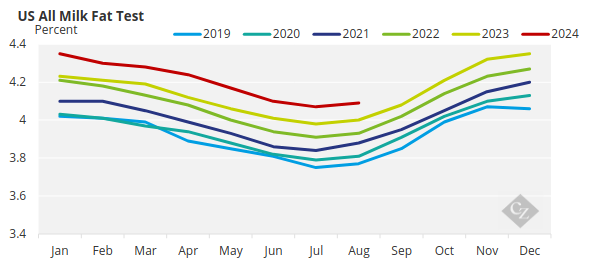

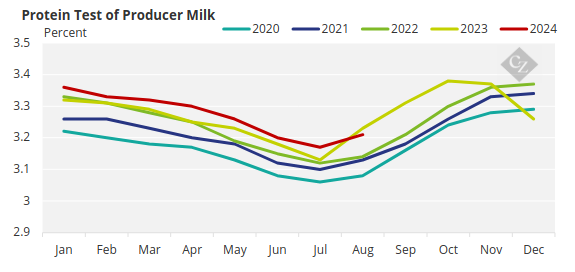

While fluid milk production in the US has been down by a cumulative 0.4% through 2024 to August, it should be noted that milk solids in the US continue to show impressive gains over time, thus undoing some of these headline reductions. Remember that commodities are made from milk solids, not just milk.

Source: USDA

Source: USDA

Until the next new cheese plant opens, expect any marginal gains in solids to show up in SMP.

At the time of writing, 14 major ports along the East and Gulf coasts of the US have seen the largest strike action in almost 50 years. Expect exports to Europe, Latin America and the Middle East to be the most affected due to reliance on East and Gulf Coast ports, while Asian exports should continue with less disruption through the West Coast.

Aside from general disruptions from West Coast ports becoming more congested, the major dairy flows that could be impacted by these strikes are SMP from the US to Colombia, and cheese and milk protein concentrates from the US to North Africa.