292 words / 2 minute reading time

- The February WASDE shows a reduction in Mexico’s import estimate for 2019/20.

- This change is not binding towards the total quota allocation; next month’s release will confirm the total Mexican quota.

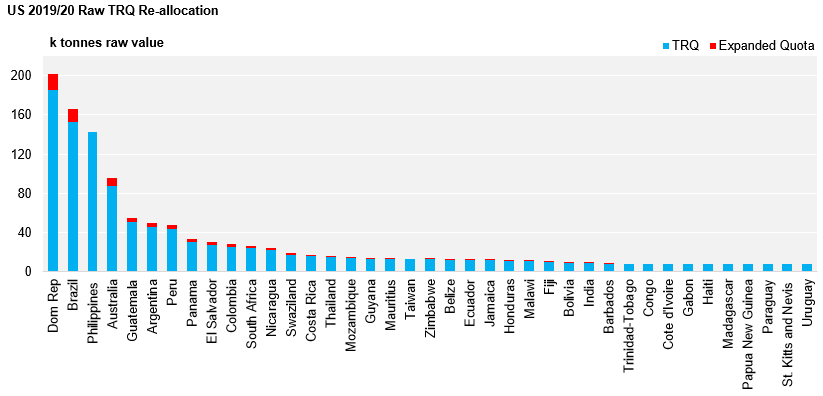

- The TRQ re-allocation we saw this week is confirmed by an increase in expected TRQ imports in 2019/20.

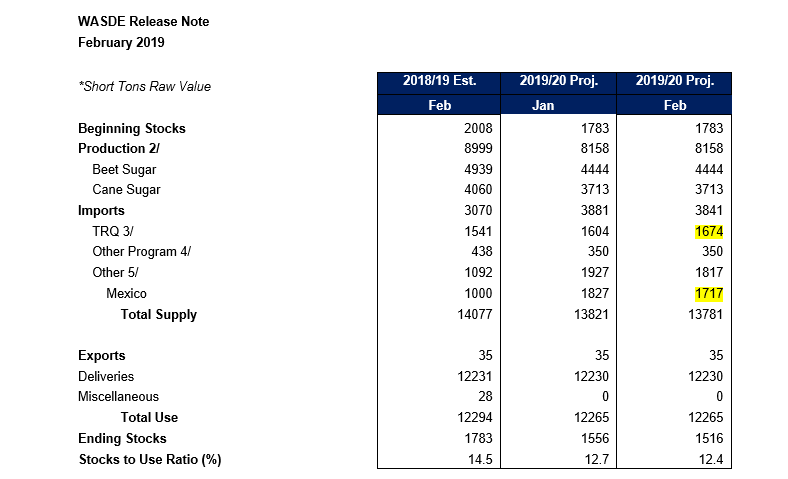

February WASDE Release

- This month’s release has reduced expected Mexican imports by 100k tonnes.

- It may be an indication that the USDA do not expect Mexico to comply with their current quota of 1.8m short tons.

- However, the reduction is not binding and the March WASDE will define the final quota for Mexican imports to the USA.

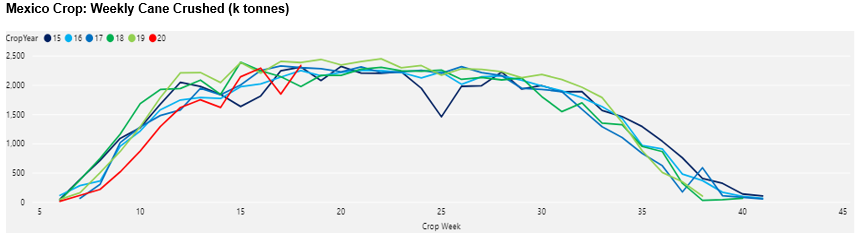

- The Mexican crop has been behind after the drought, but the final production estimates are still varied.

- The effect of this reduction is partly offset by the increase in expected TRQ sugar imports.

- This is the result of the re-allocation of quotas.

- The USDA can expand their total TRQ volumes if Mexico confirm they cannot fulfil their final quota estimate.

- This would allow them to ensure they reach the desired 13.5% annual stocks to use ratio.