Insight Focus

Global fertilizer markets have been shaken by proposed tariffs. Urea prices are rising, with Middle Eastern and Egyptian prices at their highest since September 2023. Potash and ammonia prices face uncertainty, while processed phosphate prices remain stable amid limited supply and demand.

Tariffs and Trade Uncertainty Disrupt Market

The international fertilizer market has been caught up in the indecision surrounding potential trade tariffs from the new U.S. administration. President Trump threatened – and subsequently delayed – 25% levies on Mexico and Canada, but went ahead with imposing 10% tariffs on Chinese goods.

In addition, the EU has suggested that Russian fertilisers imported to the 27 EU member states be heavily taxed with import duties on an annually escalating scale starting July 1, 2025.

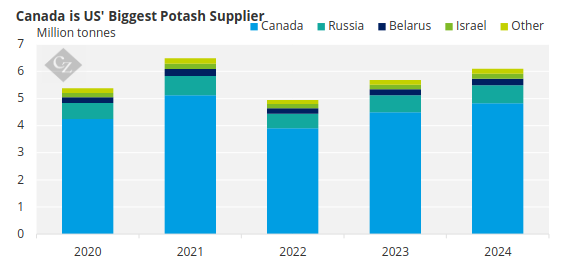

The US imports around 80–85% of all its potash from Canada. If the proposed tariffs are introduced within the next 30 days and the cost is passed on to US consumers, potash prices in the US/NOLA would surge to the highest in the world, reaching USD 338–344/short ton (USD 306-312/tonne), reflecting around USD 366–373/short ton CFR US Gulf equivalent.

Source: USGS

Currently, US/NOLA potash prices are assessed at USD 290–295/short ton FOB. Trade flow changes would certainly follow, potentially opening the door for increased Russian potash supplies.

On the phosphate side, Mexico represents roughly 26% of the US’ annual MAP imports, up from just 7% in 2023. The US already regularly maintains price premiums over other markets due to existing duties against China, Russia and Morocco. Adding Mexico to the list could further drive up prices in the upcoming spring season.

Similarly, the EU’s proposed tariffs on Russian and Belarusian products would have a massive impact, as Russia has supplied anywhere between 1 million tonnes and 1.8 million tonnes of urea to the EU over the past 10 years. In 2023, Russian-origin urea constituted 15% of total urea imports to the EU. Additionally, all major processed phosphate fertilizers, such as DAP, MAP, NPK and NPs, will be included in the tariff scheme.

On top of this, the world has seen China restrict DAP, MAP and urea exports since December 2024. Overall, the fertilizer industry—like any other sector affected by restricted trade, geopolitical tensions and a stronger USD—will suffer from the likely shift in trade flows and rising prices, which are already impacting farmers’ affordability.

Urea Prices Surge as India Eyes New Tender

The fallout from the relatively small volume of urea secured by Indian government buying agent RCF—just 588,000 tonnes versus the desired 1.5 million tonnes—combined with significant domestic urea consumption in India will most likely result in another tender soon for shipments from March onward.

India’s urea consumption for April 2024–May 2025 appears to be hitting a record 38.5 million tonnes, compared to just under 36 million tonnes for the same period the previous year. Inventory entering February 2025 was assessed at around 4.5 million tonnes, further supporting the belief that another Indian tender may be forthcoming soon.

Urea prices are rising across the board, with the latest urea tender in Indonesia this week resulting in an award at USD 438/tonne FOB for prilled urea—up from the latest granular urea tender price of USD 411.11/tonne FOB.

Middle Eastern producers have sold prilled and granular urea at USD 420/tonne FOB for March shipments, the highest level since September 2023. Iran has resumed production, and an export tender for 30,000 tonnes is expected to test the market at a price equal to or higher than the listed USD 377/tonne FOB level.

Egyptian prices have reached USD 455/tonne FOB, the highest since September 2023, with most, if not all, of the product destined for the European market, where Egypt is exempt from import duties. Brazilian CFR levels are assessed at around USD 425–430/tonne CFR, with expectations of further increases.

Once again, China remains the subject of speculation, with no confirmed news on urea exports. Some anticipate exports could resume in April or May, while others suggest June, once the domestic season concludes. Currently, domestic urea prices are hovering at seven-year lows, which could prompt the government to slowly reintroduce exports for selected destinations.

Prices in US/NOLA have risen by USD 70/short ton since the start of the year, with strong demand in anticipation of a robust spring application season.

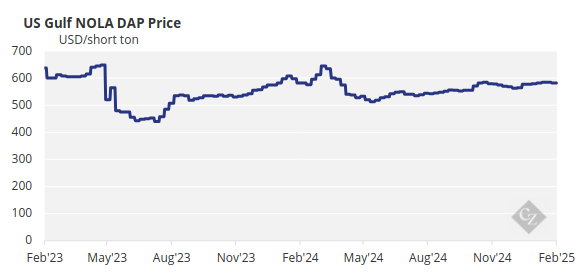

DAP/MAP Prices Rise as India, Morocco Near Major Deal

US/NOLA DAP/MAP prices are rising due to jitters surrounding the proposed 25% Mexican tariffs, which have now been delayed by 30 days. The all-important DAP import market in India has been dormant in 2025, with market players concerned about margins heading into the Kharif season.

Additionally, rumours suggest that a large-scale DAP/TSP deal between India and Morocco is in its final stages. The discussed volumes are reportedly between 2 million tonnes and 2.5 million tonnes of DAP, as well as 1 million tonnes of TSP. However, tensions have arisen as India has not agreed to include the 1 million tonnes of TSP, while Morocco’s OCP is apparently insisting that this volume is a required condition for the deal to proceed. The latest information indicates that India will purchase a total of 2.5 million tonnes, consisting of 1.6 million tonnes of DAP and 800,000 tonnes of TSP.

India is in dire need of DAP. According to the latest data, India produced 3.16 million tonnes of DAP between April and December 2024, which is 8% below levels seen the year prior. Total sales for the same period reached 8.33 million tonnes, down 14% for the April–November period.

Furthermore, India has announced a reduced 2025/26 fertilizer budget of INR 1.56 trillion (USD 18 billion). The overall budget is down 4.9% from the original 2024/25 budget. India has been attempting to cut fertiliser subsidy payments since spending over USD 30 billion in the 2022/23 fertiliser year to keep farmer prices affordable while international prices surged. Fertiliser subsidies account for roughly 40% of India’s central subsidies for 2024/25, second only to the country’s INR 2 trillion food subsidies.

MAP prices in Brazil remain stable at USD 635/tonne CFR, with the latest reported deal involving Russian-origin product for February shipment. Processed phosphate prices appear to be holding at current levels, with limited supply met by lacklustre demand.

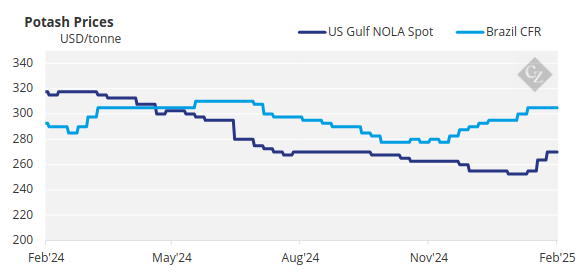

Potash Prices Climb as Market Reacts to Tariffs

The recent bullish sentiment in the potash market was evident this week, with all assessed spot benchmark prices rising across the globe. The US potash market opened in a state of uncertainty following President Trump’s executive order imposing 25% tariffs on Canadian and Mexican imports. This initial shock led to a pause in activity, as most participants stepped back to reassess the evolving situation.

Despite the market pause, one seller briefly posted pricing at USD 365/short ton FOB for Midwest warehouses before adjusting back to align with prevailing market levels. By the end of February 3, the tariffs were placed on hold for 30 days, easing some immediate concerns. Still, activity remained mixed throughout the week.

Some sellers stayed out of the market, while others resumed trading, with reported prices at USD 330–340/short ton FOB, reflecting a USD 10/short ton increase from the previous week’s assessment. Market participants remain cautious, awaiting further clarity on trade policy and its potential long-term implications.

At NOLA, barge activity mirrored the broader market sentiment, with sporadic trades reported between USD 280–290/short ton FOB. The market largely remained on hold during the first half of the week, but by week’s end, barges were more readily available, with values settling in the USD 285–290/short ton FOB range.

In Brazil, spot prices firmed to USD 315–320/tonne CFR, their highest levels since early December 2023. Demand for Q1 delivery remained limited, with most producers now offering shipments from March onwards.

In other news, Indonesia’s 350,000-tonne potash tender is expected to be scrapped, as international suppliers have refused to agree to the formula price proposed by Pupuk Indonesia and insist on maintaining a fixed-price system. As a result, a new tender is expected to be announced soon.

Potash prices look set for a steady increase across all key global spot benchmarks in the coming months. An upside risk remains due to the potential tariffs from President Trump.

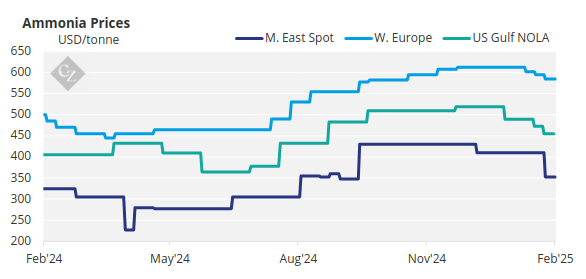

Ammonia Expected to Remain Steady

Ammonia prices, both east and west of Suez, showed little sign of reversing recent declines this week. However, surging natural gas values and stronger upgraded nitrogen pricing in Europe appear to be tempering any major downturns there for the time being.

As the two-year mark approaches since the project was first expected to be commissioned, sources in the US Gulf this week suggested that exports from the long-awaited 1.3 million-tonne-per-year Gulf Coast Ammonia (GCA) project in Texas may face further delays. Following a reported unsuccessful start-up in January, shipments are now precariously slated to begin in Q2.

Whether this delay imposes a degree of upwards pressure on pricing remains to be seen, though it may factor into March’s Tampa settlement between Yara and Mosaic, the latter of which will receive spot tonnes from Qatar later this month.

Global price indexes are expected to remain steady to soft, with the first transparent deals of the month likely to provide a clearer indication of price direction.