Some Useful Acronyms: SMP (Skimmed Milk Powder), FFMP (Full Fat Milk Powder), WMP (Whole Milk Powder), EEX (European Energy Exchange), NZX (New Zealand Exchange), CME (US Exchange), MSCI (Morgan Stanley Capital International), EM (Emerging Markets).

- SMP is at an interesting level relative to oil pricing and spreads may not fully reflect current fundamentals.

- Supply opportunities for European FFMP will depend on the sustained economic recovery in Emerging Markets and could cap WMP pricing from Oceania.

- With WMP upside capped but SMP production risky, Oceania have a tricky product-mix decision to make. As a saving grace, India may need to import in Q4.

Here’s five charts you should be watching to monitor these dynamics.

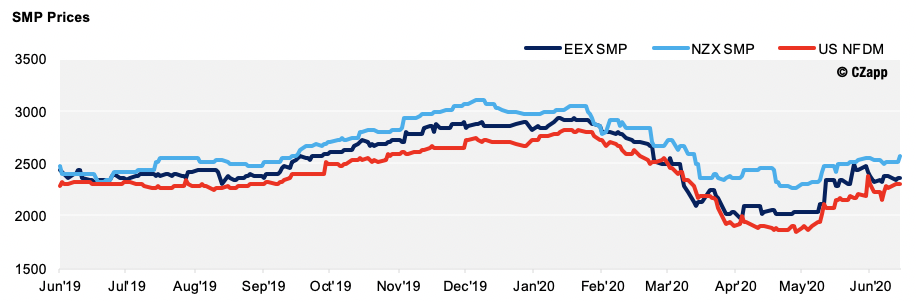

Cross Market Spreads

- The US has recently had issues exporting SMP, largely due to supply chain disruptions resulting from COVID-19.

- This caused New Zealand and European SMP vs. US SMP price spreads to expand earlier in June (above the 75th percentile).

- These spreads are much more normal now. However, given US inventories are high and growing, this could lead to spreads widening again in the near term.

- Once US supply chain issues are resolved and product exports increase as anticipated, we could see spreads return to more normal levels.

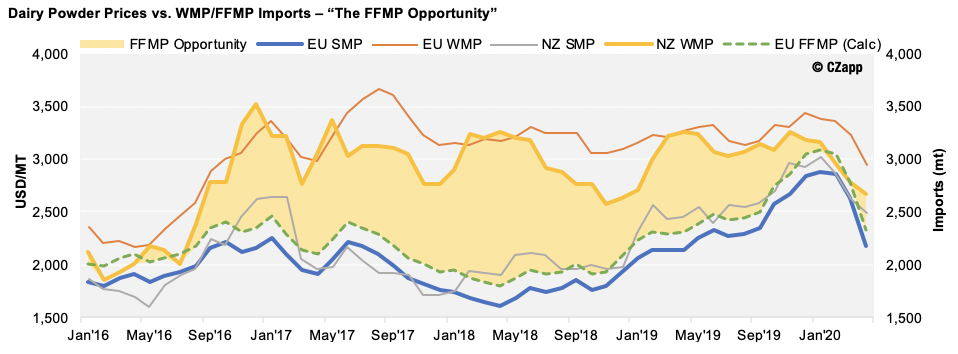

FFMP vs. WMP

- From a supply perspective, SMP and FFMP are substitutes.

- But from the demand side, some buyers use FFMP as a substitute for WMP. Thus the pricing interplay between EU FFMP and NZ WMP also drives the FFMP production decisions.

- NZ WMP was cheaper to buy than EU FFMP for two months at the start of 2020 for the first time in years, closing ‘the FFMP opportunity’ as discussed here.

- FFMP pricing has since fallen faster than NZ WMP pricing and caused this opportunity to widen again rapidly.

- This will support the SMP/Butter stream in Europe, as it provides a valuable outlet for any excess SMP there. This will be even more valuable to European processors if US NFDM starts hitting the market in size and weighs on the global SMP complex.

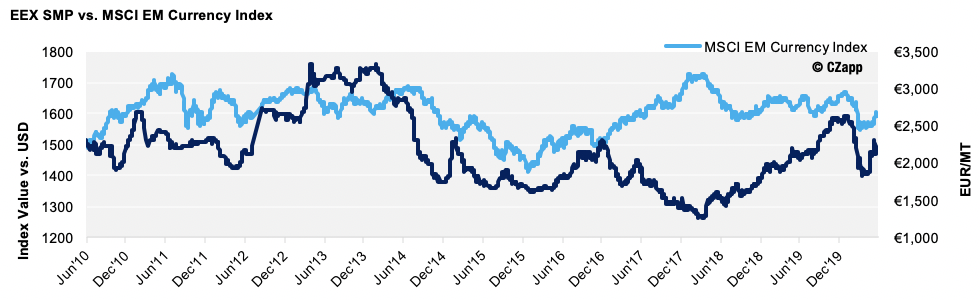

Emerging Market FX

- As we discussed last month, Emerging Markets (EM) make up a large proportion of dairy powder demand.

- Given that most major commodities trade in USD or EUR, access to these currencies and relative strength against them plays a key role in whether EM’s can purchase and the magnitude of their buying.

- After falling as a bloc in late February, we have seen EM currencies generally strengthen over the past three weeks. If this recent strength holds, it should continue to support pricing of dairy powders; being price sensitive, this will also drive convergence between the three markets.

- This is obviously a big “if”, with many commentators believing that markets will be most impacted after Government stimulus packages in more developed markets stop…

Oil Prices

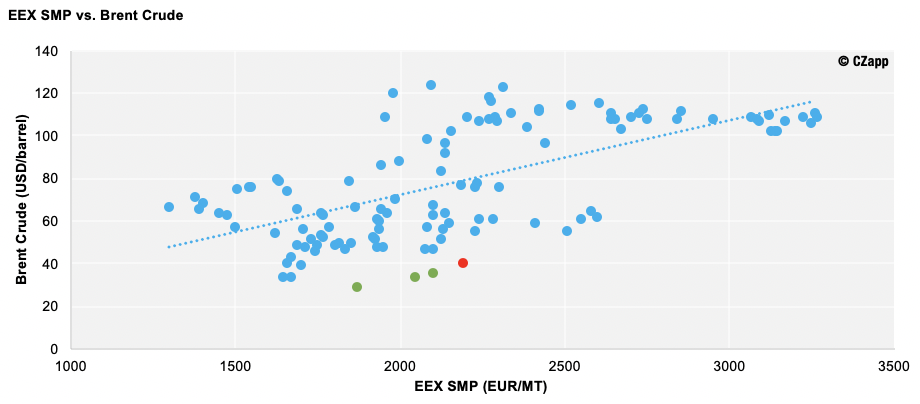

- As discussed in this article, EEX SMP prices and Brent Crude Oil prices are correlated.

- If we compare current prices of both to their trend, you might say that current levels are arguably outliers. The red point below represents June 2020, and three green points represent the three months prior.

- Though oil prices have been on the rise, further gains may be required to justify SMP pricing at current/recent levels…

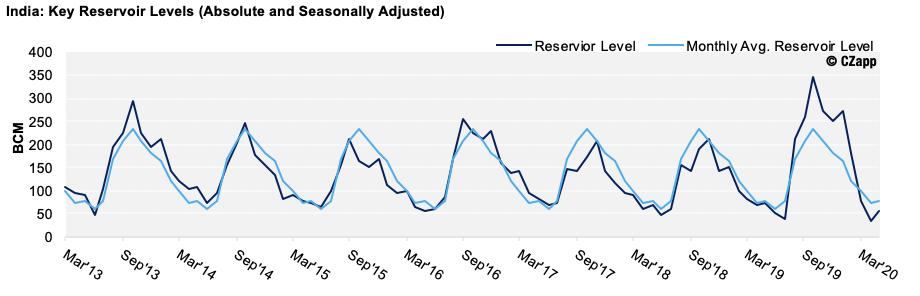

Key Indian Reservoir Levels

- As discussed in this article, there’s a relationship between water reservoir levels in India and Indian SMP trade eight months later.

- Aug’19 to Feb’20 had reservoirs at extremely full levels, but since March these have dropped to well below average.

- Every time this has happened over the past seven years, India has had to import SMP. The question this time is whether the extreme wet period preceding this enabled a buffer stock to be built (however, too much rain can also inhibit dairy production).

- The focus period will be Q4, which matches both the NZ seasonal peak and Chinese seasonal buying, so should at least support SMP pricing over this period.