Insight Focus

- Dry bulk prices depend on factors such as grains flows and industrial production.

- Geopolitical and weather issues in the Red Sea and Panama Canal will also have an influence.

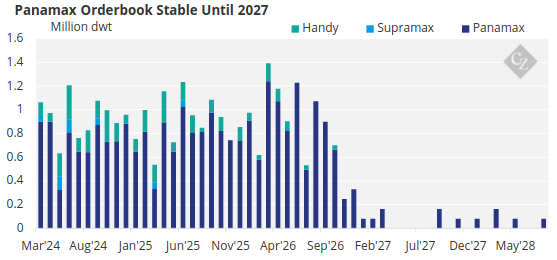

- Supply plays a part too given the robust orderbook for Panamax vessels.

While container prices depend on consumer supply and demand, dry bulk works with different fundamentals. There is some crossover, including global congestion, but dry bulk prices tend to fluctuate alongside oil prices and industrial demand.

We take a look at five of the main factors likely to impact dry bulk dynamics this year.

1. Industrial Demand

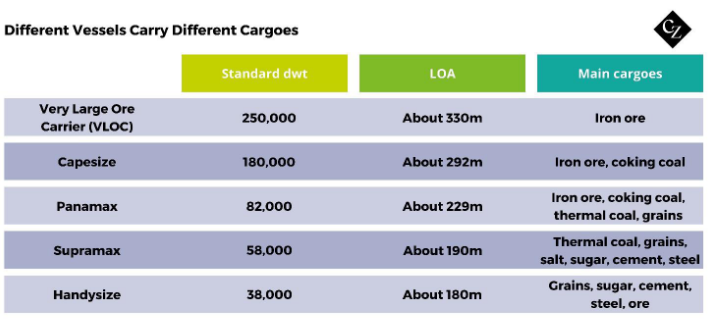

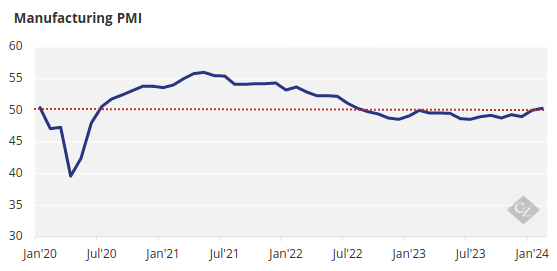

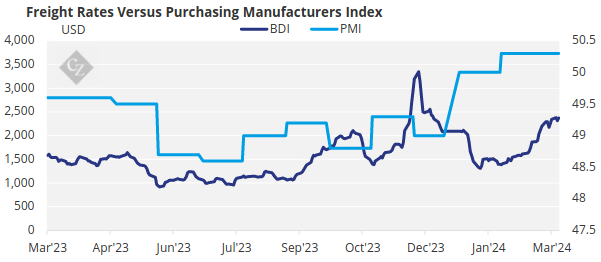

Dry bulk vessels tend to transport bulk, loose commodities, such as iron ore and coal. This means that industrial and manufacturing activity has a huge impact on pricing. When manufacturing activity is high, demand for materials – transported in dry bulk – is high. This pushes up freight prices.

So far in 2023, industrial activity has remained muted. S&P Global’s manufacturing index has remained below the baseline level of 50, which indicates growth or contraction.

Source: S&P Global

In February, global PMI rose above 50 for the first time in 18 months.

Source: S&P Global, Baltic Exchange

2. Higher Container Rates

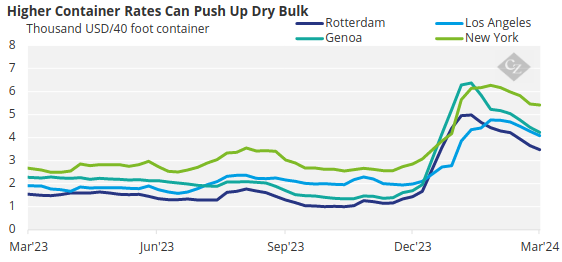

Container demand can in some instances push up dry bulk prices. This was apparent during the pandemic year of 2021 and 2022, when container rates skyrocketed. At this point, those import-export companies that could switch between containers and dry bulk began to send goods in bulk vessels, increasing demand.

Source: Drewry

Note: All routes loading from Shanghai

Container rates are currently elevated due to blockages in the Red Sea. Dry bulk rates were also initially impacted and, after a period of normalisation over Christmas and Lunar New Year, they have started to climb again.

As companies get used to navigating the Red Sea issues, freight and container prices should both stabilise. However, delays caused by re-routing vessels around the Cape of Good Hope will reduce availability, pushing up prices.

Source: AXS Marine

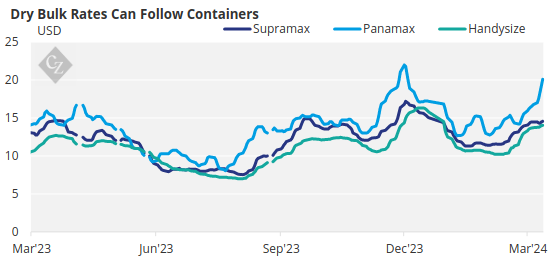

3. Global Congestion

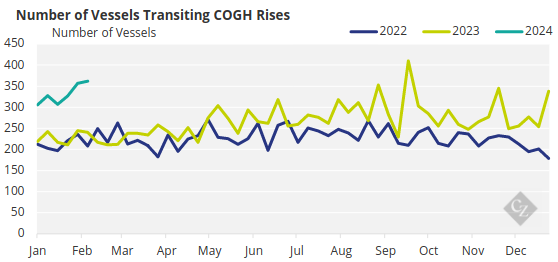

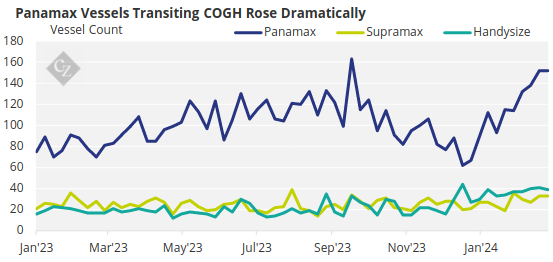

Global congestion will be a huge theme this year thanks to Red Sea issues combined with low water levels in the Panama Canal. This means diversions are necessary, pushing up tonne-mile demand.

Source: AXS Marine

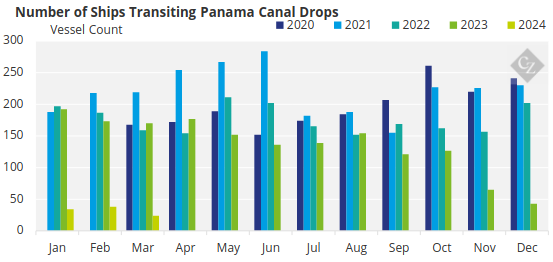

There have been fewer Panamax, Supramax and Handysize vessels transiting the Panama Canal since the final quarter of 2023. In December, January and February, crossings were unseasonably low.

Source: AXS Marine

Note: Panamax, Supramax and Handysize ships only

This would indicate that shippers are seeking alternatives to using the Panama Canal. This would often increase time and cost burdens, which are likely to be reflected in freight costs.

4. Grains Seasons

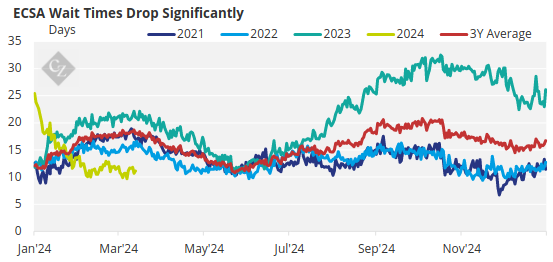

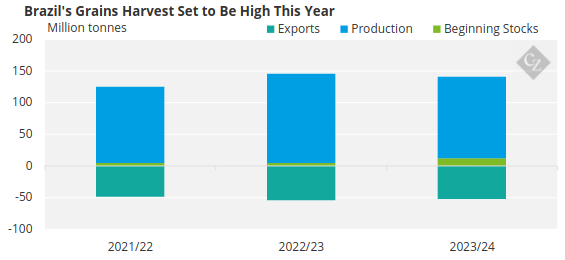

East Coast South American ports were extremely congested at the end of 2023, mainly due to poor logistics. In Brazil in particular, there have been struggles with port capacity due to huge grains and sugar harvests.

Entering 2024, this port congestion was alleviated and wait times are now well below the three-year average.

Source: AXS Marine

Note: Panamax, Supramax and Handysize ships only

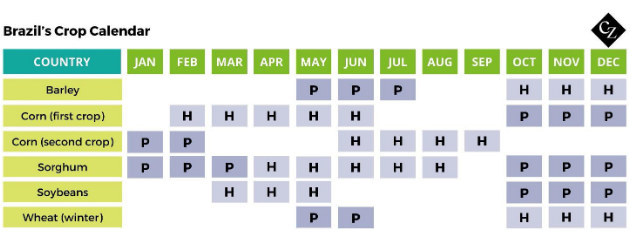

However, the new corn and soybean season is right around the corner. Between the first and second crops, the corn harvest should last from now until October, while soybeans are harvested until about June.

This year, huge corn and soybean production is expected from Brazil. The USDA projects exports will reach 52 million tonnes in the 2023/24 season.

Source: USDA

5. New Builds and Scrappages

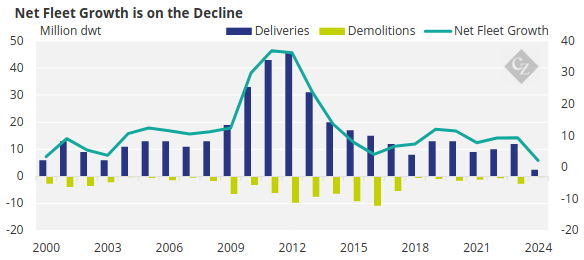

Freight prices are always influenced by supply and demand. While we have looked at a lot of demand dynamics, supply is also important. The fleet of Panamax, Supramax and Handysize vessels hasn’t grown much over the past decade or so.

Source: AXS Marine

Note: Panamax, Supramax and Handysize ships only

There are more orders pending delivery later in the year, which will increase availability, potentially suppressing freight prices.

Source: AXS Marine

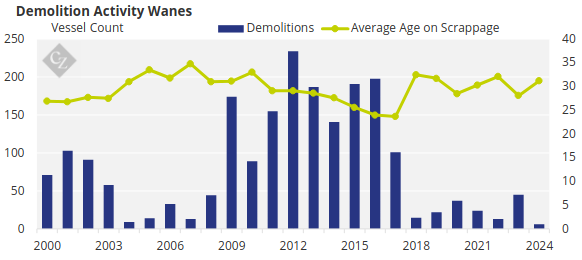

But vessels are getting older, and after years or putting off demolition, ship owners may be forced to scrap some ships soon. At an average of 31.2 years old on scrappage, shipowners are trying to push demolition back as long as possible for Panamax, Supramax and Handysize vessels.

Source: AXS Marine

Note: Panamax, Supramax and Handysize ships only

This could eventually lead to a flurry of demolitions as the fleet ages.

Concluding Thoughts

- Freight rates will likely gain support this year from lower availability due to global chokepoints and the resulting higher tonne-mile demand.

- Red Sea and Panama Canal issues will probably continue for most of the year.

- The upcoming bumper grains harvest on the South American East Coast should increase demand for Panamax vessels.

- Despite a robust orderbook, the fleet is ageing, and many vessels will need to be scrapped soon, balancing out availability.