Insight Focus

Soybean and corn futures have reacted sharply to heavy rainfall in Rio Grande do Sul.

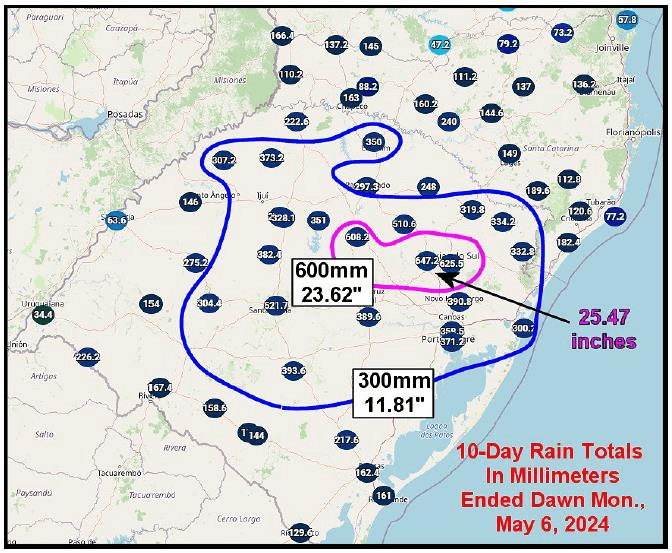

Over 11.8 Inches of Rain in 10 Days

The rains began on April 27th, and by May 6th, according to the World Weather climate consultancy, much of the state already had accumulated at least 11.8 inches during the period, with many regions recording volumes around 23.62 inches.

Source: World Weather

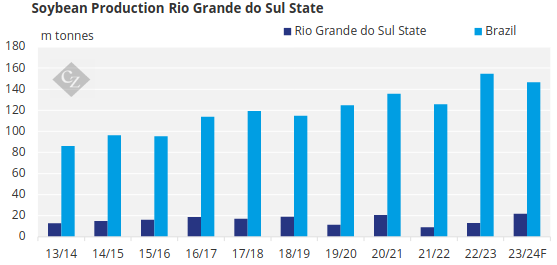

Hope for a New Record Crushed

Rio Grande do Sul is a crucial component in the Brazilian agricultural system, and in this season (23/24), according to a report by CONAB published in May, it should account for 4.6% (5.13m metric tonnes) of the national corn crop and 14.9% of soybean crop, equivalent to 21.9m tonnes.

Source: CONAB

The state has experienced losses due to weather conditions in 3 out of the last 4 seasons, all due to droughts. For 23/24, with the occurrence of El Niño, stakeholders in the supply chain were excited about the prospect of a record soybean production. However, excessive rains came, causing delays during both soybean and summer corn planting.

The News Boosts Quotes in Chicago

At the CME, quotes, previously under pressure due to the ample global supply and a more pessimistic demand outlook for both crops, reacted immediately, driving the prices of the soybean’s futures front month from USD 11.45/bu on April 30 to a peak of USD 12.40/bu on May 7 (+8.3%), while corn rose from USD 4.38 to 4.59/bu (+4.8%).

Source: CME

After the initial impact, some of the gains from recent days are being reversed, with the market entering a waiting period, anticipating the USDA reports on Friday (10th) and the CONAB report on the 14th, which are unlikely to fully account for the losses incurred from the disaster.

The Impact on Production

Initially, there’s talk of a losses up to 3m tonnes in soybean crops, which, according to CONAB, were 75% harvested as of May 6th, while in corn, with 83% of the harvest completed, the reduction is expected to be much smaller. However, we must not forget that the entire logistical structure is compromised, including submerged silos. Moreover, the conclusion of the field work is now significantly hindered by technical problems, ranging from remaining mud preventing the entry of harvesters into the fields to machinery damaged by the floods.

According to World Weather, although the excessive rain ended a few days ago, there is a high chance of new, more moderate precipitation for the next week, and the wave of significant rains may persist for at least another 10 days.

With entire cities practically submerged, the problem extends far beyond the agricultural economy, regions are expected to take months, and in some cases years, to recover. With the entire population focused on humanitarian causes, more precise and reliable estimates are likely to take time to be released.

Nevertheless, some of the losses in corn and soybean crops in Rio Grande do Sul are expected to be offset by other states, with some arguing that their estimates are underestimated by CONAB. In the global context, projections for final stocks remain high, which should keep the market in a trend of lower prices.