This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

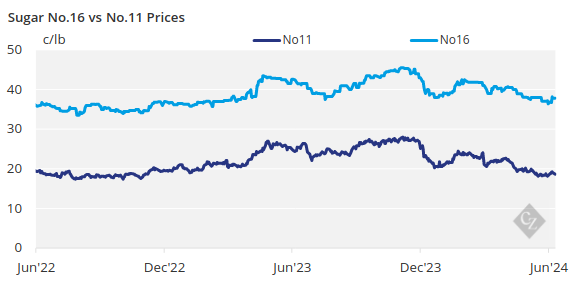

US sugar prices held steady this week as sales continued to progress. Buyers are confident that prices will remain sluggish, indicated by a lack of coverage for next year. But there are some signals that fundamentals could worsen, particularly due to drought in Florida.

Sales Steady, Prices Hold

Bulk refined sugar sales continued at a steady pace for 2024-25 in the week ended June 7. Prices were unchanged after recent weakness. Sugar beet crops were developing well, while drought in Florida cane areas was worsening.

One beet processor remained out of the 2024-25 market with most products through September, but other processors continued to sell. The sales pace seems slow compared with last year when most forward sales were completed in March and April, but it is much more typical of years past when sales progressed until the end of the crop year in September.

Forward prices were unchanged after being dropped earlier in May. Beet sugar could be bought below 50¢/lb FOB Midwest, and refined cane sugar was offered below 60¢/lb FOB Northeast and West Coast and slightly above the mid-50¢/lb area in the Gulf and Southeast. Spot sugar values were modestly above forward prices.

Buyers Reluctant to Cover

Input gathered from sugar buyers at the Sosland Purchasing Seminar that concluded June 4 indicated a wide range of coverage. Some buyers had yet to put any coverage on for 2025, and one seller noted a few buyers still have October-December 2024 to cover.

Most had some level of coverage for next year but were in no hurry to complete the process amid a lack of signals suggesting a significant rise in prices, even though there are risks such as hurricanes and dryness in Florida and Mexico. At the same time, there also is little to suggest prices will drop further from current levels. With limited downside and a bit more upside price potential, sellers were urging buyers to at least put on some coverage or add to existing coverage for 2025.

Florida Drought Could Cause Issues

Sugar beet crops were planted early, especially compared with a year ago, and most had high condition ratings heading into the summer. A better read on sugar beet planted area, which was indicated lower from 2023 in the March USDA Prospective Plantings report, will become known after the USDA’s Acreage report set for release June 28.

Sugar cane crops also were doing well, but ratings have declined over the past two weeks in Louisiana and were the lowest since 2018. In Florida, which doesn’t issue crop ratings, there were concerns about worsening drought conditions with 26% of cane area in severe drought and 74% in moderate drought, per the USDA’s analysis of the June 4 US Drought Monitor. Meteorologist Drew Lerner at the Sosland Purchasing Seminar said he expects the Florida drought to worsen as the season progresses.

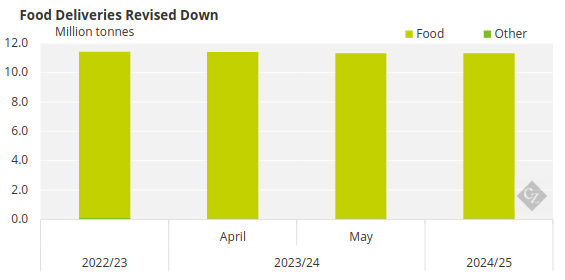

Sugar deliveries for 2024 appear to be keeping their improved pace from earlier in the year. Some processors reported strong shipments in April that continued into May, although certain sectors were better than others. Many processors had some extra sugar to sell from slow deliveries in the first half of the marketing year and thus remained in the spot market.

Even though the USDA lowered its forecast of US sugar deliveries for food by 100,000 short tons (90,718 tonnes) in May, some in the trade believe deliveries should be even lower.

Source: USDA

The corn sweetener market was quiet.