Opinion Focus

- With freight prices coming down across the board, there seems to be more supply than demand.

- But appearances can be deceiving as the world’s fleet continues to age and new vessel orders remain low.

- The price of freight in the future will depend on continued service availability.

Vessel numbers are growing, especially after the rush to place orders during the freight price highs of 2021 and early 2022. Now, as rates decline, there is concern that a new wave of inventory could collapse prices entirely. But other factors, such as IMO regulations, the preference for bigger ships and a reluctance in recent years to scrap ships could be creating more vulnerability in the shipping industry.

Current Fleet Continues to Grow

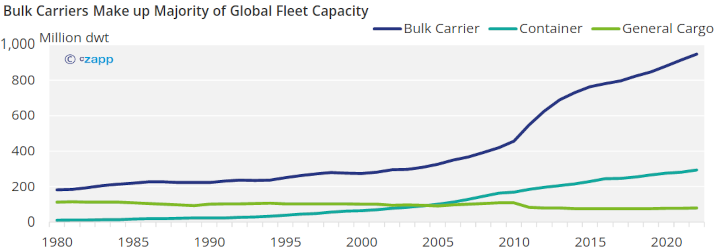

Bulk carriers represent a substantial part of the global shipping fleet. Since 2010, capacity has risen at a dramatic rate to reach almost 1 billion dwt. While container capacity has also grown, it has been at a much more modest rate.

Source: UNCTAD

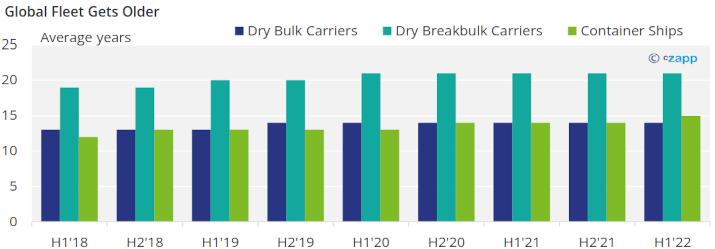

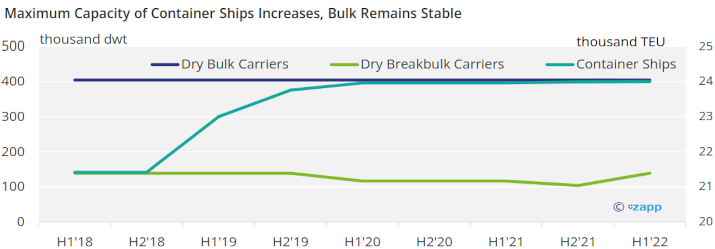

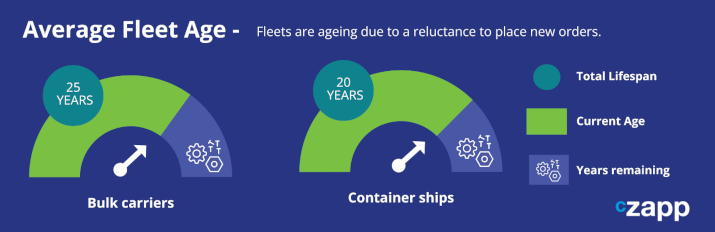

The fleet has been rising mainly as a result of ships lasting longer. As a result, the global fleet is getting older. As of the second half of 2022, dry bulk carriers are on average 14 years old, up from 13 years old in the first half of 2018.

Source: UNCTAD

In the same period, dry breakbulk carriers have aged about two years to an average of 21 years, while container ships have aged by three years to reach an average of 15.

New Orders Plateau

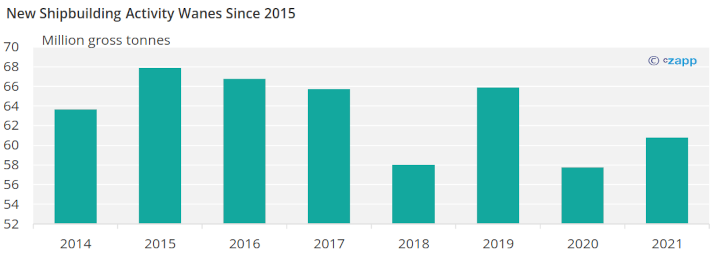

In the meantime, there has been a dearth of new shipbuilding activity. Covid-19 played a role in slower shipbuilding in 2020, but even in 2021, levels were nowhere close to 2015 highs.

Source: UNCTAD

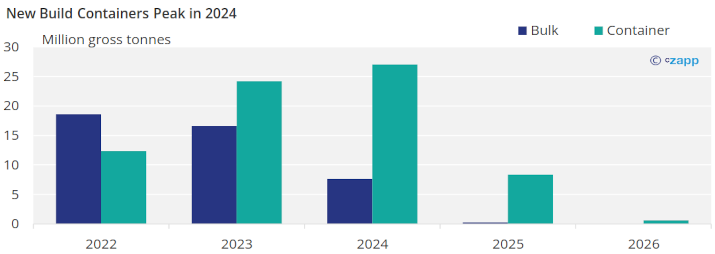

Approaching 2024, new shipbuilding activity is set to pick up, with a focus on containers. This surge was likely caused by the high freight prices in 2021 given that container vessels generally take three years to complete.

Note: 2025 and 2026 numbers likely to move higher as more orders received in 2022 and 2023

Source: IMO GISIS

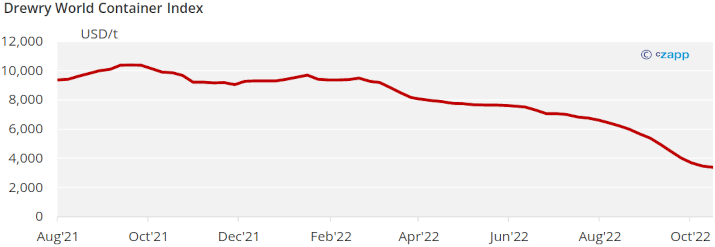

But now that a recession is looming, the container freight price is dropping fast. There are concerns that this new supply will saturate the market, weighing even more heavily on prices.

Source: Drewry

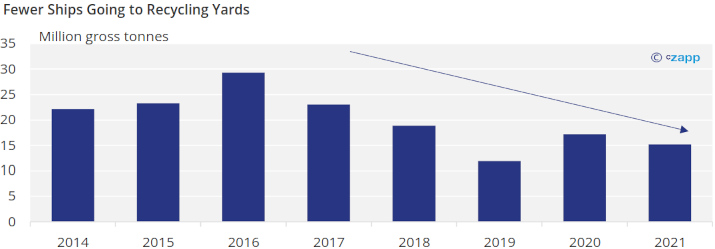

Scrappage Rates Remain Low

To add to the pressure, less capacity than normal has been scrapped in the past four years. This is very likely due to new IMO regulations, with shipowners trying to extend the lifecycle of vessels as long as possible before having to purchase costly new ships.

Source: UNCTAD

Bigger, Older Ships Pose Greater Risk

But container ships have gradually been getting bigger, meaning that scrapping just one ship today removes far more capacity than it did 10 years ago.

Source: UNCTAD

If there is a flurry of scrappages this could result in the removal of a significant amount of capacity. This issue is compounded by the fact that the bulk carrier and container fleet is approaching the end of its useful lifespan.

Looking Ahead

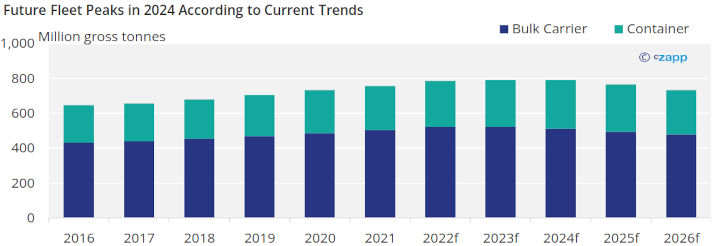

Based on current orders and historical scrap rates, the global fleet size is expected to peak in 2024, before subsequently declining. As demand softens, this also indicates a drop in freight rates to 2024.

Note: Projections calculated using historic five-year average scrap rates, current confirmed new vessel orders

Source: UNCTAD

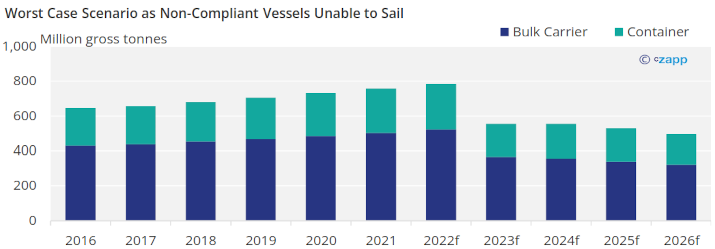

That being said, the current projections do not account for additional orders for ships in 2025 and 2026, nor does it account for new regulations that could result in 30% of the global fleet becoming non-compliant.

Depending on the scale of the impact and how quickly the vessels can become compliant again, the worst-case scenario could take a much greater amount of capacity from the market.

Note: Projections calculated using historic five-year average scrap rates, current confirmed new vessel orders, assumed 30% reduction in fleet due to non-compliance

Source: UNCTAD, Czapp projections

In this scenario, the decline in availability could coincide with a rebound in demand, creating another dramatic increase in freight prices.

If you’d like to know more about how Cz can help you manage your freight volatility, please contact Rosi Koleva on rkoleva@czarnikow.com.