Bulk Shipments

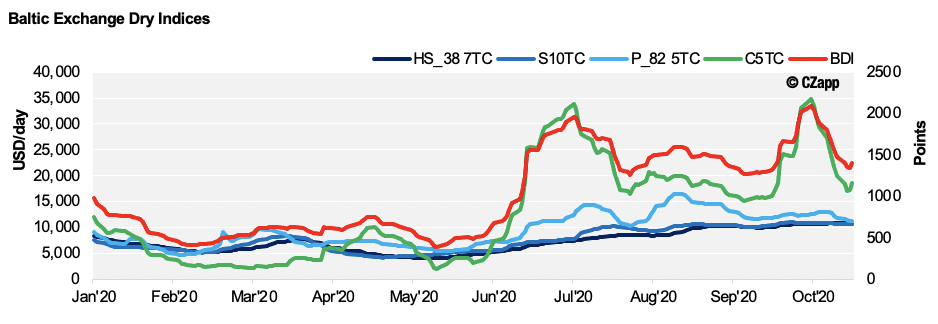

The Baltic Dry Index (BDI) settled at 1401pts on 22nd October, down 1.75% from our last update.

This comes as a volatile Cape market sent the BDI spinning over the last month, with the index trading in a +750pt range during a period that was also marked by a new 2020 high when it settled at 2097pts on the 6th October.

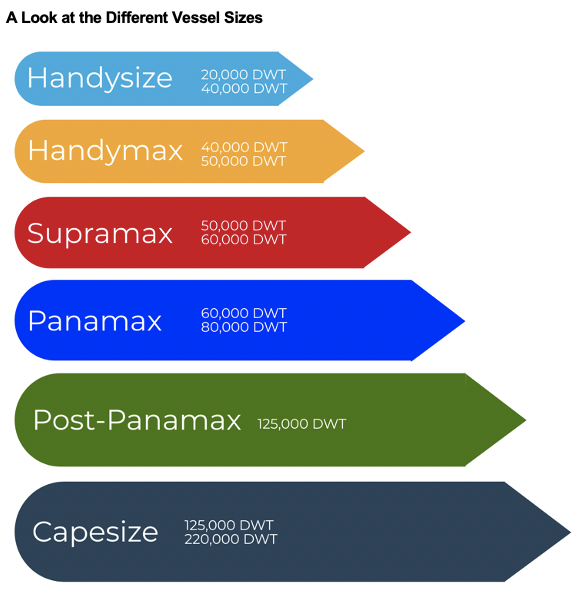

With the Cape 5TC fast retreating from the heady heights of $35,000 per day, this new direction has not trickled down into the smaller sizes, which have remained relatively stable by comparison. Average rates for both Handies and Supras are currently in the high 10s, with rates in both the Atlantic and Pacific basins well supported.

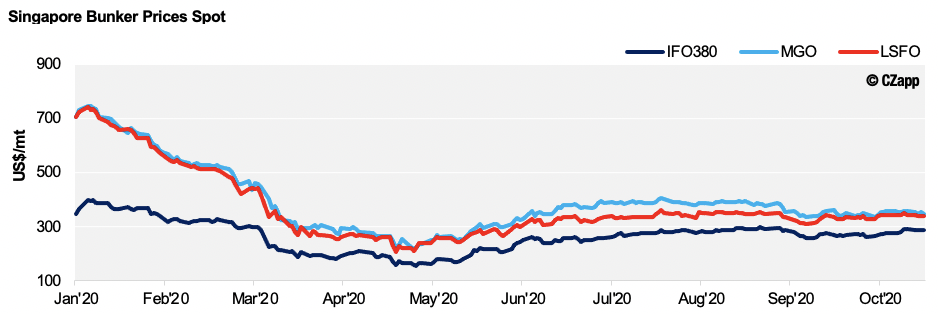

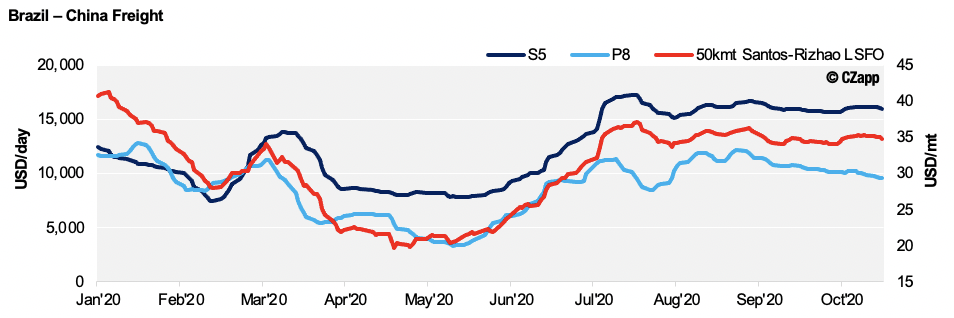

This, coupled with steady Singapore Low-Sulfur Fuel and Marine Gas Oil prices, means there is little change to report on our Santos/Rizhao 50kmt route assessment, although the Brazil-China P8 Panamax route has fallen back below the psychological 30 USD/mt price point, following some weaker prices for the larger vessels in the Atlantic basin.

Containerised Shipments

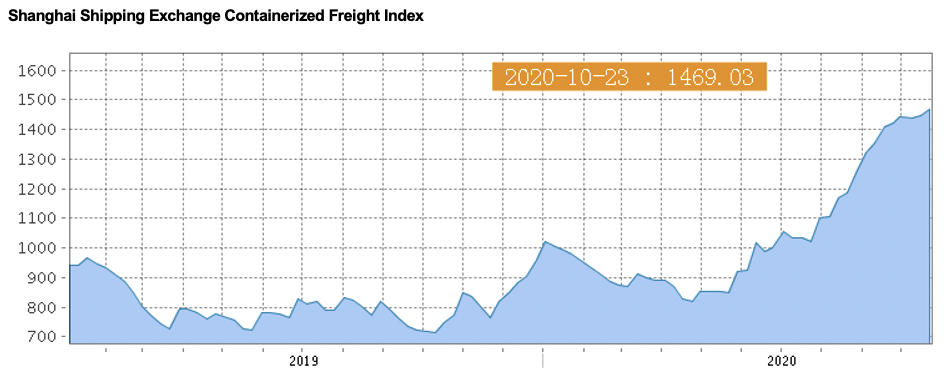

The SCFI has continued to climb as carriers manage capacity and global container demand remains high.

Even during what would usually be a quieter period, over China’s Golden Week, vessels ran full and rates remained strong. With most Christmas cargo now on the water, rates would usually fall in the coming weeks (in normal conditions). However, this year has defied the usual seasonal fluctuations on too many occasions to count.

As a second wave of COVID-19 braces many regions, much uncertainty remains around whether increased lockdown measures will have an impact on demand, particularly as stock levels increase.

With some shippers’ contract rates nearing expiry, they have been put in a difficult position, given the current environment is far from ideal for 2021 contract discussions. This has led to many shippers reverting to short-term contracts until the future outlook for the market is clearer.

As rates increase, shippers face further frustration as service levels drop across most lanes. Key ports and transhipment hubs, such as Colombo and Durban, are experiencing high levels of congestion resulting in rollovers and extensive delays. Some ports such as Dar es Salaam are seeing over seven day waits to berth, leading some vessels to skip the port call altogether. This in turn is having a knock-on effect as carriers struggle to reposition containers to meet demand. One example being India, where equipment and space shortages are driving up rates.

Planning remains key as shippers are advised to provide forecasts to shipping lines as far in advance as possible in an effort to secure both space and equipment.

Other Opinions You Might Be Interested In…