- The freight market’s have reached a 13-year high in 2021.

- However, the markets have become increasingly volatile in recent weeks.

- Is a massive correction imminent?

Volatility in the Freight Markets

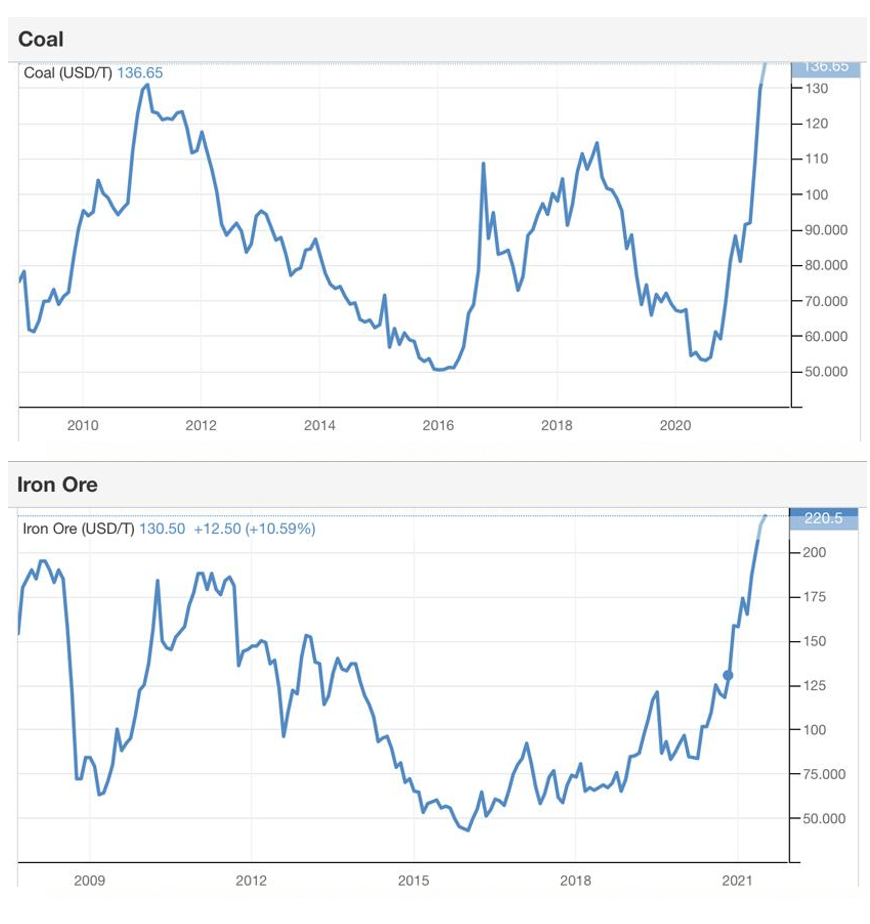

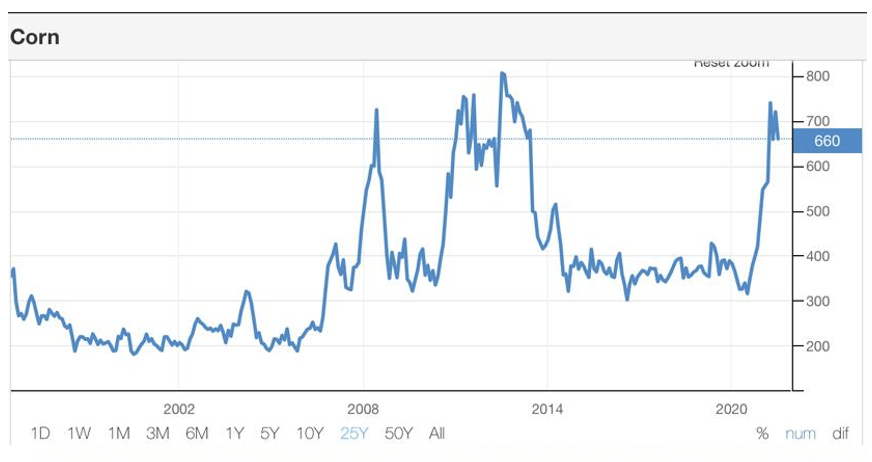

The freight markets rise over 2021 is in step with a synchronised boom in almost every major seaborne commodity.

In recent weeks, the market has become increasingly volatile in the short term as participants grapple with the longer term decisions they face.

In a market that’s trading at levels not seen since the mid 2000’s mega boom, is this fair value and will the future be more of the same, or is a massive correction imminent?

Technical analysts will recognise a triangle pattern as trendlines converge due to price action moving sideways.

This pattern usually leads to a break out and a formation of a new trend.

This sideways movement usually contains spikes of sentiment, positive and negative, as the market oscillates (sometimes erratically), trying to make up its mind about what it thinks will come next.

For those of us in the unenviable position of having to manage supply chains and make planning decisions, such as buying raw materials and locking in transportation costs, perhaps some longer term perspective is helpful.

Today, almost every major commodity is experiencing either all time highs (iron ore), decade highs (coal) or multi-year highs (corn).

Any free market economist will explain that prices rise when demand outstrips supply. The reason prices rise is to ration demand. The cure for high commodity prices are therefore high prices.

As a derived and necessary evil in this activity, Sea Freight demand rises as commodities move from their origin to destination.

The greater the demand and the further this supply pipeline gets stretched, the higher the freight price, as this service also gets rationed.

In a rational world, we could therefore expect that multi-year highs, decade highs or historical prices cannot persist, but the world in 2021 is probably many things but ‘normal’ or ‘rational’.

If the demand were purely private sector and prices continued to rise, we could fairly expect imminent rationing, substitution or delays of timelines around consumption. However, when the demand is driven by central authority stimulus agenda, then perhaps our timelines or rationality will be distorted for other ends.

Last week Reuters News Agency reported:

China will cut the amount of cash that banks must hold as reserves, releasing around 1 trillion yuan ($154.19 billion) in long-term liquidity to underpin its post-COVID economic recovery that is starting to lose momentum.

The People’s Bank of China (PBOC) said on its website it would cut the reserve requirement ratio (RRR) for all banks by 50 basis points (bps), effective from July 15.

The world’s second-largest economy has largely rebounded to its pre-pandemic growth levels, driven by a surprisingly resilient export sector. But growth is losing steam and smaller firms are bearing the brunt of a recent surge in raw material prices. It was already signalled to some extent because we had seen some tightening in Chinese money markets, and this is basically to alleviate these pressures.

If those managing the world’s second-largest economy deem it necessary to assist their constituent businesses in dealing with rising raw materials costs by easing the cost of money, those of us managing decisions around commodity and transportation purchases should be on notice that higher prices and demand are here to stay for some time yet.

Other Opinions You May Be Interested In…

Explainers You May Be Interested In…