Insight Focus

- China is a massive global economy and a key engine in global trade.

- After strict lockdown measures were eased, the country has failed to experience a significant jump in demand as was expected.

- If consumption continues to lag, this has negative implications for freight and commodity markets.

China Faces Unique Growth Challenges

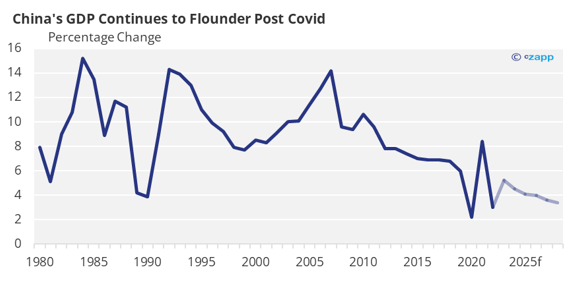

China’s growth continues to lag in the wake of the Covidpandemic and the country’s harsh lockdowns.

Source: IMF

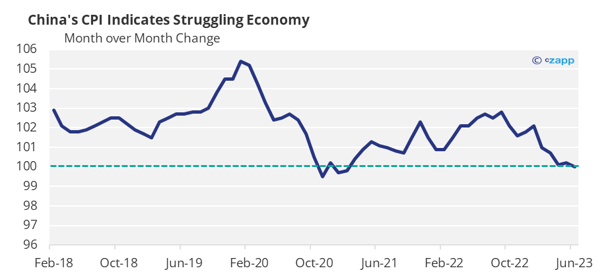

As the Eurozone, the UK and the US try to contain rampant inflation, China has the opposite issue. Data shows that the Chinese economy is entering deflationary territory, indicating weakness.

Source: China National Bureau of Statistics

Inflation is caused by consumption that outpaces supply. Conversely, deflation in China means there is lower consumer appetite than available products.

Stimulus Lacks Teeth

There is increasing speculation that the government will inject monetary stimulus into the economy. But how effective will that be?

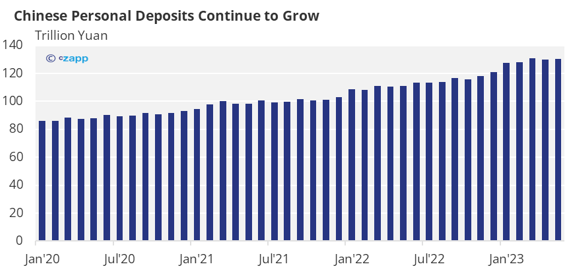

It seems that the Chinese population is now more inclined to save rather than spend, with an almost 50% increase in savings since May 2020.

Source: People’s Bank of China

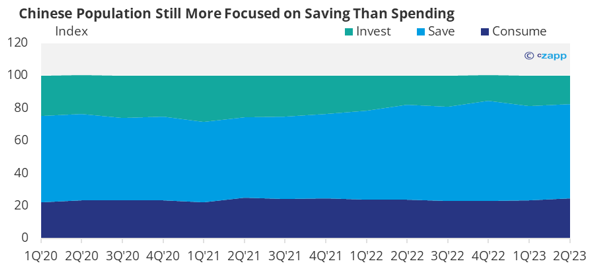

And the data from PBOC’s Urban Depositor Survey shows that there was no large uptick in willingness to consume coinciding with the end of lockdowns. Instead, the Chinese population is much more focused on saving.

Source: People’s Bank of China

International Market Depends on China

In the absence of strong local demand, China is therefore likely to remain an export-focused economy, which has implications for commodity markets.

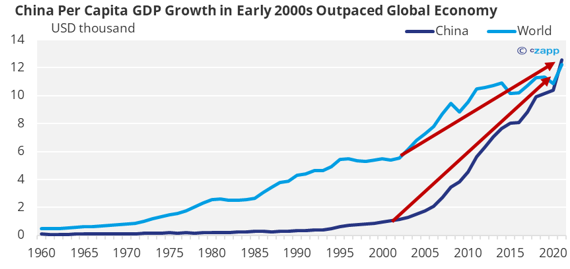

China happens to be a massive consumer of global goods. Per capita GDP growth has outpaced the rest of the world since 2000.

Source: World Bank

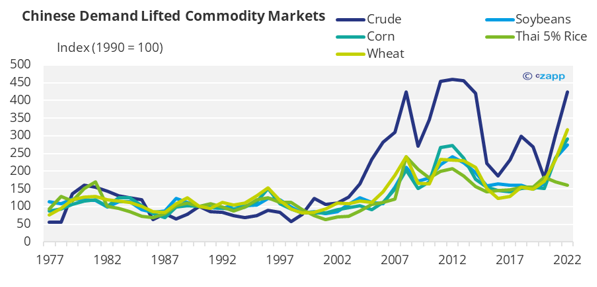

This purchasing power has huge impacts on the global economy. In fact, China almost single handedly created a commodity boom in the early 2000s due to this growth.

Source: World Bank

You can read more about China’s impact on global markets here.

A Boon for Freight Markets?

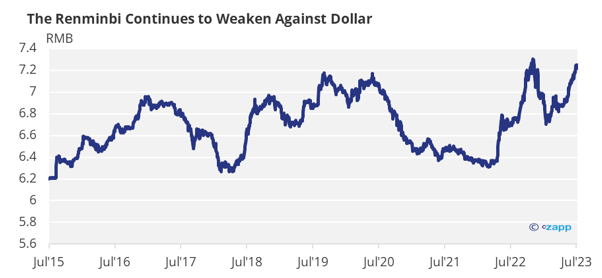

The Renminbi is now at over seven to the dollar. A weaker domestic currency means it is more beneficial to export than sell domestically in China since goods will achieve a higher price in USD.

Source: US Federal Reserve Bank

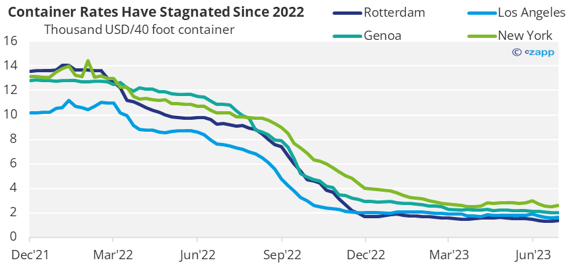

Freight markets have experienced a lackluster year in the wake of high lockdown-related demand. Higher exports from China could just be the boost that rates need.

Source: Drewry World Container Index

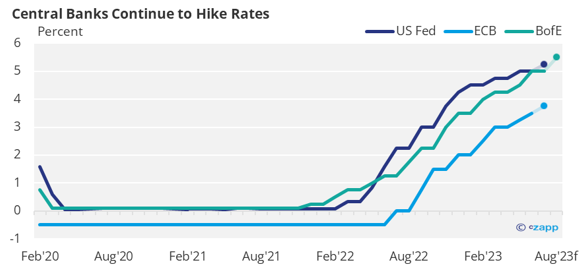

But outside of China, there is low demand due to rising interest rates.

Source: US Federal Reserve, European Central Bank, Bank of England

This means demand for Chinese exports is likely to dip in the coming months as many countries try to quell rising inflation.

If Chinese imports are lagging due to low demand in China, thisleads to less demand for commodities. If exports are also lagging, this will lead to lower prices for freight.

Concluding Thoughts

- Despite speculation, expectations are mixed for economic stimulus in China.

- Already measures such as lowering policy rates don’t seem to behaving much effect.

- According to Bank of America, the PBOC is considering a consumer voucher program to spur spending.

- More impactful measures are likely to be applied at the Politburo meeting at the end of July.

- If demand can be stimulated in China, this has positive implications for freight rates due to higher import demand.

- But if Chinese growth continues to lag, it is unlikely that there will be a peak season for containers.