Insight Focus

This year, high freight rates are creating headaches for tomato producers and processors, and they are even causing China to lose competitiveness. Despite being traditionally more expensive, Turkey and Spain could be the big winners in terms of European sales.

Freight Prices Rise

The freight market has seen historically high rate rises for several reasons, such as increased demand in western markets and low vessel availability.

The ongoing conflict in the Red Sea has forced shipping liners to travel down the horn of Africa, delaying transit time by 14+ days. This has resulted in low availability of containers, and a mismatch between demand and supply. This has exerted extreme upward pressure on freight prices to triple in some cases. With longer distances, there have been severe delays and increased costs for buyers on their goods.

This inevitably has a knock-on effect on the tomato paste industry due to its impact on pricing. This means there could be shifts in top importing countries for China, Turkey and Spain, given freight rates.

Global Production Rises

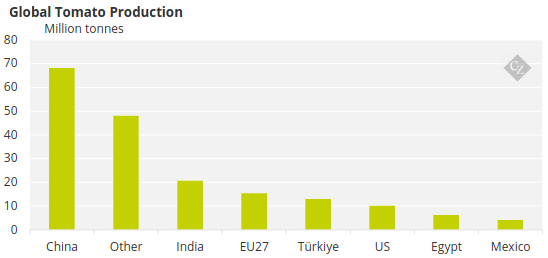

About 180 million tonnes of fresh tomatoes are produced globally each year, with 25% processed into products like paste, puree, pulp, ketchup, sauces and juices.

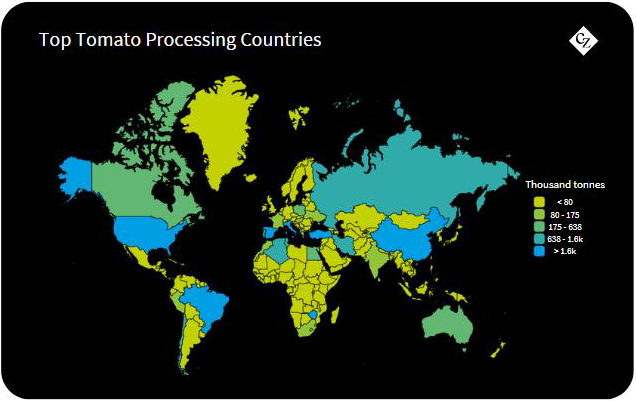

Most production occurs in temperate zones, primarily in the northern hemisphere, where 90% of processing happens in the second half of the year. The southern hemisphere processes the remaining 10% between January and June, except Brazil, which follows the northern hemisphere’s schedule.

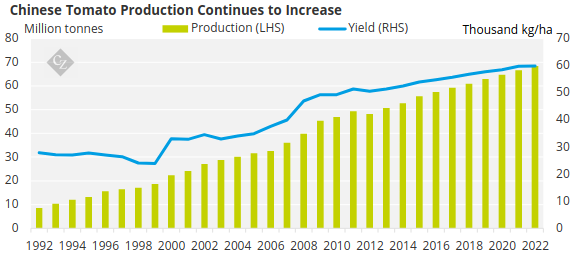

This year, global tomato paste production is expected to increase to approximately 47 million tonnes, a 6% rise from last year’s 44.4 million tonnes. This marks a historical high, largely driven by a 40% increase in Chinese production due to favourable weather and optimal growing regions.

Source: FAOSTAT

Increased production is supported by an increased demand for processed products. There is growing demand for canned, puree, and dried tomatoes in the food processing industry, which is driving market growth. The top producers of tomato paste are China, the US, Turkey, Italy, Iran, Spain and Italy.

Last year’s market faced high prices due to the low availability of products as many originations had poor crops. This year production increased in most originations pushing prices down compared to last year. Nonetheless with the increasing cost of freight across various routes, this poses a challenge to competitive pricing.

China Loses Competitiveness Due to Freight

As mentioned previously, Chinese tomato production has grown in the past year. This year, China’s fresh tomato production is on track to increase by approximately 3.5 million tonnes, from 8 million tonnes to 11.5 million tonnes. About 60% of its tomato paste is exported.

Source: FAOSTAT

Top processors in Inner Mongolia will also boost tomato paste volume, this year due to favourable weather conditions and smooth transplanting.

However, low availability of containers and high demand have driven freight rates to extremely high levels. These increased shipping costs are pushing up the final purchasing price of tomato products, undermining China’s competitive pricing, especially given the distance Chinese products need to travel.

Chinese pricing is typically one of the most competitive globally but due to freight increases, final sales prices this year will be similar to higher quality product out of competing exporting countries. As a result, we expect a decline in China’s exports, particularly to the European and UK market until freight rates drop to normal levels.

Turkey Exchange Rate Enhances Competitiveness

Turkey is well-positioned to sell effectively in Middle Eastern and some Asian buying markets given the lower freight and the zero duties. Turkish producers could also potentially sell into the European market, which has lower freight but tariff duties of 14-15%. With this in mind, Turkish tomatoes will be most competitive in the Middle East.

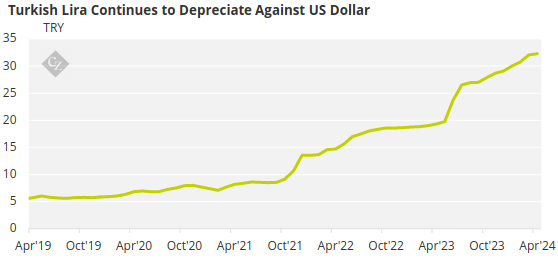

Additionally, the Turkish Lira depreciating against the US dollar has lowered the costs of production, enhancing its competitive edge.

Given the issues within the Red Sea, freight has increased for exports out of Gemlik (located on the sea of Marmara) to neighbouring countries, but these are still far less than China’s freight rates into Europe. And despite tariffs, exports from Gemlik to Europe would not have to travel through the conflict zone – unlike Chinese products.

This provides an opportunity for Turkish suppliers to gain market share, leveraging their lower production costs and comparatively lower freight rates to offer competitive pricing in the global market.

Spain Less Affected by Freight

Freight variations in Europe are less affected, given most tomato products production will stay on the continent or travel to closer destinations. This is why Spain is on track to be a valuable player in the market, supported by its promising upcoming crop and low-level freight rates. It will be interesting to see how many markets Spain will enter given this added competitive edge.

It is important to consider that due to Spain’s high quality, pricing of the products will be higher than that of China. However, due to the extra costs and risk associated with shipping from China, we may only expect to see small differences in the final sales price between Chinese and Spanish origin tomatoes in many high demand destinations.

Concluding Thoughts

- The issues with last year’s tomato crop have been overcome this year, particularly in China, which has increased production.

- However, we expect China to be less competitive in the European market, especially as freight prices continue to escalate.

- Turkey and Spain are on track to produce strong tomato processed products and will have to pay lower freight costs to key demand markets.

- Overall, the market is on track to be competitive, but external market factors are threatening prices for this year.