472 words / 3 minute reading time

Bulk Shipments

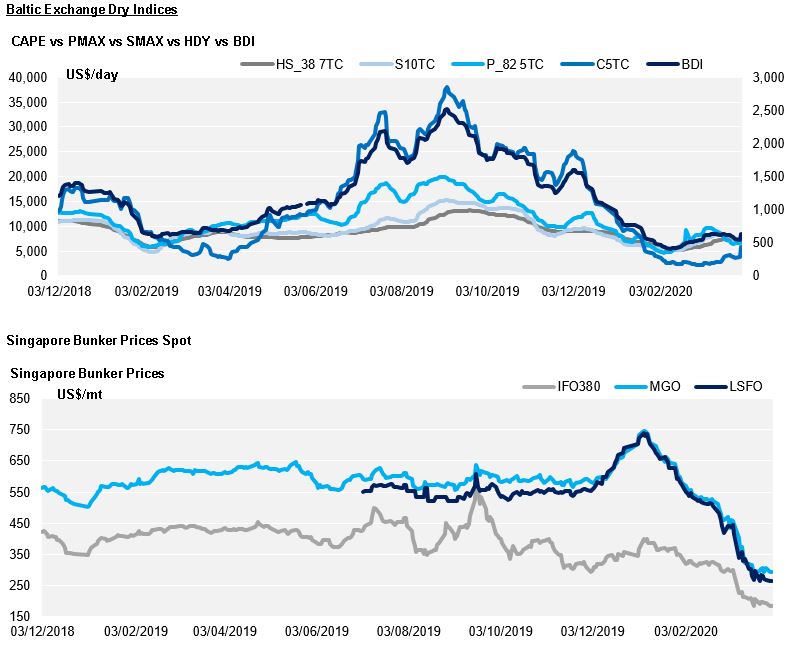

The Baltic Dry Bulk Index settled at 626pts on Mar 31st, closing out a dismal 1st quarter for the dry bulk sector with a rather positive 14% intraday gain. This was reportedly caused by a flurry ofchartering activity stemming from the miners, helping to pull the Capesize 5TCprice up by more than 55% on the last trading day of the month. Before this rally on the Capes, the BDI appeared to be under significant pressure with weak prices being reported on the smaller sizes that make up the index.

The negative sentiment which besets the physical market has also manifested itself in the futures market with the FFA forward curve for daily vessel prices coming under pressure. Supramax Q4-20 paper had been holding up at around $10,000 per day for most of this quarter. However, in recent weeks, it has fallen by almost 15% as the coronavirus pandemic tightens its grip on this market. This is despite the widespread introduction of quarantine controls, similar to those which were introduced on shipping for the containment of the Ebola virus, enabling most ports to remain open for business amid the numerous government-imposed lockdowns.

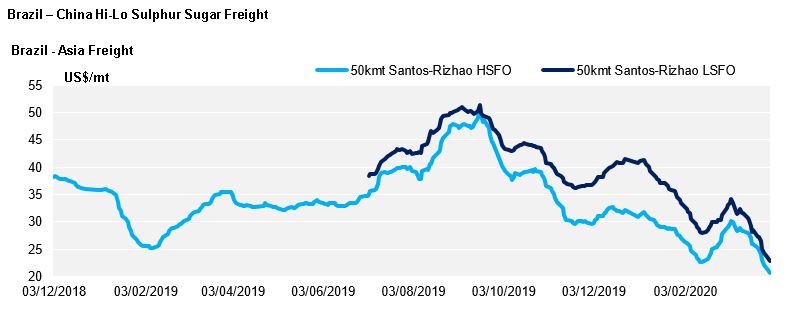

After the implosion of the OPEC+ arrangement and the ensuing price war between Saudi Arabia and Russia, we have seen crude and by association bunker prices tumble. The Hi-Lo Fuel Oil spread has now fallen well below $100pmt, reducing the scrubber premium on a typical 50kmt Brazil-China sugar charter to around $2pmt, assuming no constraints on the supply of HS Fuel to a vessel open in the South Atlantic. We await the outcome of President Trump’s intervention if at all.

Containerised Shipments

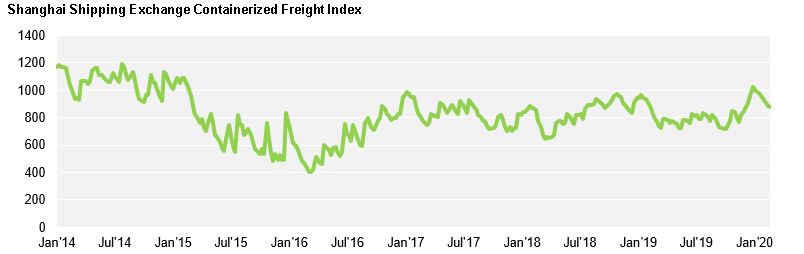

The SCFI has shown a week on week decline in rates of just under 1%. With many of China’s factories resuming operations in recent weeks, shipping lines sailing schedules were starting to return to normal after extended blank sailing programmes. A sharp increase in export demand out of China was anticipated in mid-April. However with the

COVID-19 pandemic spreading across many regions, global import demand is rapidly declining with significant levels of booking cancellations being seen for the coming weeks for exports out of China.

In response to this shipping lines have announced further blank sailings in an effort to restrict capacity and obtain rate stability.

Shanghai to Northern Europe has shown a 4.1% reduction in rates week on week however YOY rates are still up 17%.

There is much uncertainty surrounding the extent to which rates will recover in the coming weeks. With much depending on the extent to which capacity is restricted and the degree to which imports of goods not to be deemed essential are put on hold by countries in lock down.