Bulk Shipments

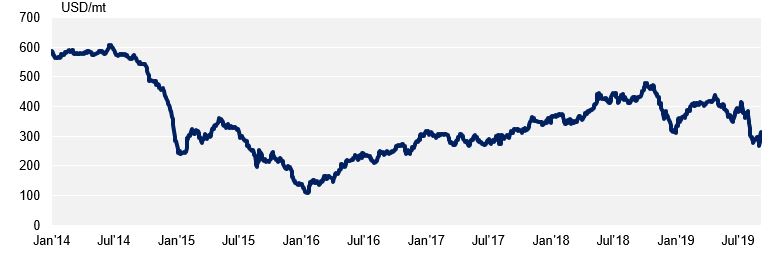

- The Baltic Dry Index, a measure of the dry bulk freight market, recently broke through 2,500pts – a level not seen since November 2010!

- Strong iron ore demand from China during the summer months led to a surge in Capesize and Panamax prices. Increased ton mile demand on the dry bulk fleet, a consequence of the US-China trade dispute, also contributed to a stronger index.

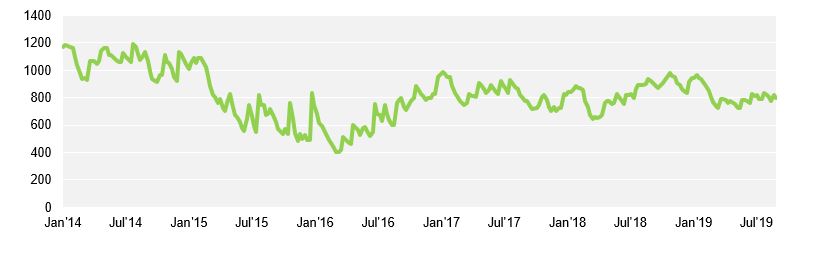

- Implementation of the IMO Low Sulphur fuel regulations approaches fast. Singapore High-Low sulphur fuel oil price spreads have been hovering around $200pmt, which equates to approximately $4pmt additional freighting cost on a typical 50kmt cargo size from Brazil to Asia.

Baltic Exchange Dry Index

Netherlands Bunker Fuel 380cst Rotterdam Spot

Containerised Shipments

- With most container ships still operating using high-sulphur fuel, the impacts of IMO 2020 are yet to be truly reflected in container freight rates. With only 5% of the global fleet being equipped with scrubbers, demand for low-sulphur fuel is expected to pick-up considerably in Q4. Depending on rate structure, these costs are likely to be reflected in the form of higher freight rates as early as November.

- Ahead of China’s Golden Week holiday, container lines spot rates from Asia to North Europe are continuing to fall even with reports of some ships achieving 95% utilisation levels. In order to seek stability in rates, many carriers have announced blank sailings for October on the Asia-Europe loop.

- Softening demand is also expected on routings from Asia to US following additional US import tariffs on Chinese goods that came into effect September 1st. Lines have announced further blank sailings the weeks following Golden Week in hopes of maintaining rates following recent GRIs.

Shanghai Shipping Exchange Containerized Freight Index