Bulk Shipments

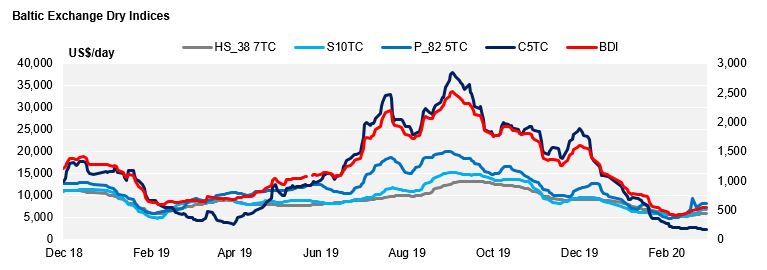

The Baltic Dry Bulk Index bottomed out at 411pts on Feb 10th, recording daily gains since then to settle at 539pts last night. It’s difficult to call this a recovery given where the index peaked less than 6 months ago, however increased activity in the Panamax and smaller Supramax and Handysize sectors have certainly helped to stabilise the BDI, notwithstanding the fact that the Capesize sector continues to drag on any meaningful recovery.

The post Lunar New Year bounce may help to explain an improving BDI, however the prospect of Coronavirus driven weak iron-ore and coal import demand from China weighs heavily on the market, particularly so in the Capesize sector, where the BCI has remained in unprecedented negative territory since the end of January (settled at -348pts yesterday), prompting the Baltic Exchange to hold a review into the index route weightings.

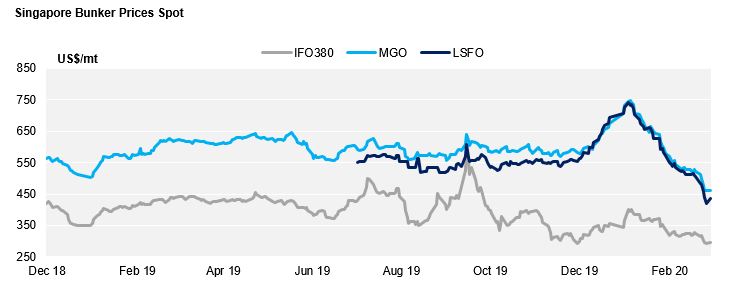

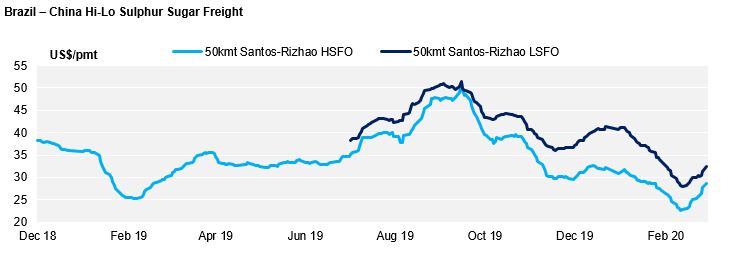

Bunker prices have in general been falling since the beginning of the year. However, the narrowing Hi-Lo Fuel Oil spread is probably the more interesting dynamic at play. The spread was more than $300pmt at the beginning of the year when IMO-2020 came into effect and is now less than $150pmt, testament to how well stakeholders in the fuel oil supply chain have transitioned across (it was never in doubt hey!) at the same time as weakening the business case for scrubbers, which in open-loop form have been banned by a list of countries that is likely to only get longer. On a typical 50kmt Brazil-China sugar charter, the scrubber premium has narrowed from around $10pmt at the beginning of the year to around $4pmt today, assuming no constraints on the supply of HS Fuel to a vessel open in the South Atlantic.

Containerised Shipments

The manufacturing slowdown in China due to Coronavirus is believed to have resulted in a 20-40% reduction in port volumes out of China in the three weeks commencing from January 20th. While rates typically fall post Chinese New Year, carriers have extended their blank sailing programmes in an effort to seek rate stability amidst this weakened demand.

With production picking up again in China, demand is expected to increase significantly in the second half of March. As a result many carriers are only offering spot quotes for the first half of March as they look to capitalise on the increased demand in the second half of the month, when rates can be expected to increase.

As the blank sailing programmes from the Far East commenced in late January, Northern Europe is starting to feel the impacts as less calls are being made to Northern European ports, resulting in drying up container supply for exports out of many ports. This is also having an impact on vessel capacity as many lines announce space and equipment imbalance surcharges for shipments out of Northern Europe.