Bulk Shipments

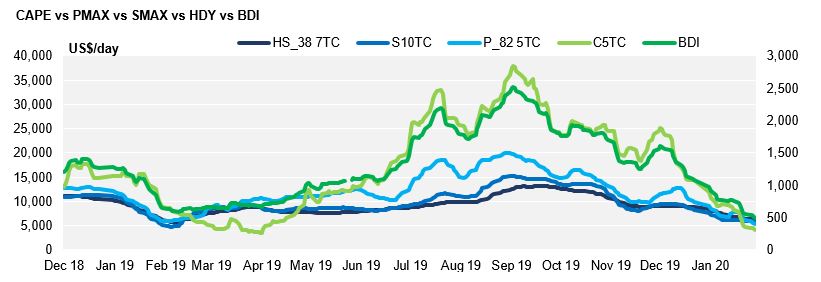

- The BDI settled at 498pts yesterday, representing a fall of more than 2000pts from the 2019 high when the index reached 2518pts on 04/09/2019

- All dry bulk asset classes are feeling the effects of seasonality as alluded to in our previous freight update. The Cape5TC recorded its 36th consecutive daily drop, last printing green on 03/12/2019. The revised back-haul C16 route is now at -$11,150 – suggesting that a Capesize Owner pays the Charterer this daily sum of money to reposition Pacific tonnage into the stronger Atlantic market!

- Owners will be hoping for activity levels to pick up after the lunar New Year. The Supramax FFA curve certainly suggests that better times are on the horizon with the Q1/Q2 2020 spread at around $2,200 per day. The Coronavirus out-break is likely to dampen a post lunar New Year recovery in freight levels and may have a longer-term effect on demand if the situation worsens.

Containerised Shipments

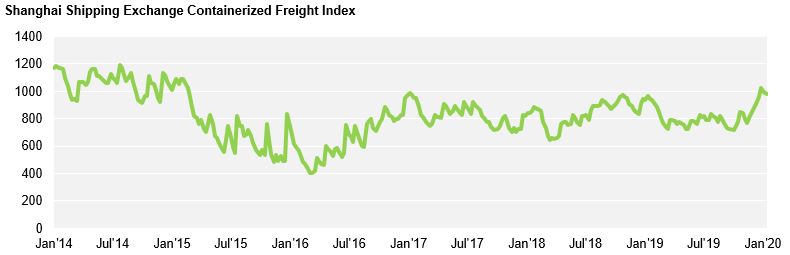

Spots rates are softening as a result of seasonal drop in demand post Chinese New Year. This is despite the lines attempts at restricting capacity by announcing further blank sailings last week, partly in response to the extended holiday in China which is expected to further reduce demand. Idle container fleet capacity was said to be approximately 3.4% last week, up from 2.8% the week prior. Blank sailings are approximately double what was seen this time last year, which if successful could see sharp increases in spot rates in coming weeks.

Many are arguing that the rate increases seen in January were not necessarily reflective of successful implementation of IMO surcharges, but rather due to restricted capacity in the market and a seasonal increase in demand ahead of the Lunar New Year.

New build box prices hit a three year low towards the latter part of 2019 as competition rose and demand weakened in an oversupplied market.